Hedge Fund Outlook 2025: Post-Covid expansion set to continue as industry matures

Share:

Challenges remain but the industry's maturity will support growth opportunities

Hedge funds can look toward 2025 with a degree of optimism, although the allocator floodgates are far from opening. Investor sentiment has steadily improved since the industry offered protection from 2022’s market drawdowns and many now see hedge funds as a central tool to ride out future volatility.

It can be a fool’s errand to make market predictions at this time of year. But the deregulatory agenda of the new US Administration and divergent global economic policies and fortunes could provide fertile ground for a range of hedge fund strategies.

Evidence of the industry’s increasing maturity is hard to miss. Launches are larger, but overall numbers down, while hedge fund firms are keen to show the world (and potential investors) that they can be sustainable long-term asset management businesses. This can be seen in the way they are expanding globally, moving into new asset classes, toughening up liquidity terms and bulking up on talent.

Not everything is rosy, and investors will continue to push hard on fees. But they will also increasingly pay a premium for alpha and funds with a proven track record of delivering uncorrelated returns.

At the current rate, hedge funds will surpass the $5 trillion mark by 2028 and reach $5.5 trillion by the end of the decade. Although this could happen much sooner under more optimistic scenarios (see fig. 1).

FIGURE 1

LP risk manoeuvres set to drive hedge fund growth

Since proving their risk mitigation qualities during 2022’s big equity and fixed-income drawdowns (see fig. 2), we have been monitoring a slow but steady improvement in investor sentiment towards hedge funds.

This looks set to continue for 2025, particularly given the number of large US pensions launching or building out sleeves for risk mitigation strategies (RMS) to be deployed in the coming years. Certain influential LPs, such as CalPERS and Ohio PERS, are plotting significant moves back into hedge funds through a RMS bucket after high-profile past exits. Billions of dollars of new capital will be allocated from larger pensions we are tracking to strategies such as relative value, trend-following CTAs, macro and risk premia.

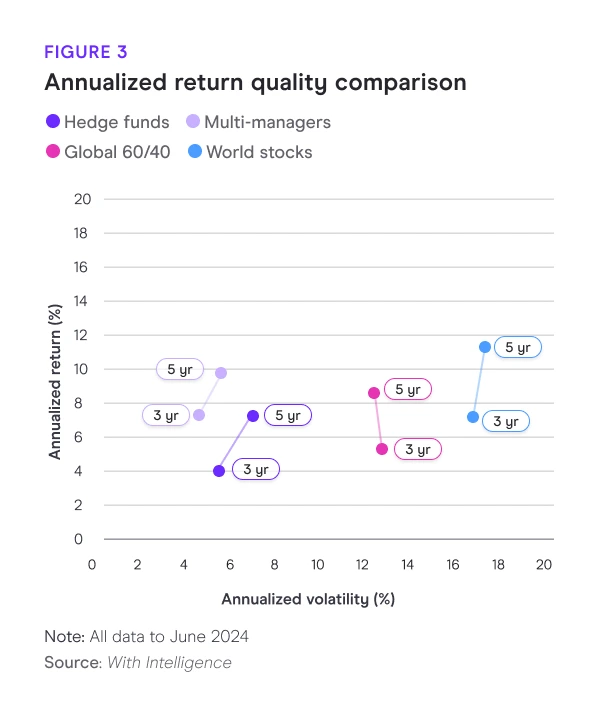

Allocators building out these portfolios have been impressed by the strong three and five-year risk-adjusted returns posted by hedge funds over world stocks and a typical 60/40 portfolio (see fig. 3).

More generally, we see a positive outlook for a range of hedge fund strategies (given various geopolitical dynamics), which are likely to attract more opportunistic LPs to invest in hedge funds across their portfolios to play themes on the long and short side.

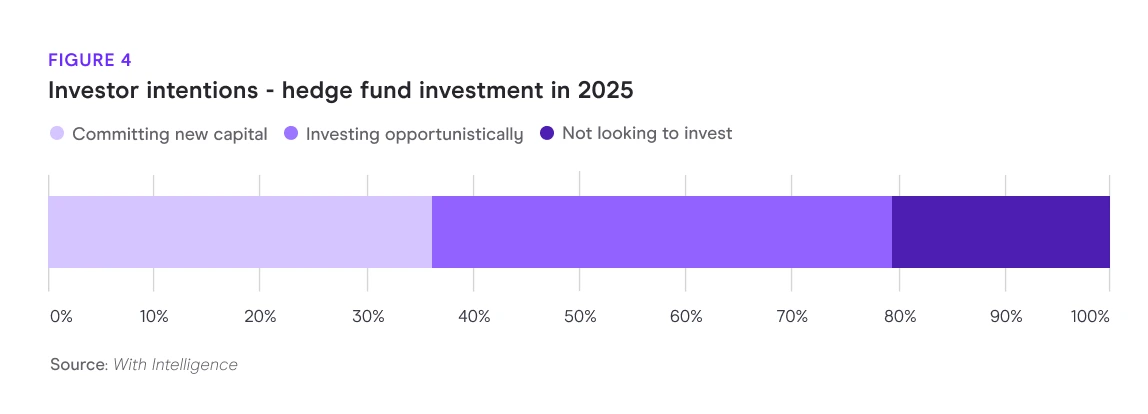

According to our research, 36% of allocators with oversight of hedge funds will commit new capital into the industry in 2025, with a further 43% looking to invest opportunistically and only 21% not looking to invest (see fig. 4).

“36% of allocators with oversight of hedge funds will commit new capital into the industry in 2025”

Globally, Middle East allocators will continue to be strong supporters of hedge funds, particularly through separate accounts and as seed/day one investors in popular spinouts, with large multistrategy and quant funds in demand. We are also seeing interesting pockets of activity across Europe. For instance, credit and long/short equity favorability in the Nordics and global macro remains a popular diversifier for UK and Dutch pensions. More sophisticated Italian institutional investors are seeking low directional exposure to reduce the volatility inherent in their equity allocations.

In the wealth space, large private bank platforms will dominate flows with hedge funds unlikely to benefit much from the so-called “democratization of alts” that is seeing large amounts of mass affluent and high-net-worth wealth capital move into private vehicles. In the longer term, however, we see the institutionalization of wealth channels as a net positive for hedge funds.

Multi-strats as allocators will grow in prominence

The importance of multi-strategy, multi-manager hedge funds to the industry will tilt towards their role as allocators in the year ahead.

Capacity constraints among the largest will lead to continued allocations to external managers. This practice will offer more opportunity for the best performing multi-manager challengers to grow, while also providing important capital to start-ups and other niche funds.

Our research shows the largest multi-strategy hedge funds had (as of mid-2024) deployed at least $20 billion in assets to more than 50 third-party managers in a bid to put capital to work, led by Millennium Management. Start-ups such as Taula Capital, Kodai Capital and Scopia Capital have benefited from tickets of a billion dollars or more from Izzy Englander’s firm.

The trend of backing third-party managers through managed accounts continues at pace as the largest managers in the space become more creative in deploying capital.

We also see potential consolidation between second-tier players and smaller multi-manager shops that have struggled to scale. These second or third-tier platforms have a good opportunity to move up the ranks organically, given that bigger firms are restricting the flow of new assets and charging a high premium for their services.

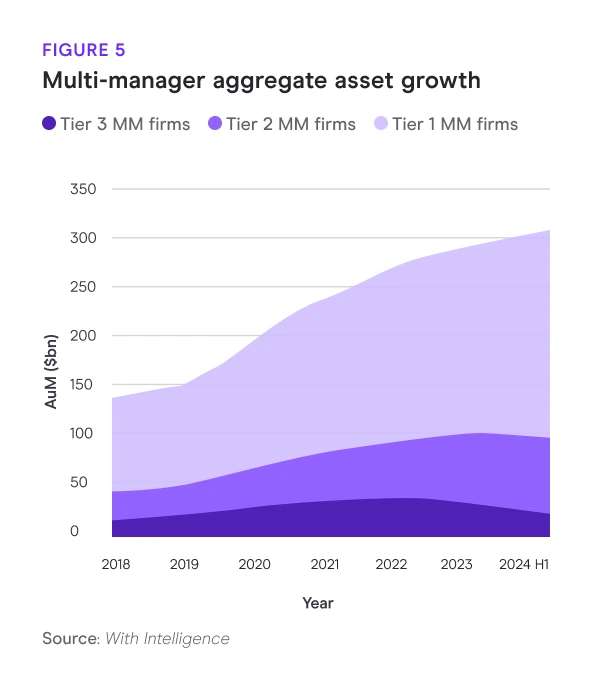

The aggregate growth of multi-manager assets, now as much as one-tenth of the hedge fund industry, has slowed in 2024 amid some estimated net outflows and voluntary capital returns (see fig. 5).

But the largest continue to outperform the broader industry, delivering double-digit returns (in 2024) after a relatively weak 2023, to put them back at the apex of the hedge fund strategy performance rankings.

Blockbuster launches will help reshape the industry

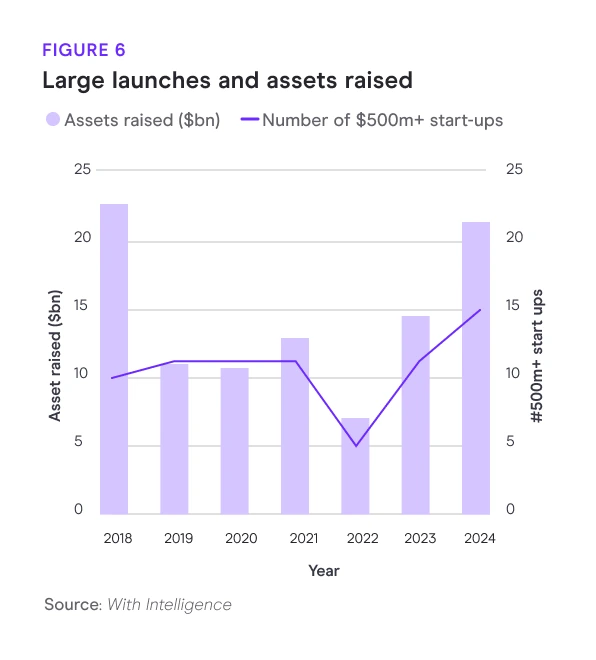

Hedge fund start-up numbers have been in decline in recent years, but 2024 was a blockbuster year for big launches, raising the most assets since 2018 (see fig. 6).

“2024 was a blockbuster year for big launches”

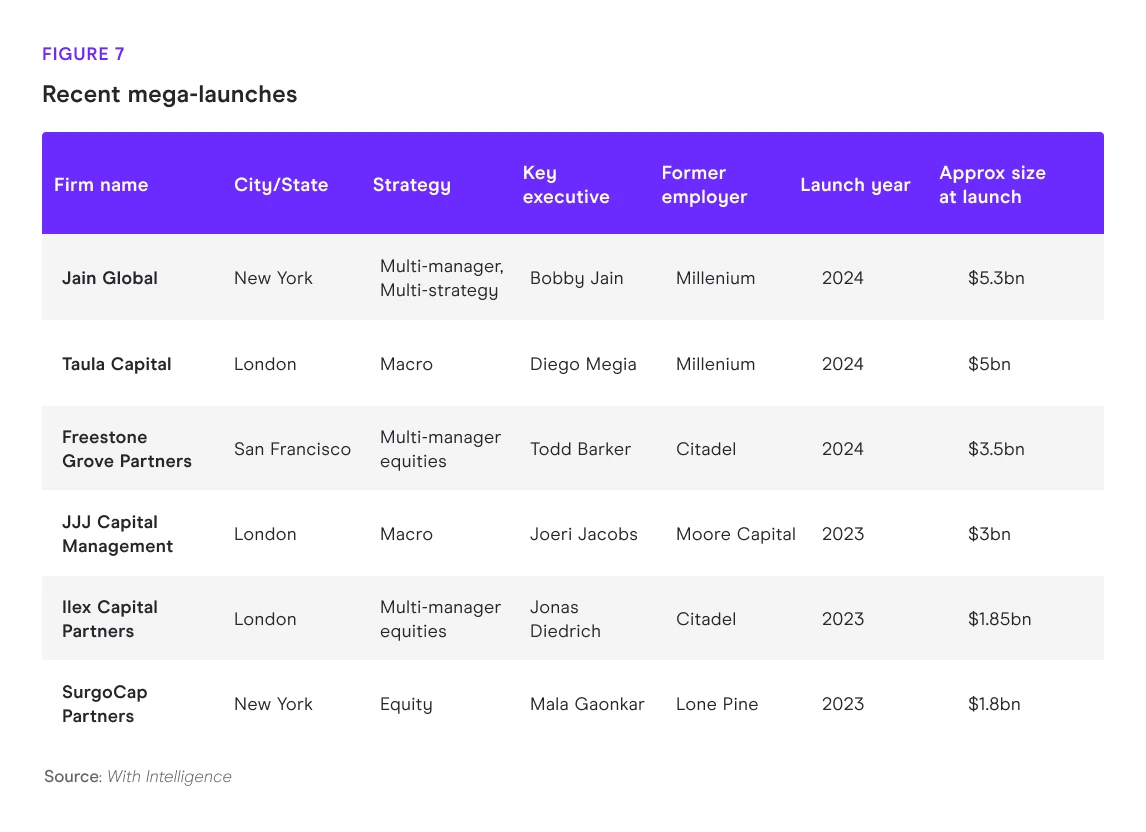

Mega launches Taula Capital and Jain Global each raised at least $5 billion (see fig. 7), making them the biggest start-ups since ExodusPoint debuted with $8 billion in 2018.

We don’t see this repeating in 2025, but the revival of larger launches from the doldrums of 2022 look set to continue with increasing support from capacity constrained pod shops.

Should top Portfolio Managers (PMs) who manage large books at name brand, billion-dollar hedge funds leave to set up on their own, they will find a growing ecosystem of emerging manager allocators – from multi-manager platforms to seeders and dedicated separately managed account (SMA) investors - all fighting for capacity rights.

We see an uptick in the use of SMAs driving a new round of emerging managers, offering investors greater flexibility on fees and liquidity terms, while giving PMs a cheaper and quicker way to get up and running.

A mature and competitive managed account platform space will only support this growth.

However, hedge fund launches will be split between those that raise several hundred million or more with relative ease and those that struggle to bring in $50 million.

Overall launch numbers are unlikely to see a reversal of the lower numbers we’ve seen in recent years, with Asia notably depressed.

One area of heightened activity will be the number of hedge fund managers launching dedicated private markets vehicles, particularly private credit. News that emerging manager backer Lighthouse will be moving into the private credit space in 2025 is indicative of a wider shift as managers look to diversify their asset base and spot significant opportunities across non-bank lending. We will see a growing number of ‘billion-dollar club’ hedge fund managers make such moves through this coming year and beyond.

Competition for top performers will remain intense

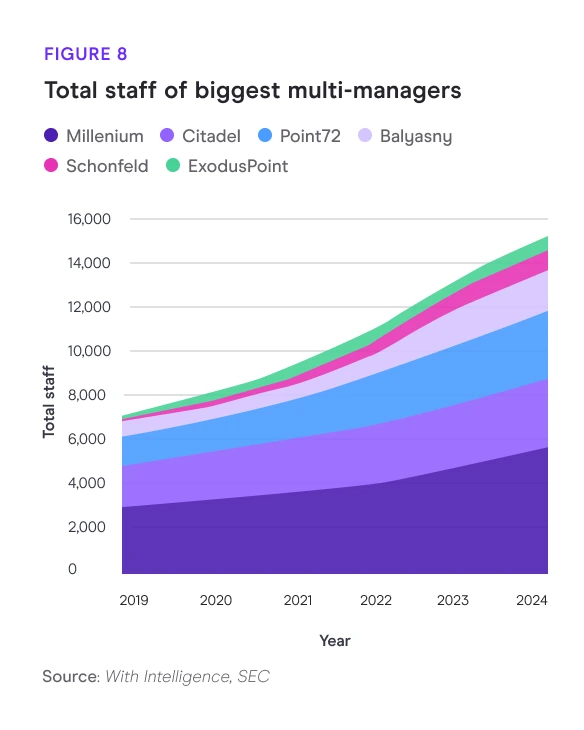

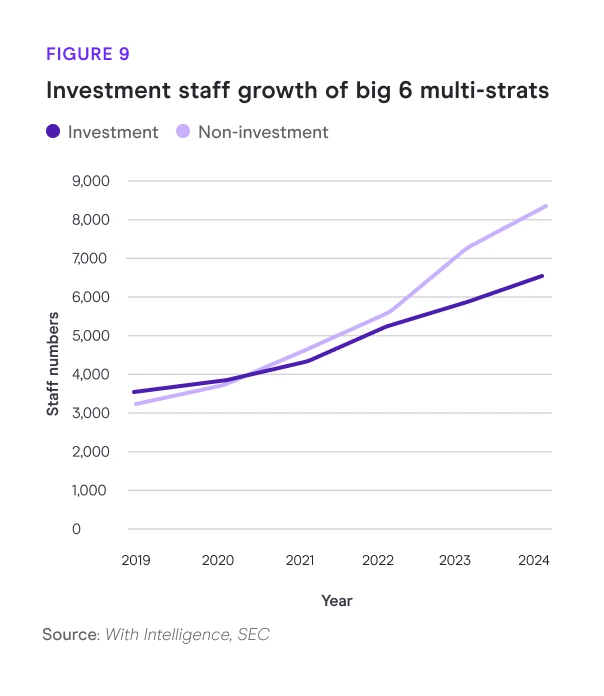

The outsized impact of multi-managers on the hedge fund talent landscape shows little sign of abating with headcount continuing to rise (see fig. 8 and 9) to as much as one quarter of the industry’s total.

“Demand for top talent remains greater than the supply of quality PMs”

While talk of “peak multi-manager” has gained currency as asset growth has slowed and annual performance dipped from earlier highs, competition for talent is set to remain intense.

Demand for top talent remains greater than the supply of quality PMs, and the biggest players are prepared to pay whatever it takes to lure top performers in areas where they have gaps (particularly as these costs will often be passed through the fund).

Another notable area of growth is the investment by multi-managers in business development and talent sourcing teams, with investment bank prime brokerage executives now increasingly being lured into these roles. These roles are getting even more prestigious as they increasingly look to deploy capital to external managers as well as hunt for new PM talent to join.

Top firms will continue to pay a heavy premium to extract the very best talent from competitors, although PMs will usually need to take considerable time out of the market due to non-compete clauses. Several prominent PMs were lured away from rival firms for payouts as big as $50 million.

The heavy costs required to attract talent are also making it harder for smaller multi-managers hoping to muscle into the space to hire or retain top alpha-generating PMs (as is the reducing the number of launches), as prospective start-ups decide to take pod shop money instead.

Regional growth will be a top priority

One sign of the industry’s growing maturity and institutionalization is the global expansion activities of larger managers.

We have been monitoring the increasing regional footprints of US and European managers in recent years and see several reasons why this activity will continue, both for investment and sales/investor relations priorities.

“Hong Kong is back on the radar”

Interestingly, Hong Kong is back on the radar for many managers after a Covid pullback and concerns over an increasingly authoritarian approach from the Chinese government have reduced. Various tax breaks to attract asset managers have helped give a sense that the territory is regaining its allure as a prominent hedge fund hub with plenty of available talent (notwithstanding an expat talent drain), and easy access to mainland Chinese and other investors. An uptick last year in the number of Securities and Futures Commission licensed financial professionals and asset managers underscores the trend.

Improved access to the substantial capital pools in the Middle East, notably the variety of family offices over the well-fished sovereign funds, has been a key driver of the boom in hedge funds expanding their local presence in the UAE. Over one quarter of the top 100 hedge funds are now present there (see fig. 10), and with a fastdeveloping hedge fund ecosystem and improving regulatory regimes, we expect the figure could double in the next two years, although the pace is expected to slow. Strategic connectivity to global markets, beneficial tax regimes and lifestyle factors have also been motivators.

FIGURE 10

In Europe, an initial post-Brexit boost for Paris has slowed and feels unlikely to revive, especially given the current political uncertainty. While Italy’s attempt to lure managers with tax breaks has yet to move the needle in any significant way.

Macro, relative value and event-driven strategies likely to garner most interest

FIGURE 11

Compared to the previous year, more hedge funds ended 2024 with performance likely to have met, or even exceeded, investor expectations. But we see the opportunity set for different hedge fund strategies - and their attractiveness to allocators - materially changing in the year ahead.

A shift from speculative to macroeconomic events that are driving market volatility - from central bank rate cuts to US policy changes and geopolitics - will generate more opportunities for macro, relative value and event-driven funds in particular, while equity strategies may have to work harder.

A Trump presidency, driving tax cuts, deregulation, a focus on oil and gas production, tariffs and a tougher stance on China, will likely offer opportunities for macro traders around currency fluctuations, interest rate changes, and commodity price swings, and could fuel a rise in mergers and acquisitions activity for event-driven funds, especially in energy, finance, and technology.

A significant divergence in fiscal and trade policies in the US, compared to Europe and Asia, will also set up more relative value trades (for instance in differing stock valuations), even as declining rates remove some of the favourable conditions for equity funds.

Additionally, global trade disruptions could lead to a rise in corporate defaults or debt restructuring opportunities, while changes faced by US industries such as healthcare, technology or energy, could result in distressed opportunities.

Demand for directional and market-neutral digital assets-focused hedge funds is expected to rise as market expectations of more accommodative regulation and the nomination of Paul Atkins as SEC Chair boost the asset class.

Fee alignment to become more aggressive

The debate around the alignment of incentives between hedge funds and their clients has stepped up in the recent high-interest rate environment and is unlikely to quieten.

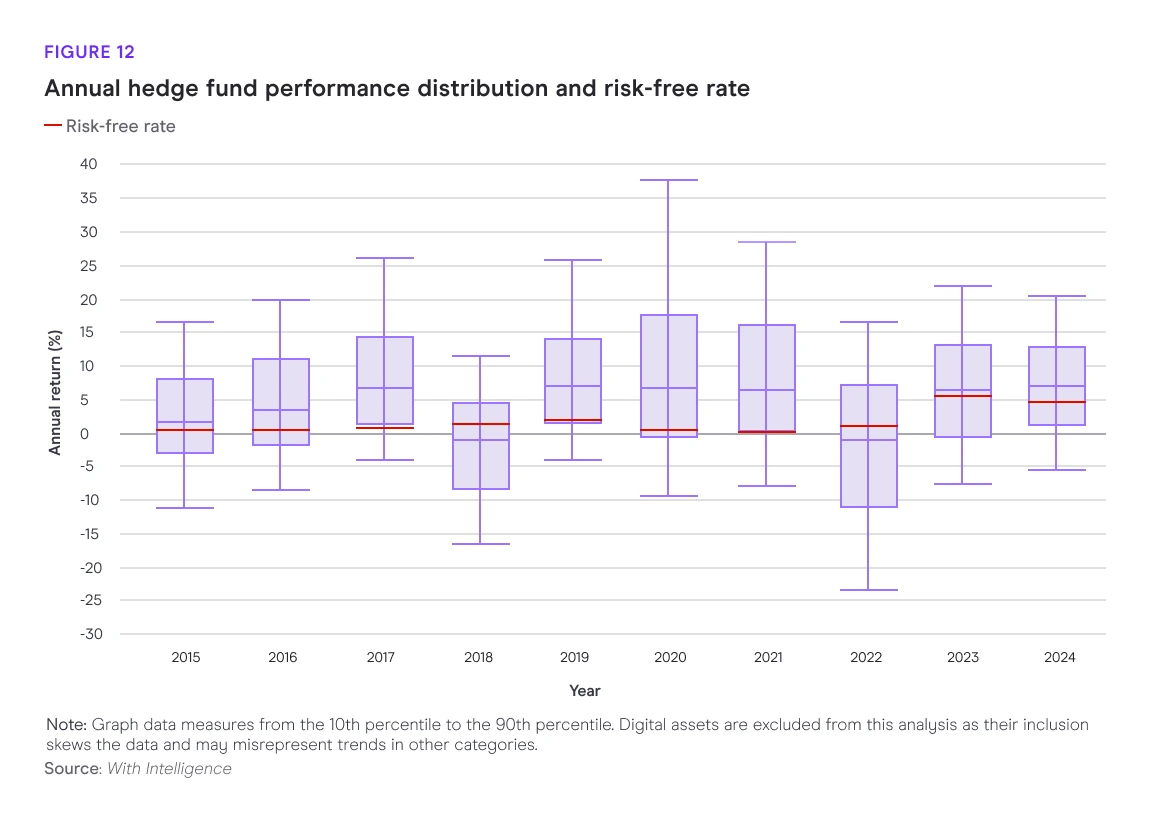

Investors will continue to demand better value from their hedge funds and stronger alignment in fee structures, with growing support for cash hurdles to reward those delivering real alpha over risk-free rates (see fig. 12). Industry participants in a recent With Intelligence survey suggested they were evenly split on the question of whether limited partners would be successful in their campaign to make hurdles standard in the industry. However, many noted there may be an uptick in adoption on a case-by-case basis.

Some 55 allocators and five investment consultants have signed up to an open letter penned by Texas Teachers calling for such change.

The other side of the fee alignment coin though is that top performers can sometimes charge higher performance fees where they are delivering uncorrelated alpha, particularly in sought after or niche areas.

While there will continue to be dispersion of fee structures and arrangements, investor demands for lower management fees from established managers has also started to play out in the increase in SMA allocations, where there has been a willingness to pay higher incentive fees for performance, but less for overheads.

Nevertheless, the power of the largest multimanagers with demonstrable track records of delivering consistent alpha will allow them to continue to dictate liquidity and fee terms, with pass-through models now ubiquitous. Weaker multi-manager performers are likely to start to feel more pressure.

Attempts to replicate pass-through structures by other types of managers to compete in the current talent environment will remain difficult given the differing investment return profiles.

Hedge Fund Outlook

KEY CONTRIBUTORS

- Paul McMillan Research Lead

- Matt Smith Head of Hedge Fund Content

- Fraser Irving Deputy Europe Editor

- Nye Longman Chief Reporter (Europe & Asia)

- Brett Haensel Chief Reporter (US)

- Andrew Marquardt Senior Reporter (US)

- Connor Owen Deputy Editor, US Investor Team

- Christina Pantelly Reporter (Europe and Middle East)

- Michael Hunt Alternatives Data Analyst

- Jannine Ravens Head of Insight