Infrastructure emerging managers to watch in 2025

Share:

Industry veterans from giants such as Macquarie and BlackRock are launching most talked-about infrastructure fund managers despite historically low levels of fundraising.

In conversations with LPs, GPs and industry experts, With Intelligence’s Infrastructure Emerging Managers to Watch in 2025 report has identified the most exciting GPs in the sector getting their first funds off the ground.

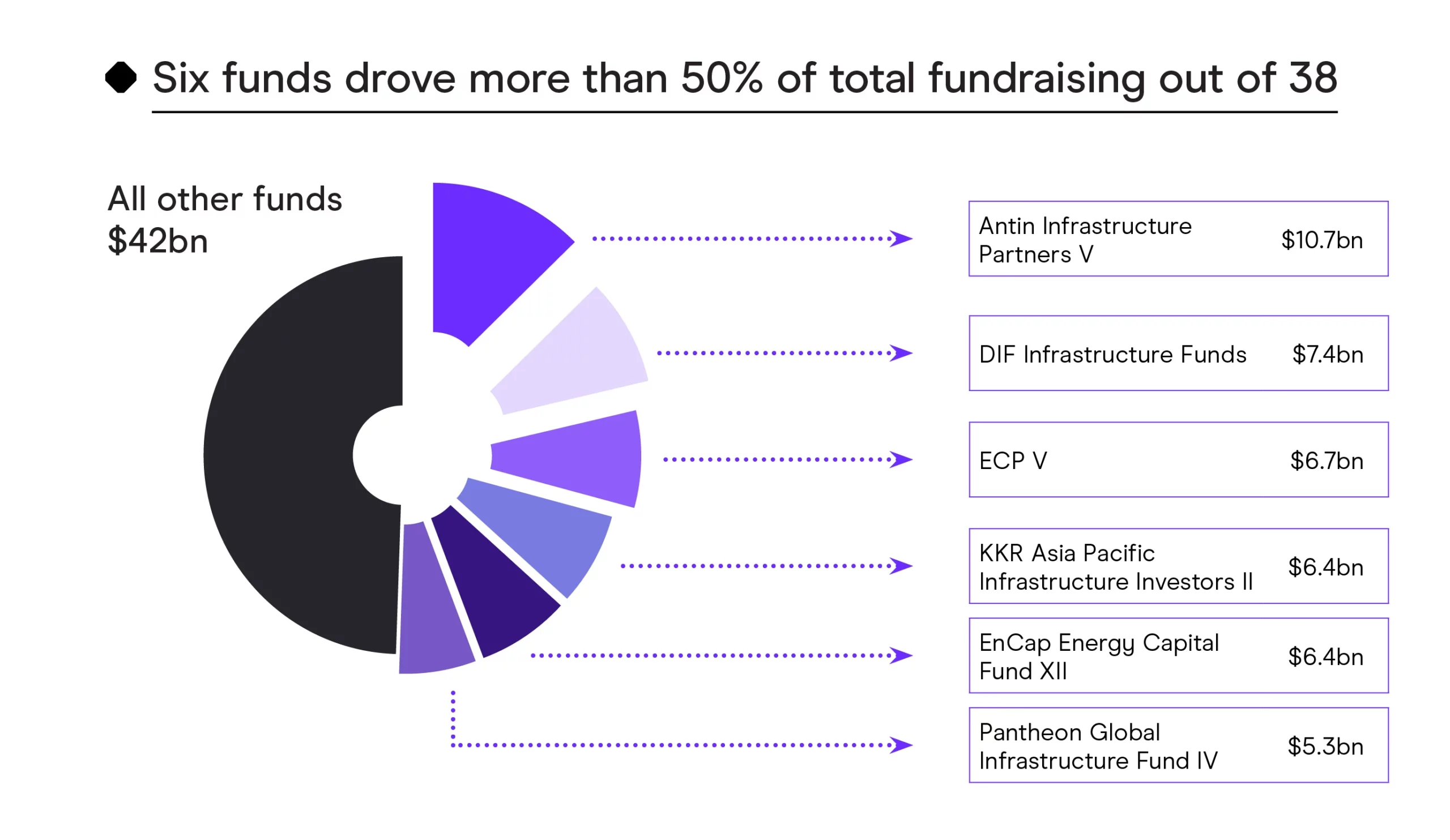

With Intelligence’s first Infrastructure Fundraising Report highlighted a highly concentrated market – with just six funds accounting for over 50% of total capital raised – where established managers dominate.

Despite that, 13 first-time funds closed in 2024, raising a total of $19.3bn as energy transition strategies are favored by specialist funds and opportunities abound across renewables and digital infrastructure.

The list of infrastructure emerging managers to watch in 2025 strongly reflects this picture, as the vast majority include new managers being set up by industry veterans or new infra-specific units and first-time funds being launched by managers with an established footprint in other private markets.

It is interesting to note that, while most of these managers launched a few years ago, they only started marketing their first funds last year, confirming the challenges facing new entrants in a slow and often unpredictable fundraising environment.

VisionEdgeOne | Boe Pahari | Value-add | London | Transportation, energy, digital, social infrastructure

Established in 2022, VisionEdgeOne (VE1) actively came to market with its first infrastructure and energy transition fund in 2024. VisionEdgeOne Infrastructure Partnership is looking to raise up to €1bn in capital commitments and was targeting a €100m first close imminently as of February.

The firm was founded and is chaired by Boe Pahari, former CEO and global head of infrastructure equity at AMP Capital, where he oversaw a $21bn infrastructure platform.

Managing partners Claus Lyngdal, former head of alternatives at PensionDanmark, and Adam Ringer, our head of origination and a former AMP Capital partner.

VisionEdgeOne’s leadership includes a team of industry veterans with extensive experience in infrastructure investment and asset management.

Manish Aggarwal, managing partner at VE1, was previously a partner at AMP Capital and has over 30 years of experience in private equity and infrastructure investment.

Christopher Tang, former chief investment director and head of infrastructure at Danske Bank Asset Management, is part of the firm’s investment team, along with Bruno Erbel who joined from Marguerite in September last year.

Katie Sunderland and Sudhanshu Garg lead investor relations and capital-raising efforts.

Glentra Capital | Henrik Tordrup | Value-add | Copenhagen | Power generation, transmission, energy storage, electrification of heat and transport, carbon storage, and energy efficiency

Copenhagen-headquartered Glentra Capital has a similar story. Established between 2022 and 2023, the manager began to actively fundraise for its first infrastructure fund – Glentra Fund I – in 2024 with a target of €750m and a hard cap of €1bn.

The firm was launched by former Copenhagen Infrastructure Partners (CIP)’s Henrik Tordrup and Vestas’ Lars Villadsen with €400m of seed capital from institutional investors Pensionskassernes Administration (PKA) and Novo Holdings.

Last summer, another former CIP, Steen Lonberg Jorgensen, joined the firm as head of investor relations and capital formation to propel fund I’s fundraising activity beyond the initial cornerstone investments from Novo and PKA.

In December last year, the manager reached a second close by raising an additional €100m from US and Canadian investors. A third close followed in March, which took fund I to a total capital raised of €540m.

Final close is set for June and is expected to hit the €750m target. Additional capital is expected to come from non-Danish, European LPs.

Glentra Capital seeks investments in mid-market growth platforms and companies in the energy transition space across sectors including power, heat, sustainable fuels, storage, carbon, energy integration, and capital-intensive supply chain infrastructure.

Its geographic focus includes Europe and North America, with target investments ranging from €100 million to €200 million.

Jacmel Infrastructure | Nick Jean-Baptiste | Core/Core-plus | New York | Transportation, energy, digital, social infrastructure

Following on from a trend of industry veterans and established firms making their first foray into infrastructure, Jacmel Partners in January launched Jacmel Infrastructure.

Established in 2015 by former Macquarie’s pro Nick Jean-Baptiste, Jacmel Partners’ strategy has so far focused on private equity.

In January, the firm announced the launch of Jacmel Infrastructure seeking investments in critical infrastructure projects and operating platforms, primarily in the transportation, energy, social and digital sectors.

The platform will be led by operating partner Mike Salzman, who previously held various roles in the industry, including a position as global head of airports for real estate operator Unibail-Rodamco-Westfield in Los Angeles.

The company’s strategy will center on providing capital to government agencies and municipalities as well as investors and developers in the infrastructure market. It will look to leverage its key relationships with local and state authorities to gain early access to opportunities in the infrastructure space predominantly in the form of public-private partnerships. Jacmel Infrastructure will favor a value-added approach to large-scale infrastructure projects.

Kingston Capital Management | Darren Dixon, Joshua Packwood | Opportunistic | Miami | Digital, social and environment, transportation, energy and renewables

Another company coming out of a pro spin out, Kingston Capital Management was set up by former Goldman Sachs’ partner Darren Dixon and ex-Balyasny Asset Management investment pro Joshua Packwood in 2022 and is currently in the market with its first infrastructure fund.

Kingston Infrastructure Partners I is seeking to raise at least $2bn to invest in digital, social and environment, transport, energy and renewables assets in North America and Europe. As of September last year, the fund had drawn between $500m and $1bn of capital commitments from five LPs.

The Miami-based firm has also been rapidly expanding its team with the recent appointment of former Goldman Sachs banker Guilherme Dzik as managing director in London. The firm has also recently hired of Jody-Ann Bailey-Smith as CFO, including three further appoints of Nicholas Welsh as vice president in Miami; Siyu Xie in London; and Michael Horn in New York.

Lieef | Brad Kavin | Value-add | Los Angeles | Renewables, power generation and storage, EV charging, sustainable fuels and wastewater

Yet another spin-out firm in the US, Lieef was established in 2020 by former BlackRock executive Brad Kavin in Los Angeles.

Five years down the line, the firm is fundraising for its first fund since launch. According to SEC filings in January, Lieef GP Capital Fund had raised at least $25m from two investors.

The new fund focuses on project and corporate investments into emerging infrastructure opportunities with the capability to invest into both companies and projects, and as a control or minority investor.

It will invest mainly in renewables power generation and storage, EV charging, sustainable fuels and wastewater, with a target investment size of $25m to $75m per deal, with the ability to scale the initial investment size down or up alongside co-investment partners.

While the fund’s mandate provides the flexibility to invest in OECD countries, the firm is prioritizing opportunities in the US and Canada.

Luminori | Hamish De Run | Value-add | London | Sustainable transportation

Following a similar timeline, but on the other side of the Atlantic, London-based Luminori is in the market with its first infrastructure fund, targeting between £500- 600m.

Founded in 2021 after Hamish De Run departed from Federated Hermes, Luminori specializes in infrastructure and energy assets.

Luminori has been building its team with key hires including Kirsty Galliano, who leads client and product solutions, and Lauryn Favillier, director of infrastructure investments. Both joined from Federated Hermes.

While Luminori has been active in advising deals globally—such as acquisitions of airports in Europe and North America—this marks its first foray into launching its own fund. The fund’s focus on transportation infrastructure reflects a broader industry trend to finance projects that reduce carbon emissions and promote sustainable growth.

LBP AM European Private Markets | Peter Arnold | Core-plus | Paris | Private corporate debt, capital investment, and infrastructure debt and equity

In January, French manager LBP AM announced the launch of its new private markets platform – LBP AM European Private Markets – led by former Schroders executive Peter Arnold.

The new platform encompasses the firm’s direct lending, infrastructure debt, real estate debt and capital solutions units. It has 45 staff members, including 20 full-time investment professionals.

Shortly after, the firm launched its first European Long Term Investment Fund (ELTIF) - LBPAM Private Opportunities – investing across private corporate debt, capital investment, and infrastructure debt and equity.

The vehicle will allocate to funds managed both by LBP AM and third-party asset managers, and will be diversified by vintage. The fund has a minimum investment of just €100.

ELTIF will be managed by the capital solutions team, which is led by ex-Natixis Investment Managers pro Irène d’Orgeval, who re-joined LBP AM in July 2023, having previously helped build the firm’s private markets platform between 2012 and 2018.

Ones to watch 2025: Infrastructure

| Firm | Founder(s) | Pedigree | Location | Sector | Strategy |

|---|---|---|---|---|---|

| VisionEdgeOne | Boe Pahari | AMP Capital | London | Transportation, energy, digital, social infrastructure | Value-add |

| Glentra Capital | Henrik Tordrup | Copenhagen Infrastructure Partners | Copenhagen | Power generation, transmission, energy storage, electrification of heat and transport, carbon storage, and energy efficiency | Value-add |

| Jacmel Infrastructure | Nick Jean-Baptiste | Macquarie Group | New York | Transportation, energy, digital, social infrastructure | Core/Core-plus |

| Kingston Capital Management | Darren Dixon, Joshua Packwood | Goldman Sachs, Balyasny Asset Management | Miami | Digital, social and environment, transportation, energy and renewables | Opportunistic |

| Lieef | Brad Kavin | BlackRock | Los Angeles | Renewables, power generation and storage, EV charging, sustainable fuels and wastewater | Value-add |

| Luminori | Hamish De Run | Federated Hermes | London | Sustainable transportation | Value-add |

| LBP AM European Private Markets | Peter Arnold | Schroders | Paris | Private corporate debt, capital investment, and infrastructure debt and equity | Core-plus |

Source: With Intelligence