Private Credit Outlook 2025: Specialty finance emerges as new battleground as direct lending matures

Share:

Executive summary

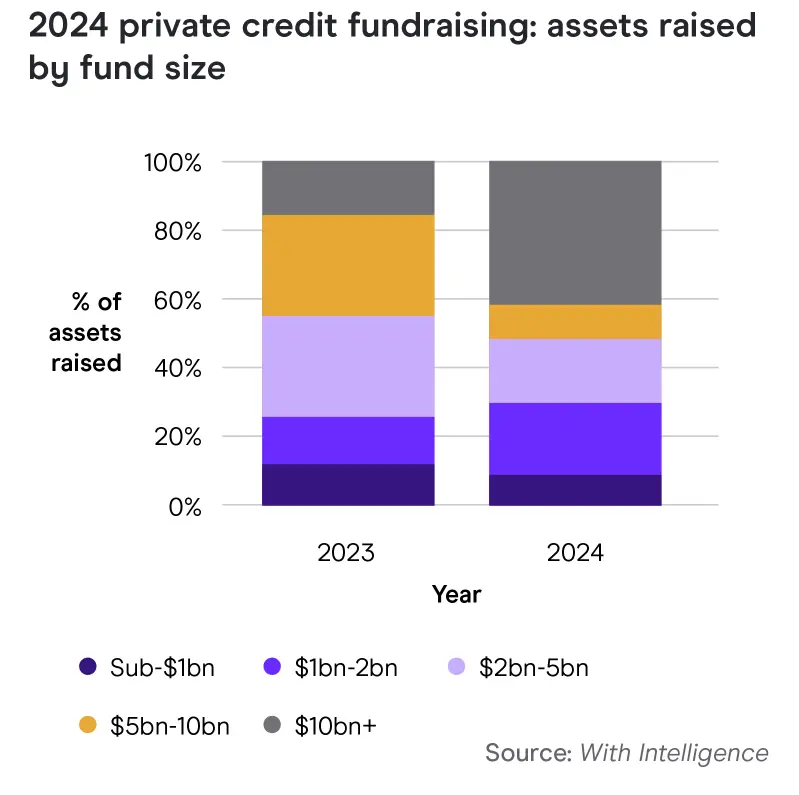

2024 was another blockbuster fundraising year for private credit. After recovering from a slow start, the year finished at $209 billion of final closes – 5% higher than 2023. In 2025, investor appetite for direct lending shows no signs of slowing down and we expect another strong year for the asset class. Although, if the recent trend towards ‘mega funds’ is anything to go by, fundraising will be concentrated among an ever smaller group of established, top-tier managers.

As investors increasingly put a premium on longevity, managers without a current private debt business will likely be forced to pay top dollar to buy an established player, such as BlackRock’s recent $12 billion acquisition of HPS Investment Partners.

However, as direct lending matures, we are seeing signs of a new battleground emerging in private debt, namely specialty finance and opportunistic credit strategies.

With Limited Partners (LPs) now increasingly comfortable with private debt, they are beginning to branch out into niche strategies such as asset-based lending, litigation finance, Net Asset Value (NAV) lending and royalty financing.

Unlike direct lending, where scale is the name of the game, specialty credit offers opportunities for first-time managers to differentiate themselves from the pack – as highlighted by the increasing proportion of new launches running non-direct lending strategies.

Meanwhile, the sheer size of the addressable market – up to $20 trillion according to a recent estimate from Apollo Global Management – suggests massive potential for new entrants to make a name for themselves in the sector.

“Managers without a current private debt business will likely be forced to pay top dollar to buy an established player”

Regulatory changes, such as the ‘Basel III Endgame’, look set to accelerate bank retrenchment, driving assets away from banks and towards private debt managers.

Elsewhere, we anticipate that the ‘democratization’ of private credit will continue in 2025, as the industry presses the Trump administration to allow further access to 401k plans.

Middle Eastern sovereign funds will also continue to flex their muscles, leading to a further rise in private debt managers opening up shop in the region.

‘Buy’ will replace ‘build’ for new entrants to direct lending

Despite the huge buzz around direct lending in recent years, significant new manager launches in the asset class have been conspicuous by their absence, with LPs instead preferring to allocate to established players.

This was particularly pronounced in 2024, with five $10 billion+ ‘mega funds’ raising $89 billion between them – two-thirds of all direct lending fundraising for the year and over 40% of all private credit fundraising (see fig. 1).

Establishing a credible direct lending franchise as a firsttime manager has proven tricky, with managers either having to sell General Partner (GP) stakes in return for a seed investment (such as 5C Investment Partners), or taking drastic measures to set up a team, such as Corinthia Global Asset Management’s well-publicized raid of Barings’ direct lending team in April 2024.

Even being able to attract top talent is no guarantee of success, with Fidelity International scrapping its plans for a direct lending business in 2023, less than two years after hiring its team.

“Being able to attract top talent is no guarantee of success”

As a result, for managers without a current direct lending business, the safest (albeit most expensive) approach will be M&A, as demonstrated by BlackRock’s $12 billion deal to buy HPS late last year.

“Establishing a credible direct lending franchise as a first-time manager has proven tricky”

We expect this trend to continue in 2025, with LPs telling us that the key thing they look for in private credit is whether a team was together during the Global Financial Crisis – and therefore has experience dealing with the last big, distressed event credit markets have faced.

Given the increasing strain on portfolio companies in a ‘higher-for-longer’ interest rate environment, experience managing through a cycle is a key consideration for investors, and our data shows an overwhelming preference for long-established GPs (see fig. 2).

FIGURE 1

FIGURE 2

Allocators will look beyond direct lending in hunt for alpha

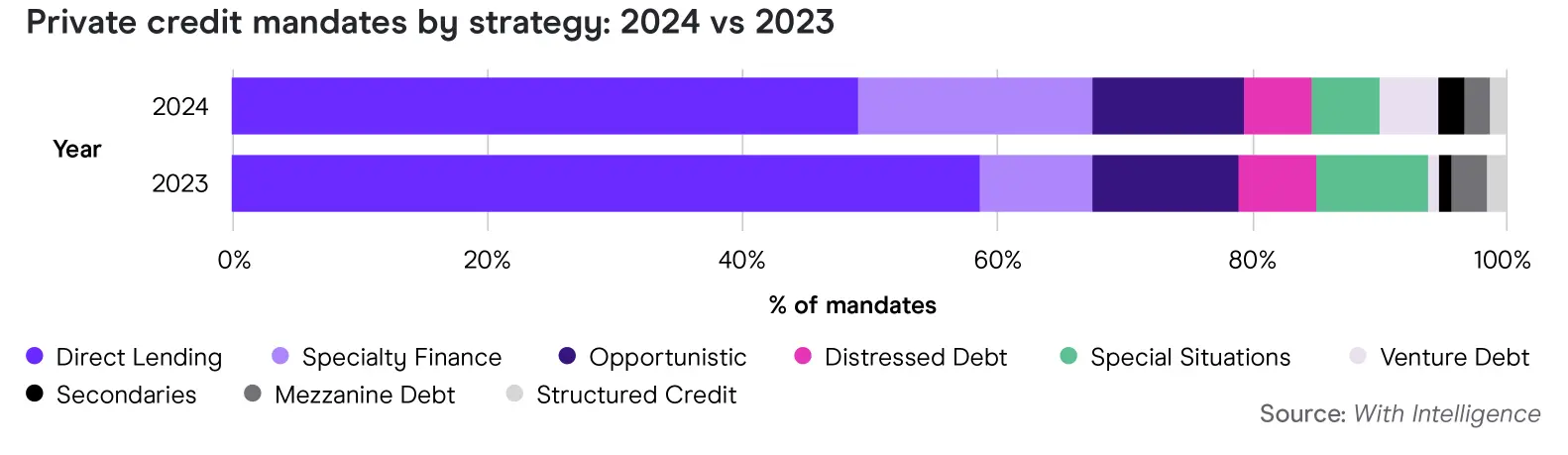

While we expect direct lending to comfortably maintain its position as the largest subset of the private credit market, our mandate data indicates that LPs are increasingly broadening their horizons as they look to build a more comprehensive ‘alternative credit’ allocation.

In 2024, direct lending accounted for 50% of new LP allocations to private credit, down from to 58% in 2023.

By contrast, specialty finance allocations increased from 10% of mandates in 2023 to 18% of mandates in 2024.

“Specialty finance allocations increased from 10% of mandates in 2023 to 18% of mandates in 2024”

Between them, specialty finance and opportunistic credit - a flexible investing approach spanning the full range of private credit strategies – accounted for 30% of mandates tracked by us in 2024, up from 21% in 2023 (see fig. 3).

FIGURE 3

We expect this trend to continue in 2025, with a recent survey of investor intentions revealing significant appetite for specialty finance and opportunistic credit funds, especially from LPs without a current allocation to either strategy.

CalPERS, the US’ largest pension fund with $500 billion in AuM, has indicated a strong preference for asset-based financing as it looks to double its own private debt allocation.

Meanwhile, investment consultants including AON, bfinance, Callan, Cambridge Associates, Mercer and StepStone have all recommended specialty finance and opportunistic credit to clients as a diversification tool.

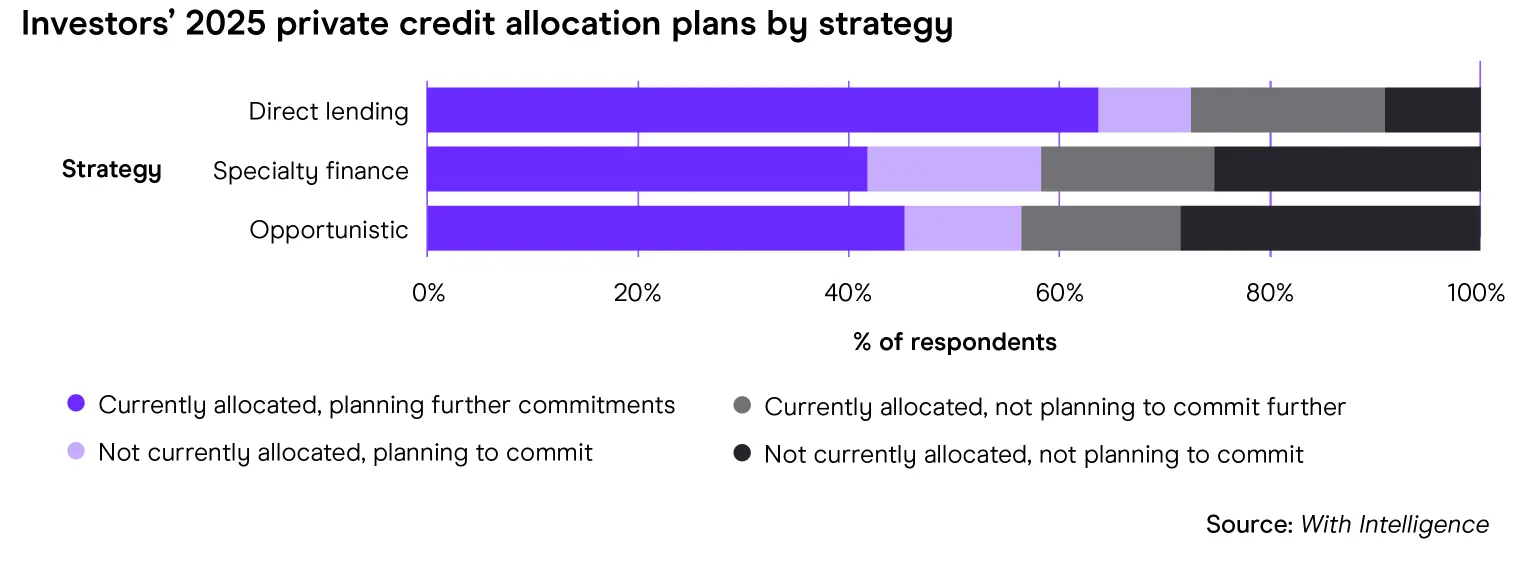

LP investment intentions data shows strong appetite for direct lending and specialty credit

Our Intentions and Preferences data reveals that LPs are keen to allocate to direct lending, specialty finance and opportunistic credit strategies in 2025.

Almost three-quarters of respondents indicated plans to allocate further to direct lending this year, while more than half plan to invest in specialty finance, opportunistic credit and special situations funds (see fig. 4).

Specialty finance is the most popular new private credit strategy for LPs. Of respondents looking to make their first commitments to a new sub-strategy next year, 17% said they planned to allocate to specialty finance, while opportunistic credit and secondaries were tied for second at 11%.

FIGURE 4

Find your specialty: More GPs expected to launch niche funds

While breaking into an increasingly crowded direct lending market may be impossible without significant scale, specialty credit and opportunistic strategies offer managers a chance to differentiate themselves.

Specialty finance and opportunistic credit strategies accounted for over one-third of all new funds in development in 2024, and the proportion ticked up steadily over the course of the year, from 23% in January to 38% by December (see fig 5).

“Specialty finance and opportunistic credit strategies accounted for over one-third of all new fund launches in 2024”

FIGURE 5

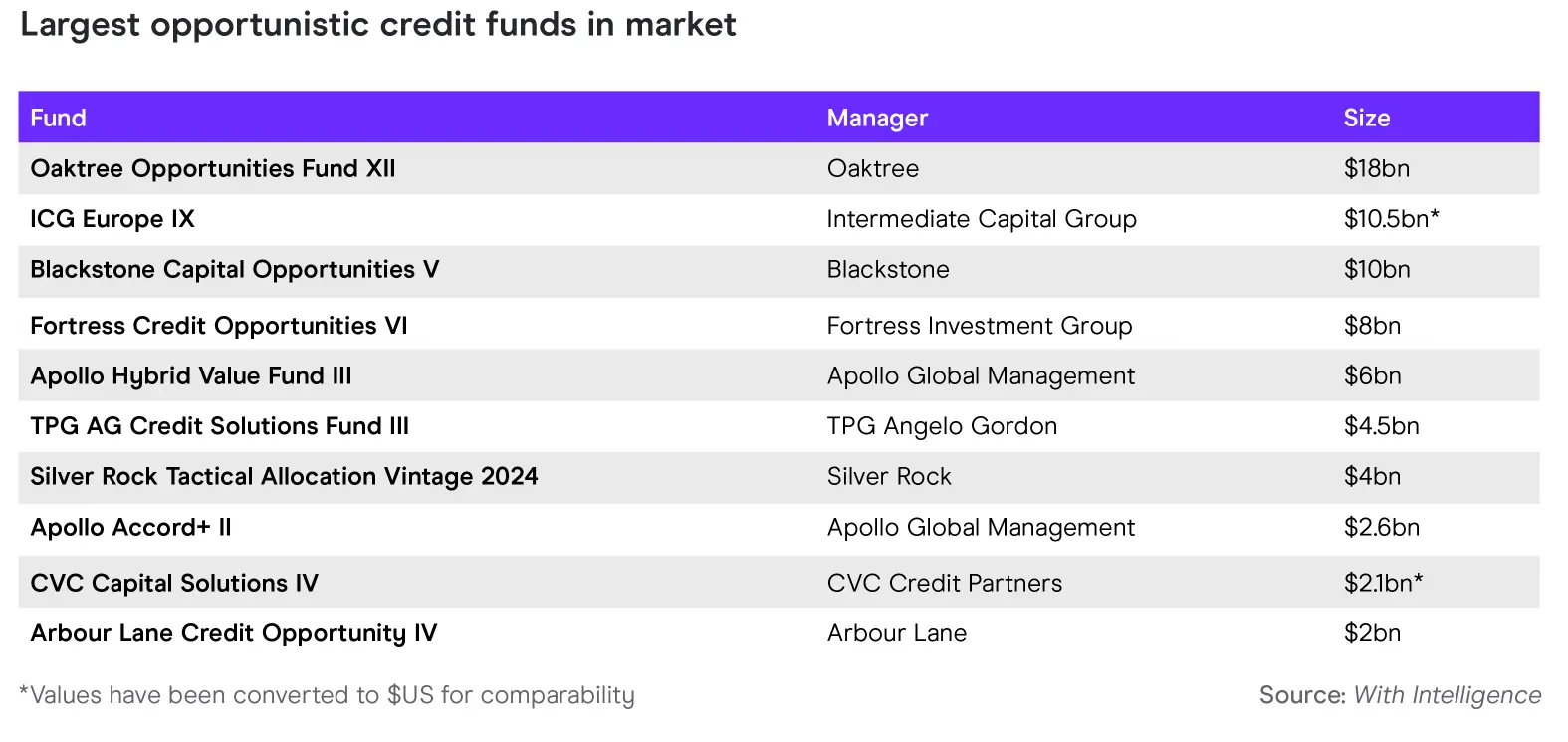

With major players in private credit looking to flex their muscles in asset-based finance, and big opportunistic credit launches including D2 Asset Management and Scott Graves’ Lane42 in the works, we anticipate an increase in activity in both strategies in 2025.

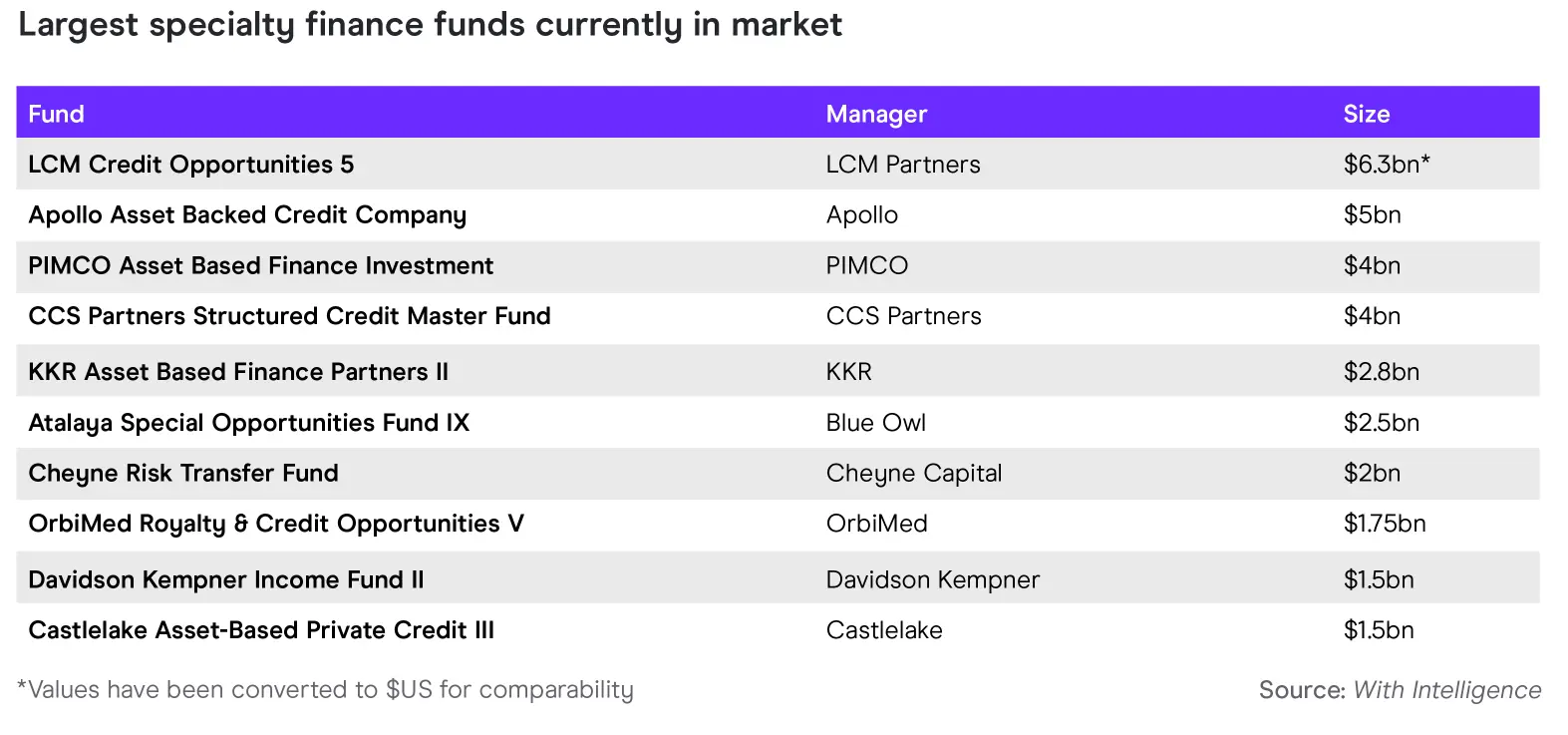

While these funds typically have smaller targets than corporate direct lending vehicles due to their more specialized strategies, we’ve tracked a number of opportunistic credit strategies targeting multi-billiondollar raises in the past year – highlighting significant LP demand for funds outside of direct lending (see fig. 6).

This is also true on the specialty finance side, with multiple $1 billion+ funds currently in the market – including a $4 billion offering from startup manager CCS Partners, 2024’s largest first-time private credit launch (see fig. 7).

FIGURE 6

FIGURE 7

Banking on it: Regulatory capital funds set to grow amid Basel III tightening

One subset of specialty finance poised for further growth in 2025 is the market for significant risk transfer (SRT) deals, as US regulators look set to implement the so-called “Basel III Endgame”, which will significantly increase banks’ regulatory capital requirements.

Historically an opportunistic play associated with long-short credit hedge funds, private debt managers are ramping up their activity in the market with closed-ended fund structures dedicated to regulatory capital trades, particularly given an anticipated explosion in US issuance over the coming years.

“US market for SRTs is currently significantly smaller than in Europe”

In contrast to almost every other corner of the private debt market, the US market for SRTs is currently significantly smaller than in Europe – leaving much room for growth.

Historically, European banks have accounted for around 85% of global SRT issuance, according to the European Central Bank.

However, since the Federal Reserve greenlit the use of SRT deals in September 2023, US banks have accounted for around 31% of global volumes, and last year saw Bank of America and Wells Fargo issuing SRTs for the first time.

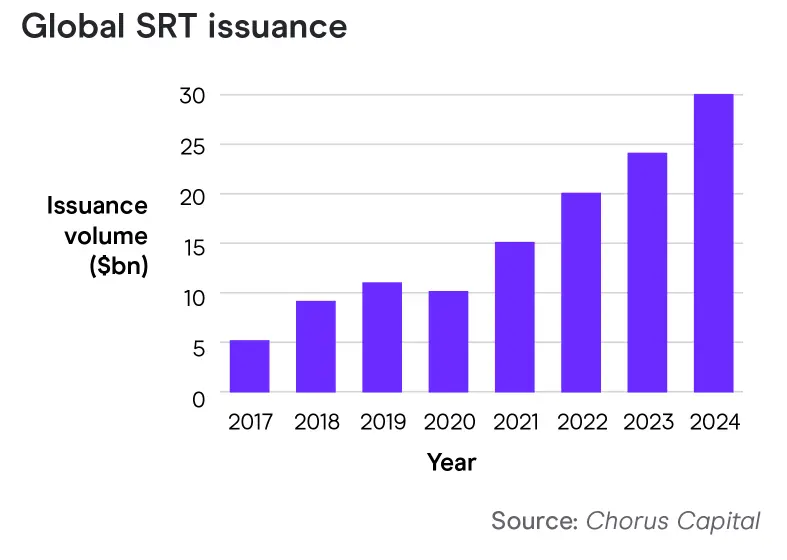

According to London-based SRT investor Chorus Capital, SRT issuance has grown at a Compund Annual Growth Rate (CAGR) of 25% since 2017, with 2024 set for a record year of around $30 billion of global issuance (fig. 8).

FIGURE 8

Total outstanding SRT volume increased 40% from 2023 to 2024, from $50 billion to $70 billion, and another investor in the space, Pemberton Asset Management, anticipates that global outstanding SRT volume will hit $130-150 billion by 2030.

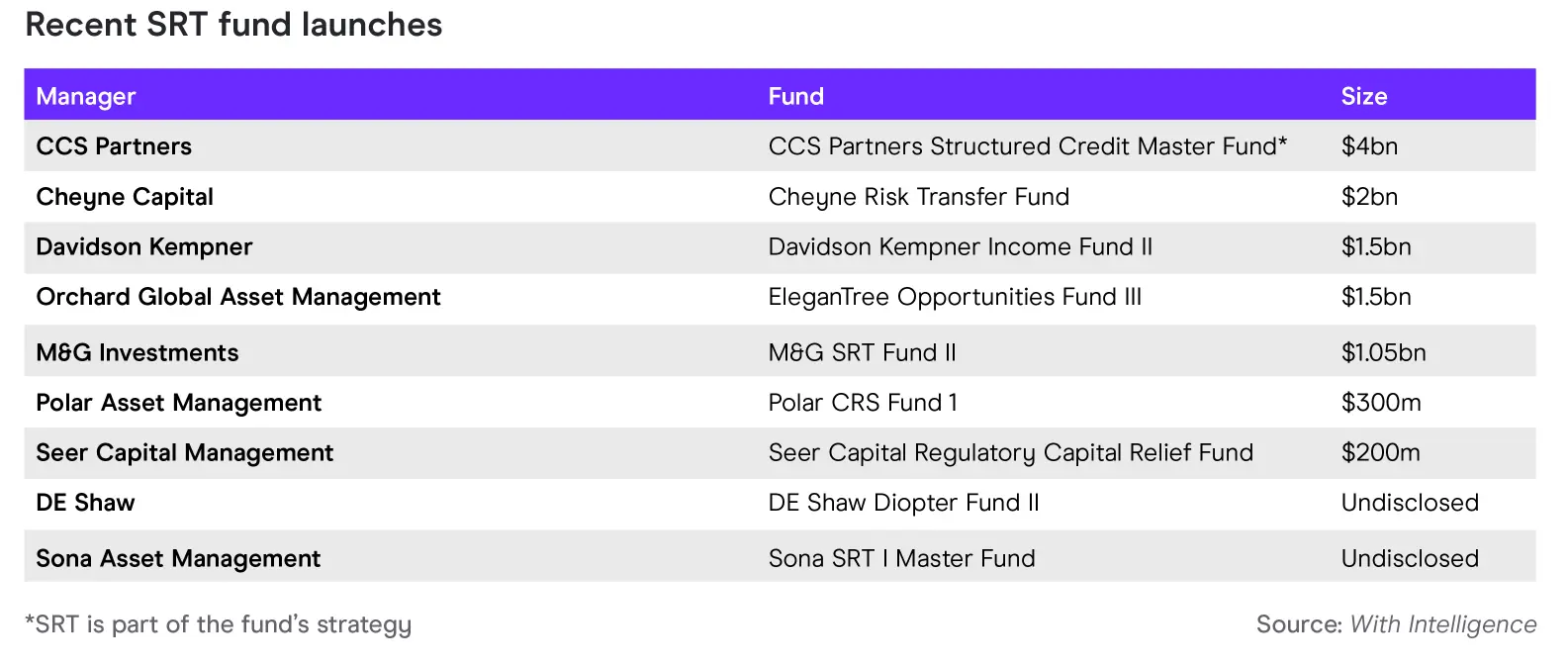

2024 saw the two largest ever SRT fund closes – from Chorus Capital and Axa IM Alts, both raising $2.5 billion – while at least four managers are raising $1billion+ SRT specific vehicles (see fig. 9).

Meanwhile, CCS Partners - a structured credit startup led by Robert Kinderman and Randy Takian - has already raised $4 billion for its debut fund, which will have a significant allocation to SRT deals.

With demand for risk transfer on course to grow further in 2025, we expect an increase in new SRT fund launches over the coming year.

“2024 saw the two largest ever SRT fund closes”

FIGURE 9

No exit: NAV lending here to stay

Much like SRTs, fund financing is another market ripe for disruption by private debt managers as a consequence of the 2023 banking crisis.

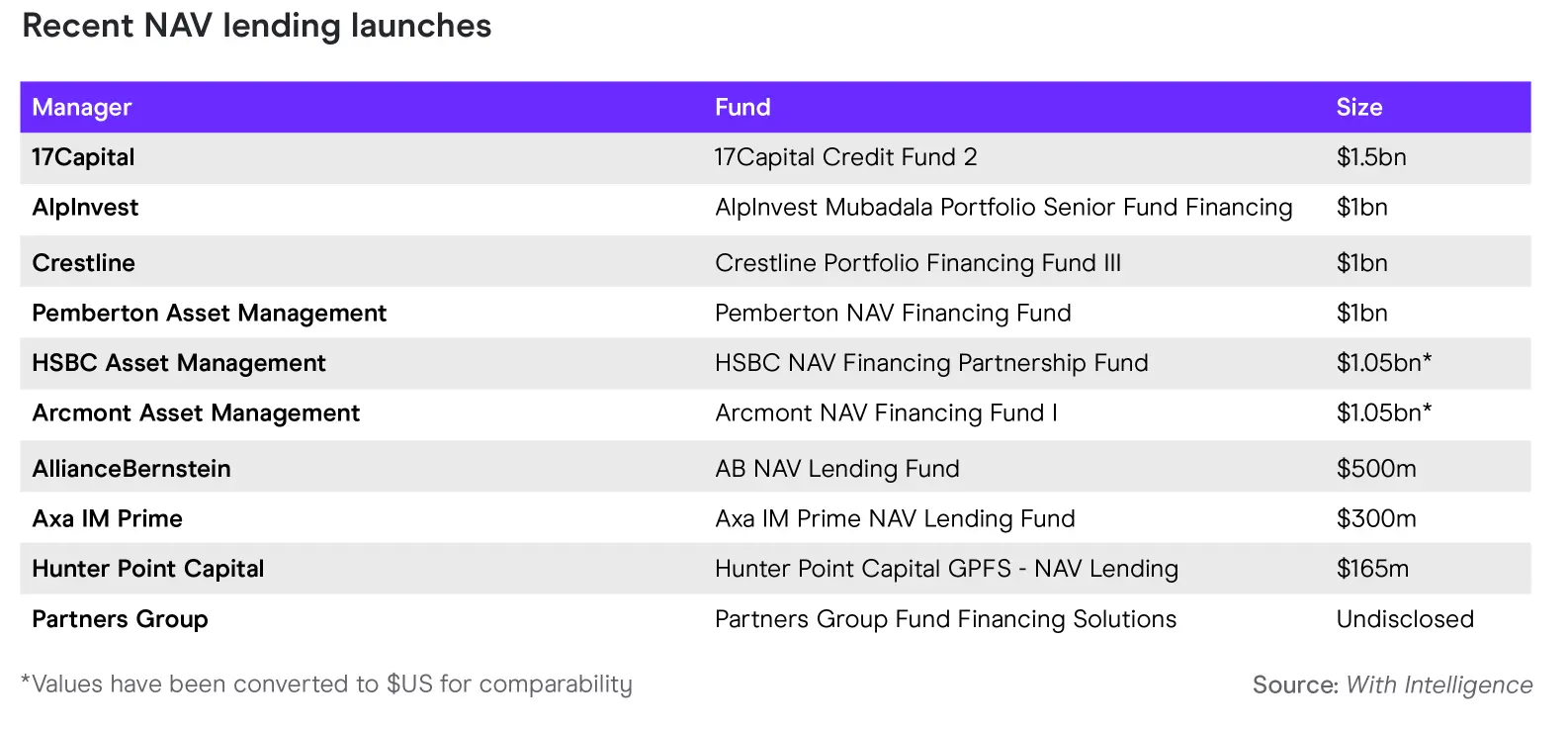

The NAV lending market – where private equity funds take out loans secured against their portfolio companies – has exploded in recent years amid a tough exit environment in private equity.

Citco estimates that the market grew at a 30% CAGR between 2019 and 2023, while S&P estimates the current size of the market at $150 billion in outstanding loans.

While NAV lending was previously a bank-dominated market, private credit firms are increasingly breaking into the sector since the collapse of Silicon Valley Bank in early 2023, which was a major player in fund financing.

In 2024, we tracked $1 billion+ NAV lending launches from Arcmont, Pemberton, HSBC and Crestline (see fig. 10), while 17Capital received a $1 billion cash injection from Brookfield for its latest vehicle, 17Capital Credit Fund 2.

While the rise of NAV lending has been controversial, recent moves such as the Institutional Limited Partners’ Association issuing a set of ‘best practices’ for NAV lenders, should help ease LP concerns around the practice, driving further growth.

“The NAV lending market has exploded in recent years amid a tough exit environment in private equity”

FIGURE 10

‘Democratization’ of private credit set to continue

Private credit has been a major beneficiary of the socalled ‘democratization’ of alternatives over the past several years, and we expect this trend to continue in 2025 with several big players coming to market with new funds.

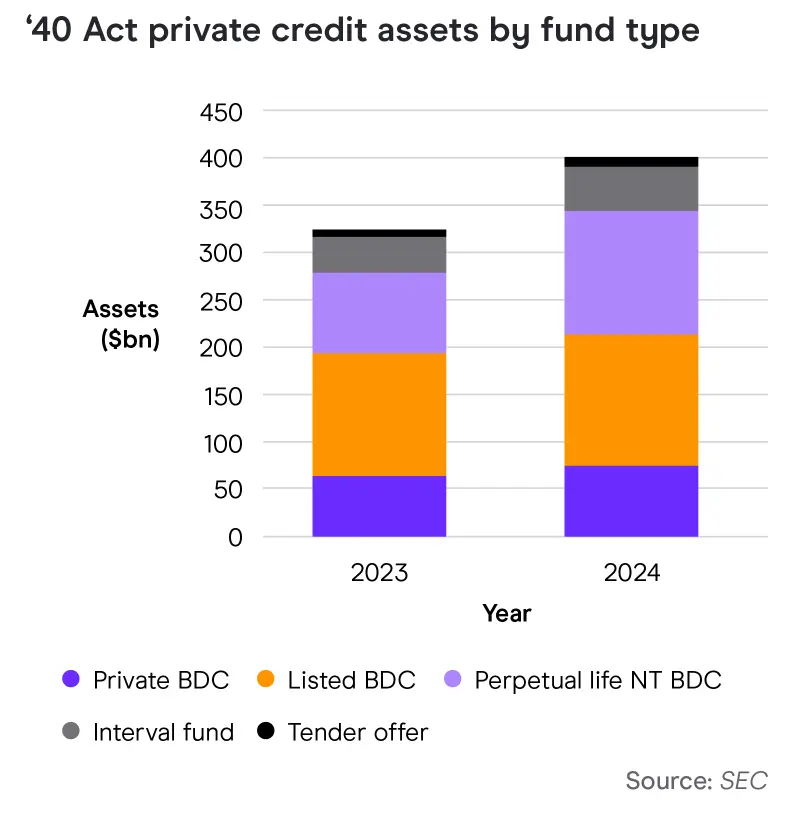

In the US, private wealth vehicles such as business development companies (BDC), interval funds and tender offer funds now hold over $400 billion in AuM - up 25% on a year ago (see fig. 11) - while Blackstone’s flagship non-traded BDC, BCRED, is now comfortably the world’s largest private credit fund, with $66.6 billion in AuM.

“Blackstone’s flagship nontraded BDC, BCRED, is now comfortably the world’s largest private credit fund, with $66.6 billion in AuM”

As more investment consultants look to launch fund of funds-type discretionary strategies within these vehicles, we will also see more private wealth assets being allocated across traditional private fund structures as the former become increasingly

important allocators. For instance, Cliffwater’s $20 billion+ interval fund, Cliffwater Corporate Lending Fund, currently invests in over 90 private credit funds.

Meanwhile, the alternative asset management industry is set to lobby the Trump administration for further access to individual investors, pushing for it to be made easier for 401ks to invest in private credit and private equity.

In Europe, individual investment in private markets is poised to increase following recent changes to the European Long-Term Investment Fund (ELTIF) framework – so-called “ELTIF 2.0” – which were designed to encourage an increase in new launch activity.

There are now 95 active ELTIFs managing a total of €13.6 billion, with European rating agency Scope projecting that this figure will increase to €35 billion by the end of 2026.

Meanwhile, the UK’s equivalent structure, the Long-Term Asset Fund (LTAF) gained further acceptance in 2024, with 17 new approvals – over double 2023’s total of seven.

FIGURE 11

According to Carne Group, around three-quarters of private markets managers in the US or UK expect to launch a LTAF over the next three years, indicating further growth in 2025.

“Cliffwater’s $20 billion+ interval fund, Cliffwater Corporate Lending Fund, currently invests in over 90 private credit funds”

Middle Eastern LPs will be a top priority

As Middle Eastern sovereign wealth funds continue to pile resources into the asset class, we expect a continued drive by private debt managers to put boots on the ground in the region.

2024 saw 29 private debt GPs opening new Middle East offices, 27 of whom opted for a hub in the United Arab Emirates, while BlackRock and Franklin Templeton opened new offices in Saudi Arabia.

In contrast to the hedge fund market, which is dominated by Dubai, Abu Dhabi has emerged as the more popular choice of base for private debt managers, given the ease of access to the emirate’s sovereign wealth funds, Mubadala Investment Company and the Abu Dhabi Investment Authority (ADIA) (see fig. 12).

Mubadala demonstrated its ongoing commitment to private credit in 2024 by announcing a $1 billion NAV lending partnership with AlpInvest and buying a 42% stake in Silver Rock Financial.

2024 also saw Mubadala extend its origination partnership with Apollo, complete its acquisition of Fortress Investment Group, and announce a $1 billion AsiaPacific private credit tie-up with Goldman Sachs Asset Management.

Similarly, ADIA remains an active player in private credit, anchoring AGL Credit Managements debut private debt fund with $1 billion, as well as making sizeable commitments to funds managed by Arrow Global and SC Lowy.

FIGURE 12