China's struggles and India's H1 hedge fund gains

In the first half of the year, Indian equity long/short funds did better than Chinese funds after good results in June. With Intelligence data reveals that Indian managers were up 10.8% on average for the first half of 2024 thanks in part to June’s 4.4% gain. This contrasted with a more modest 2.2% H1 return from Chinese hedge funds.

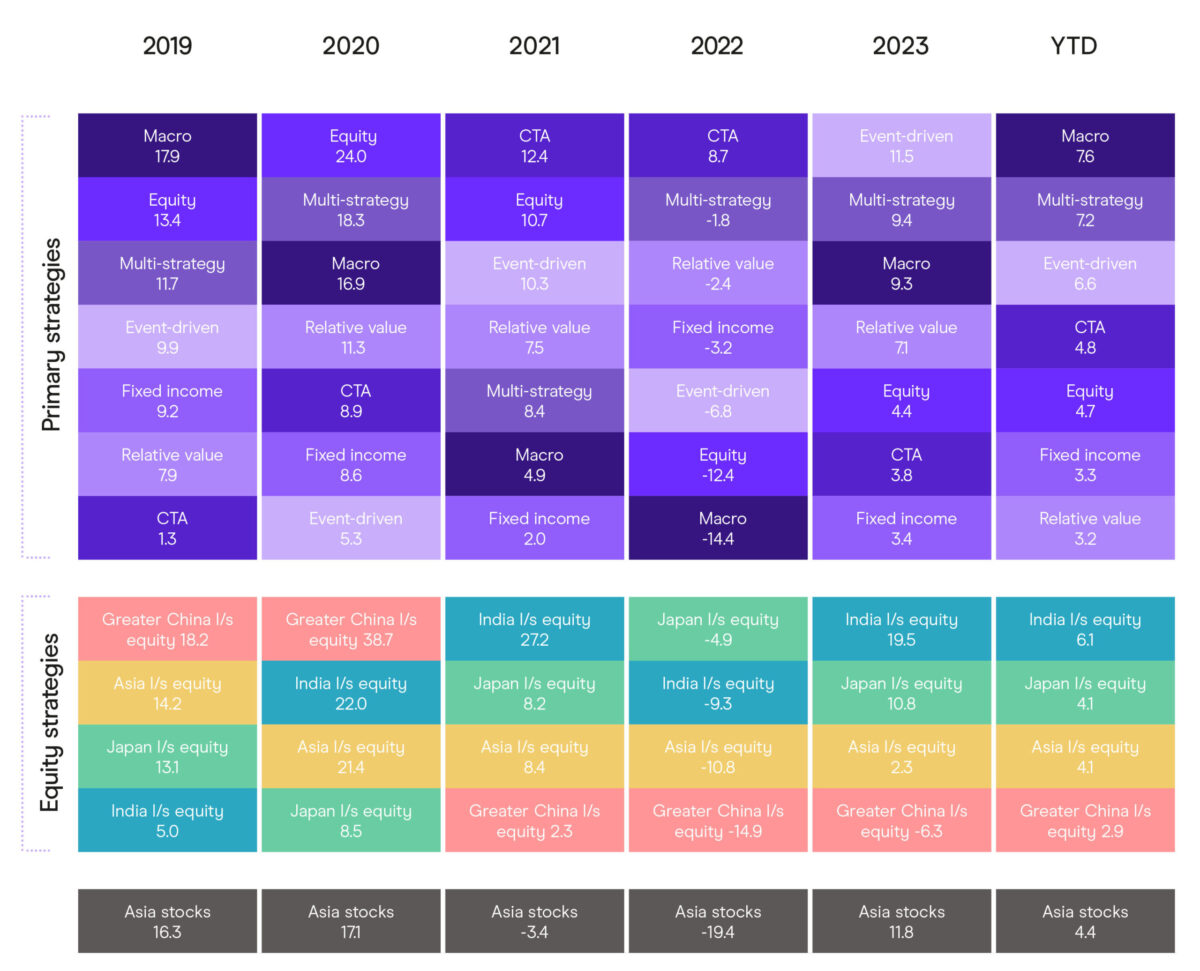

Asia-Pacific Strategy Returns Map

India's Strong Economic Performance Boosts Long/Short Equity Hedge Funds

India has been riding a wave of positive sentiment, underpinned by one of the fastest-growing economies in the world. The Nifty50 index went up by 20% in 2023 due to good company profits and positive economic conditions at the end of the year. This market environment has enabled many managers to outperform the index.

Although Prime Minister Narendra Modi's BJP party's re-election with a smaller mandate initially caused some market jitters, investors remain optimistic that his 'Make in India' policy will continue stimulating growth in the manufacturing and industrial sectors. This policy has been instrumental in attracting foreign investment and boosting domestic production.

Top Performing Long/Short Equity Funds in India

Several India-focused strategies boast notable returns in 2024. The Malabar India Fund, Dalton India Fund, and Alpha Alternative Equity Absolute Return are among the top performers.

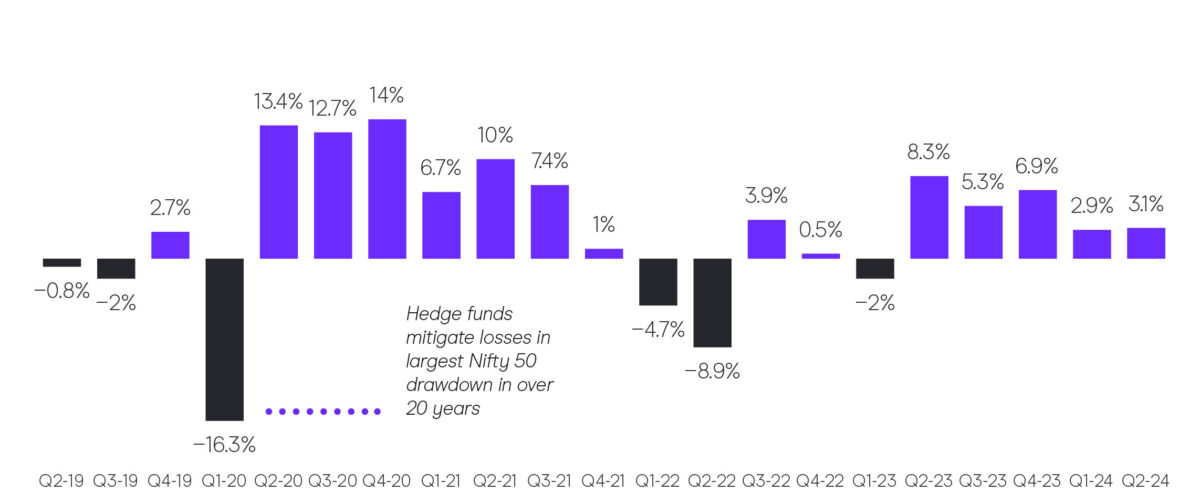

India Long/Short Equity Funds - Quarterly Returns

Why Long/Short Equity Strategy is Thriving in India

India's economy continues to benefit from strong growth drivers. The country is making changes to improve business.

It is working on tax reforms and better labor laws. These changes are being made to attract more investments and make it easier to do business. Furthermore, India's demographic dividend, with a growing young workforce, significantly boosts its economic prospects.

The 'Make in India' initiative has revitalized the manufacturing sector. The initiative aims to transform India into a global manufacturing hub by encouraging foreign and domestic manufacturing investments. This policy has also led to job creation, technological advancements, and increased industrial output.

India's tech and service sectors have also thrived, contributing to economic growth. The IT and software services industries have been strong pillars of India's economy, generating substantial revenue and employment opportunities.

Chinese Long/Short Equity Hedge Funds Falter

China's economy has experienced issues such as property and fiscal crises. These problems have impacted market sentiment and major companies like PinDuoDuo and DiDi. Chinese hedge funds did not do well in the first half of 2024, with a 2.2% return. With Intelligence estimates that this is less than half of the 4.7% return. This return was achieved by Asian long/short managers during the same period.

Top Performing Long/Short Equity Funds in China

Despite weaker performance, some China funds have delivered positive results. The UG Hidden Dragon Special Opportunity Fund, Mandarin Offshore Fund, and Value Partners Classic Fund are among the winners.

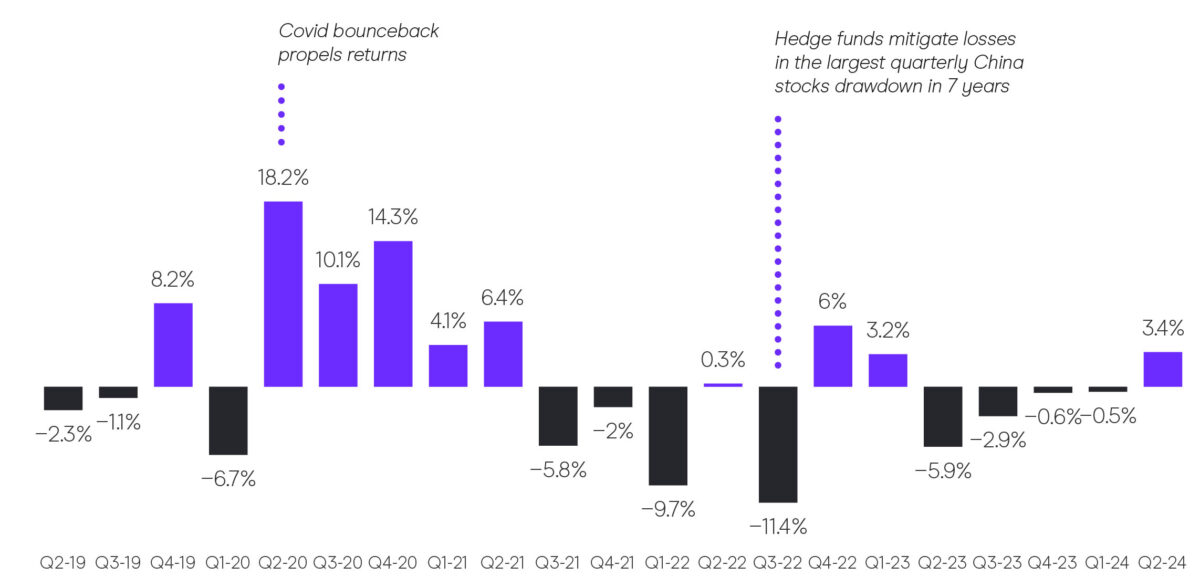

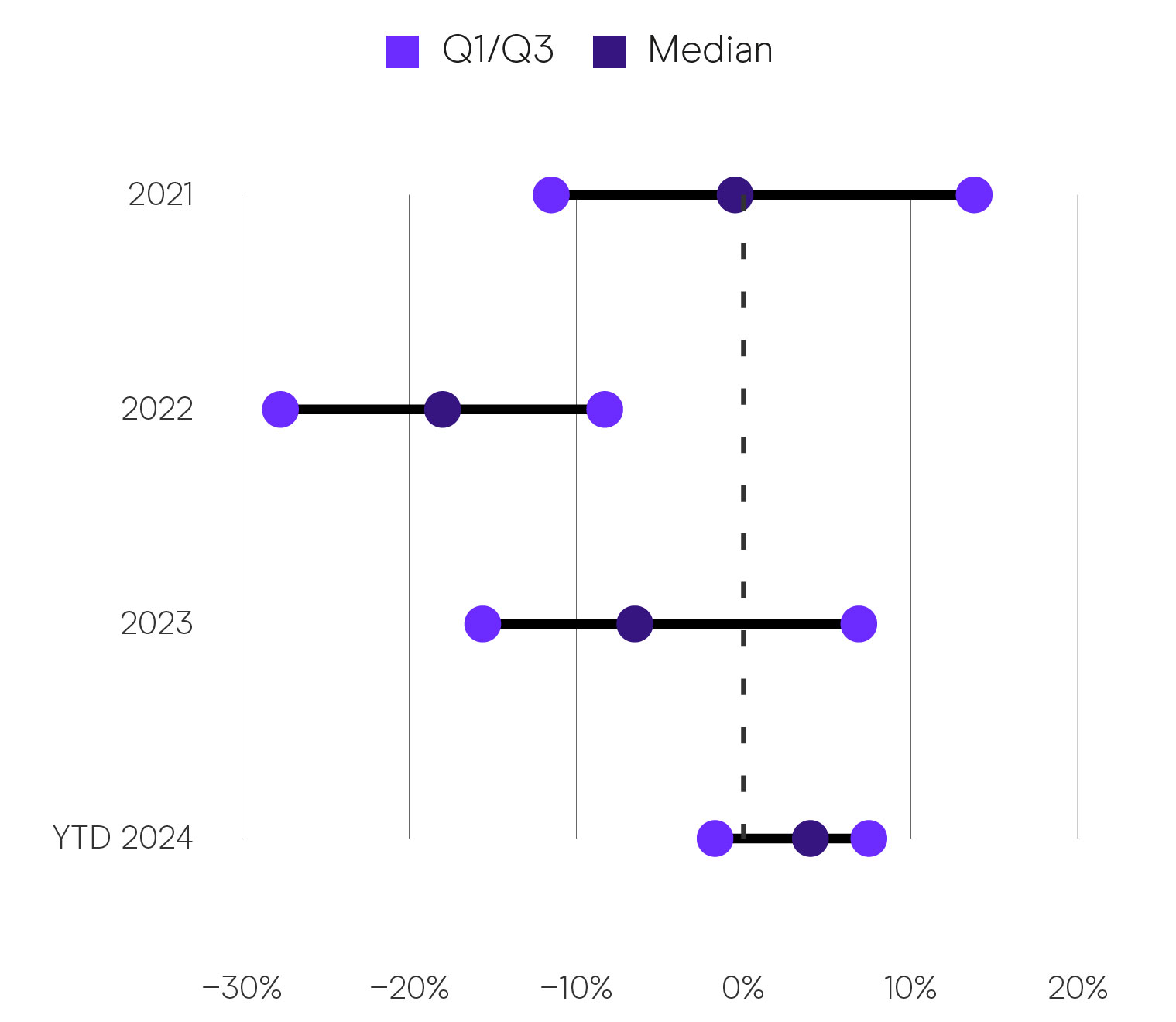

Greater China Long/Short Equity Funds - Quarterly Returns

What Challenges are Affecting China’s Long/Short Equity Fund Returns

The country's property market, a significant driver of its economic growth, has been under severe stress. Major property developers have faced liquidity crises, leading to project delays and defaults. This has affected investor sentiment and raised concerns about the broader economic implications.

The Chinese government has implemented measures to stabilize the property market and boost economic growth. However, these measures have yet to succeed. China's fiscal policies have also been under pressure. China's local governments have a lot of debt and not enough money. This makes it difficult for them to increase economic growth using fiscal policies.

Despite these challenges, China remains a crucial player in the global economy. The country is focusing on transitioning from an investment-driven growth model to a consumption-driven one. Efforts are being made to boost domestic consumption, improve social safety nets, and enhance technological innovation.

Comparing Indian and Chinese Long/Short Equity Strategies in 2024

The results of Indian and Chinese equity funds are different. This shows that the economic situations and market sentiments in both countries are not the same. Indian funds have benefited from strong corporate earnings, favorable macroeconomic conditions, and investor optimism driven by government policies. In contrast, Chinese funds have struggled because of to economic uncertainties, property market woes, and weaker investor sentiment.

India Long/Short Equity Funds - Quarterly Returns

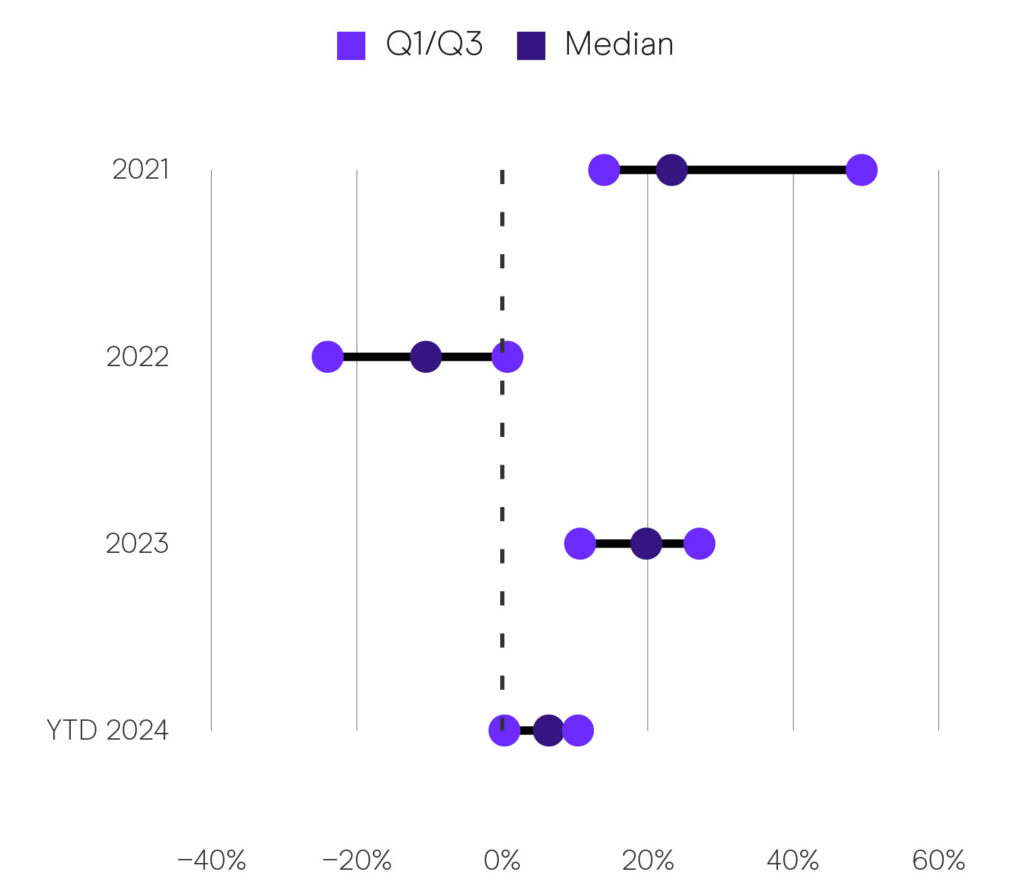

Greater China Long/Short Equity Funds - Performance Dispersion

The Hedge Fund Regional Report: Asia-Pacific is available to all subscribers of With Intelligence. The full report provides regional insights across Asia on strategy returns, prime brokers, and APAC Billion Dollar Club rankings.

Schedule a demo today to find out more about With Intelligence and become a subscriber.