Infrastructure Fundraising Report 2024

Share:

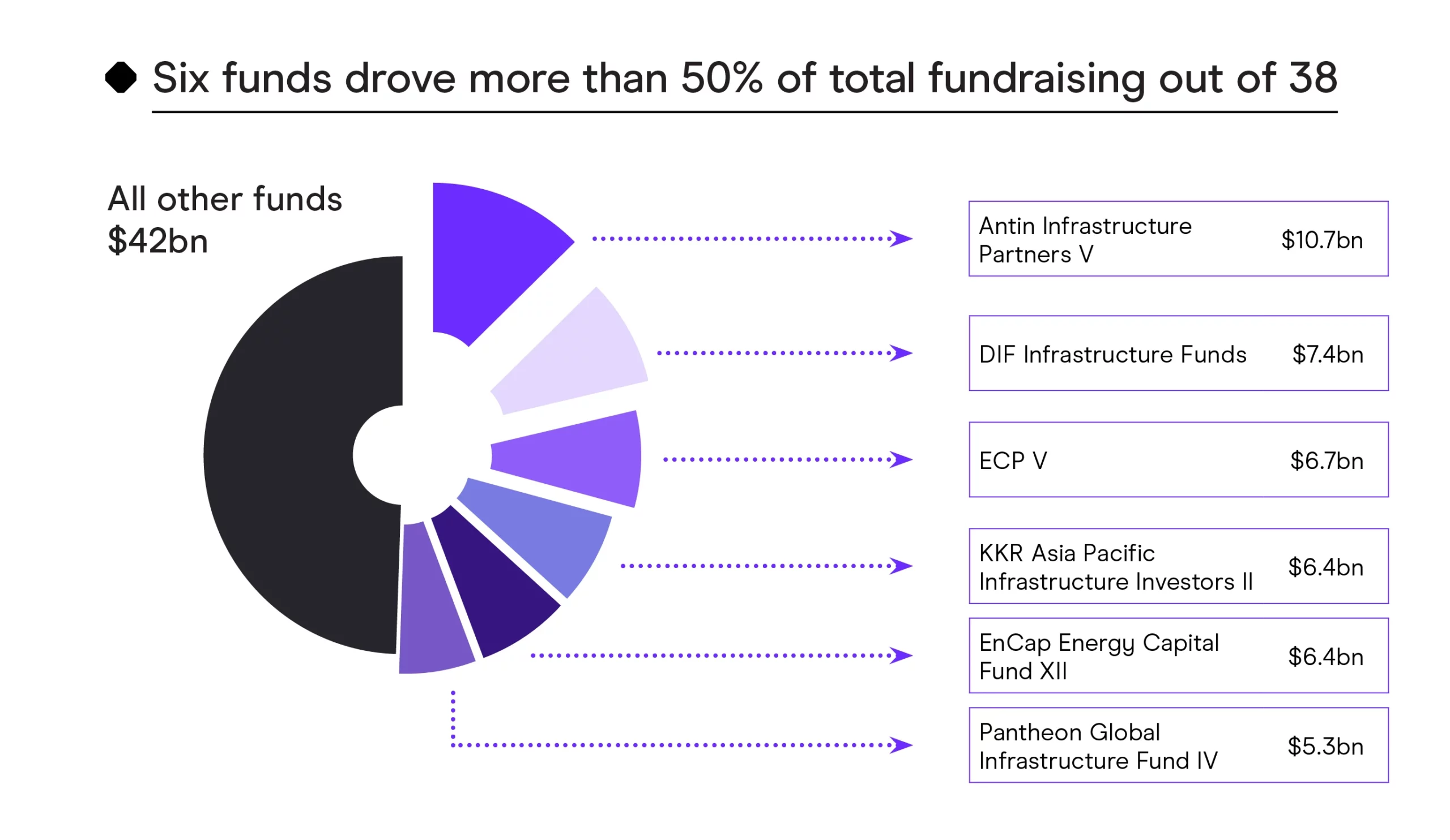

In 2024, infrastructure fundraising was heavily concentrated among the largest funds.

Half of the $84bn raised came from funds closing above $5bn, reflecting broader trends in asset management.

Just six funds accounted for over 50% of total fundraising in 2024. The trend is set to accelerate further in 2025, with a group of $15bn+ mega funds set to close. Most of the capital surrounds AI-related investments such as digital infrastructure as well as renewable energy.

Infrastructure fundraising remains challenging, similar to 2023. The last two years were the lowest capital-raising period since 2015.

Mega funds

By the end of 2024, Antin Infrastructure Partners V had deployed 40% of its capital, primarily into energy-focused investments. Deals included Blue Elephant Energy, Consilium Safety, Opdenergy, Portakabin and Proxima.

Infrastructure fundraising remains concentrated in mega funds ($10bn+). Many are taking longer to raise capital, suggesting 2025 could be a bumper year for fund closures.

Mega funds in market

| Manager | Fund name | Strategy | Fund size |

|---|---|---|---|

| Global Infrastructure Partners | Global Infrastructure Partners Fund V | Core plus | $25bn |

| EQT Partners | EQT Infrastructure VI | Value add | $20bn |

| KKR | KKR Global Infrastructure Investors V | Value add | $20bn |

| Brookfield Asset Management | Brookfield Global Transition Fund II | Core plus | $20bn |

| I Squared Capital | ISQ Global Infrastructure Fund IV | Value add | $15bn |

| Stonepeak | Stonepeak Infrastructure Fund V | Core plus | $15bn |

Top funds

Antin Infrastructure Partners V was the largest fund close of 2024 and the only one above $10bn. Macquarie closed an $8.7bn fund in December 2023. Several $5bn+ funds were also raised by major GPs, including KKR, EQT and Stonepeak.

$6.4bn KKR Asia Pacific Infrastructure Investors II was the biggest fund close in Asia.

20 largest funds closed in 2024

Specialist versus generalist

Generalist funds raised $52bn (61%) of total fundraising, while energy transition and renewable-focused specialist funds led among sector strategies.

Top 20 managers by total raised in 2024

| Manager | Specialist vs generalist | Total raised |

|---|---|---|

| Antin Infrastructure Partners | Generalist | $10.7bn |

| EnCap Investments | Energy transition | $7.9bn |

| DIF Capital Partners | Generalist | $7.4bn |

| Energy Capital Partners | Energy transition | $6.7bn |

| Stonepeak | Generalist | $6.5bn |

| KKR | Generalist | $6.4bn |

| Pantheon | Generalist | $5.3bn |

| Global Infrastructure Partners | Generalist | $4.7bn |

| EQT | Energy transition | $3.2bn |

| LS Power | Energy transition | $2.7bn |

| Infranity | Impact | $2.1bn |

| SDC Capital Partners | Digital infrastructure | $2.1bn |

| I Squared Capital | Generalist | $1.8bn |

| Arcus Infrastructure Partners | Generalist | $1.7bn |

| Five Point Energy | Water | $1.4bn |

| Ancala | Generalist | $1.3bn |

| H.I.G. Capital | Generalist | $1.3bn |

| Arjun Infrastructure Partners | Generalist | $1.2bn |

| Silver Hill Energy Partners | Oil and gas | $1.1bn |

| Denham Capital | Energy transition | $1.0bn |

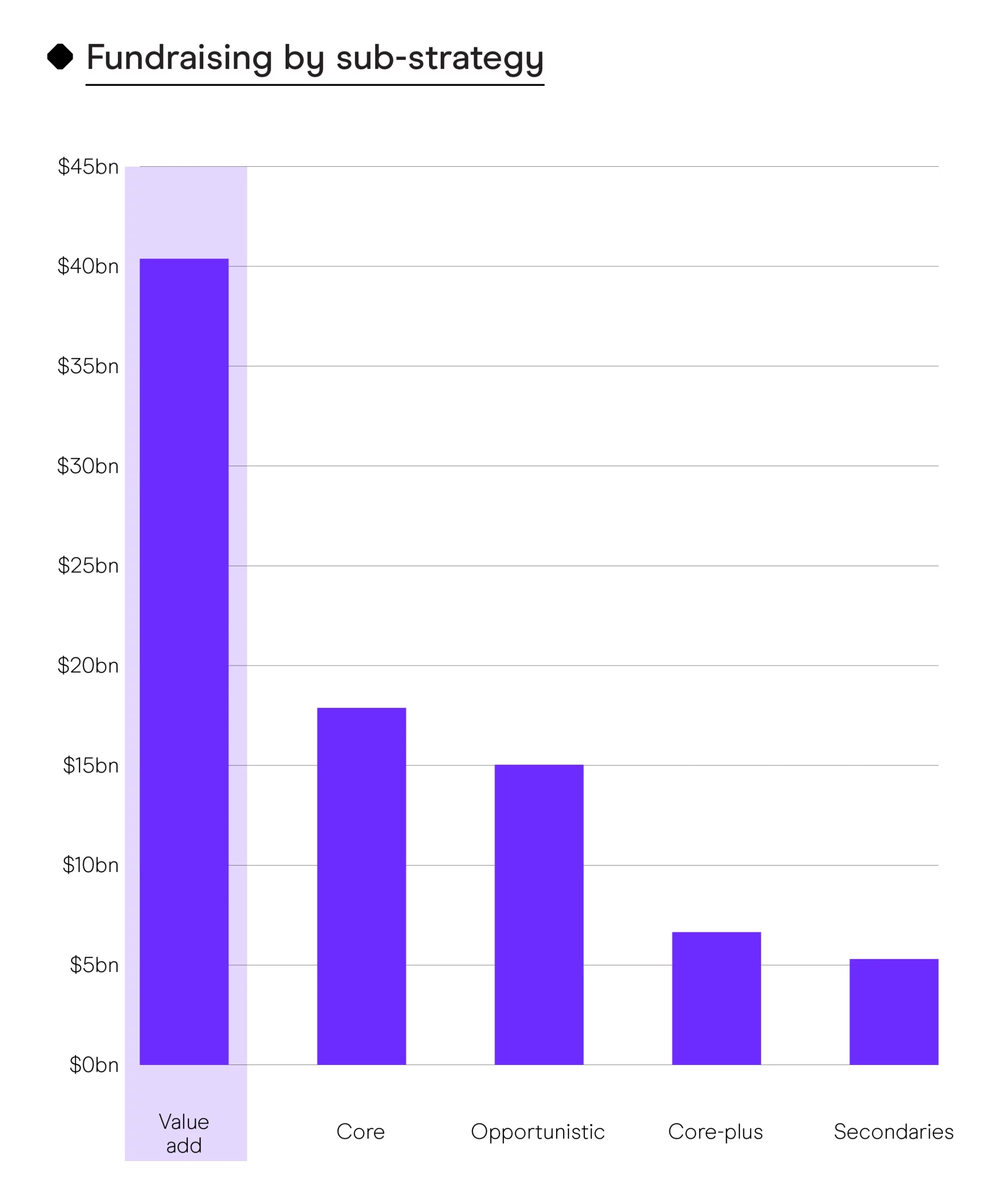

Sub-strategies

As LPs demand higher returns, GPs have adjusted their portfolios accordingly. In 2024, $55bn (70%) of all fundraising flowed into value-add and opportunistic strategies.

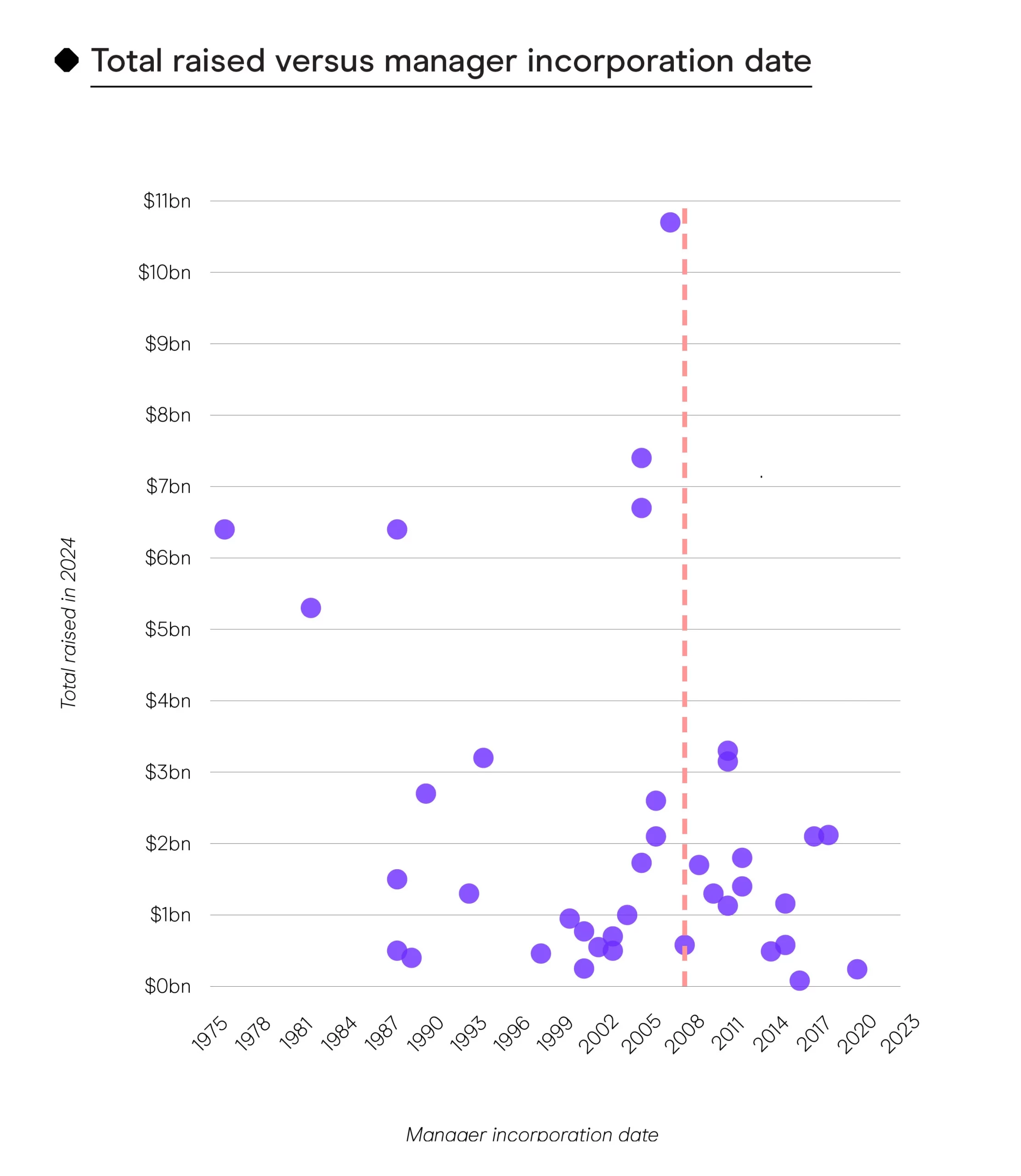

GFC track record

Manager experience plays a key role in allocation decisions. Established GPs, especially those founded before the financial crisis, are capturing the majority of capital. In 2024, 97% of fundraising went to managers founded in 2017 or earlier.

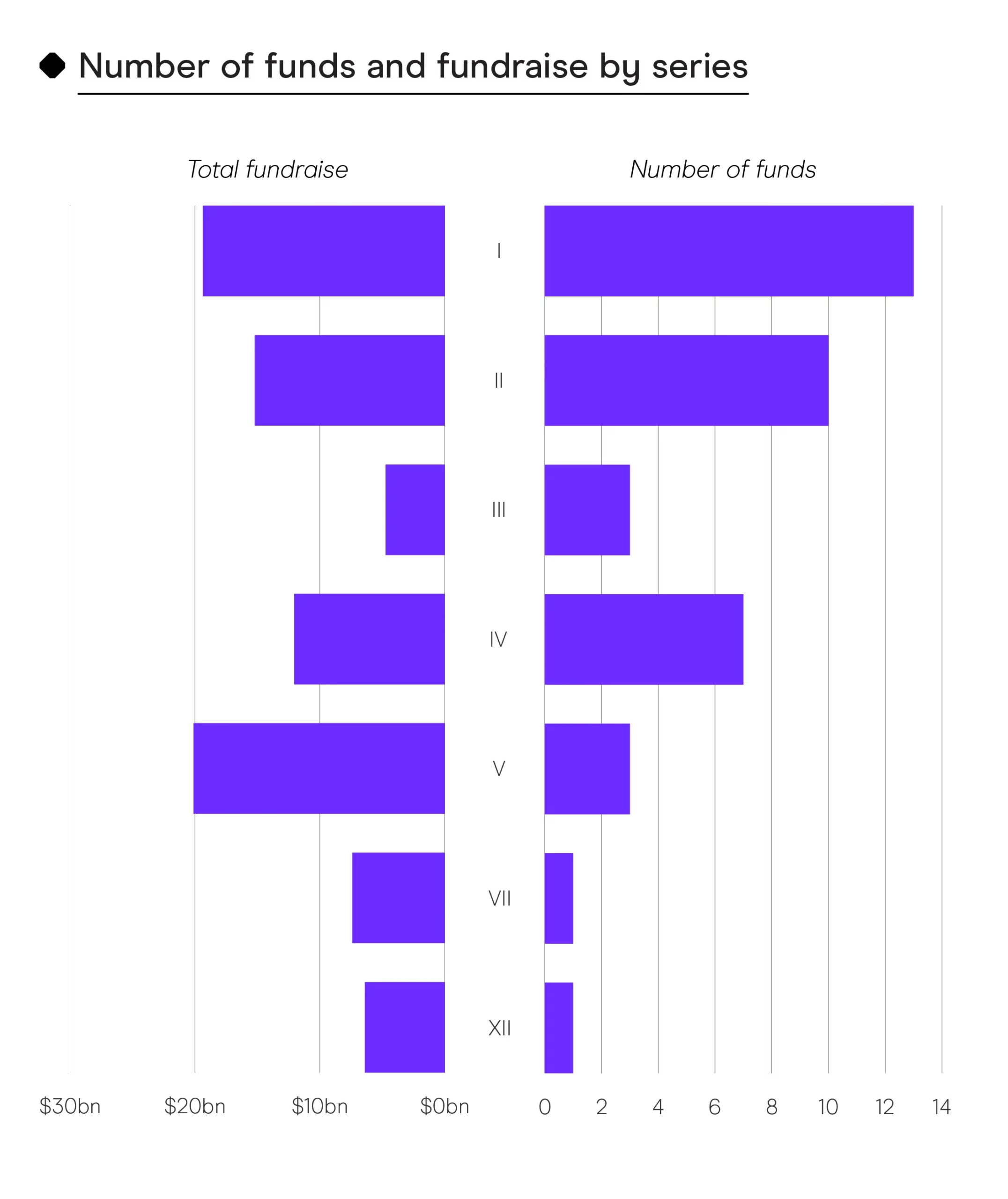

Fund series

Despite a tough environment, 13 first-time funds closed in 2024, raising a total of $19.3bn. This highlights a resilient market for investors exploring new opportunities.

Fund vintage

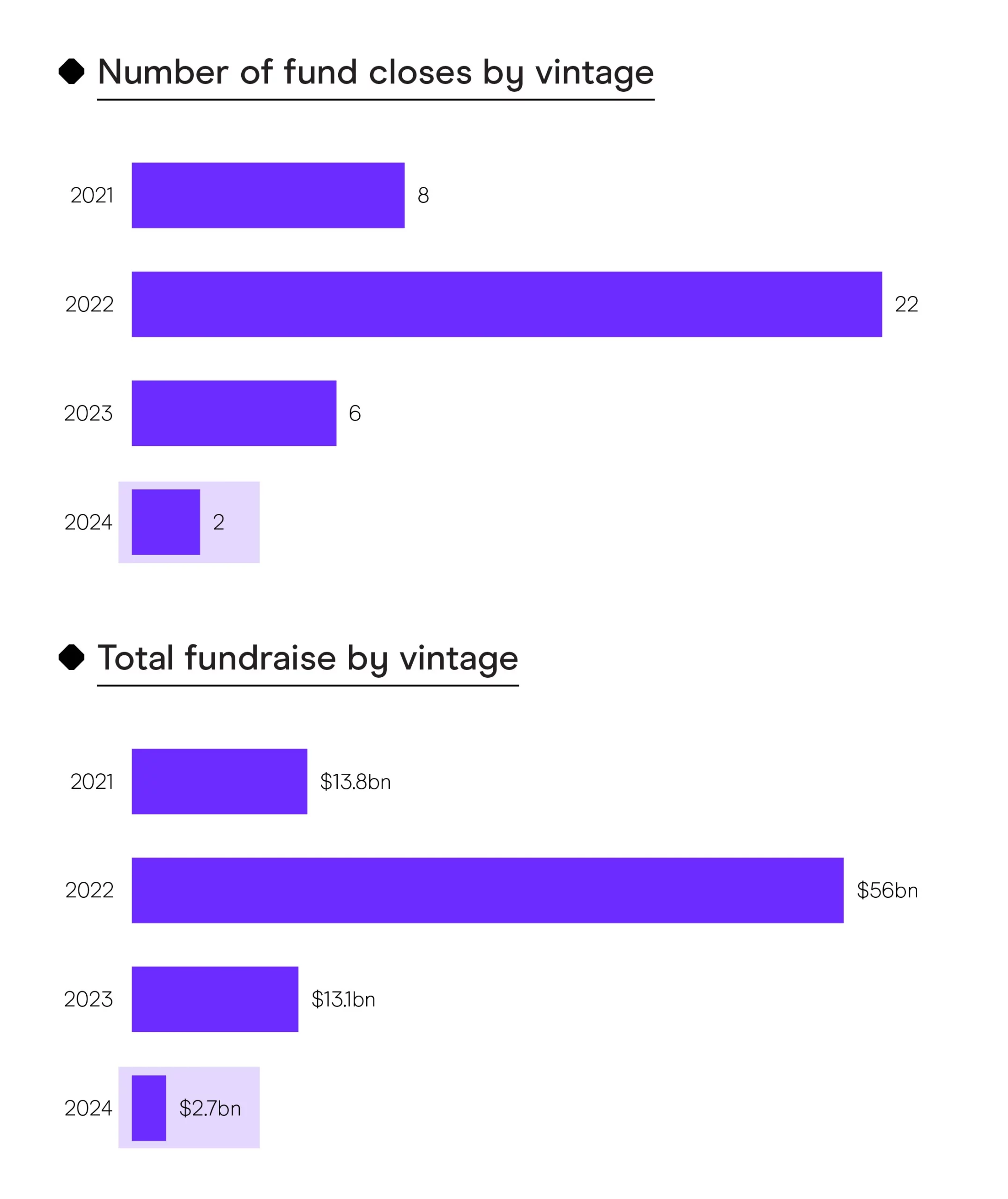

With Intelligence tracked $70bn in raised capital from funds launched in 2021 and 2022, reflecting a larger amount of time spent on the road compared to previous years.

Two 2024 vintage funds closed last year: SDC Digital Infrastructure Opportunity Fund IV raised $2.1bn in just a few months, underscoring strong demand for digital infrastructure. This follows Fund III, which closed at $1.5bn three years earlier. Lanza Capital Fund II also closed at $0.6bnSS.

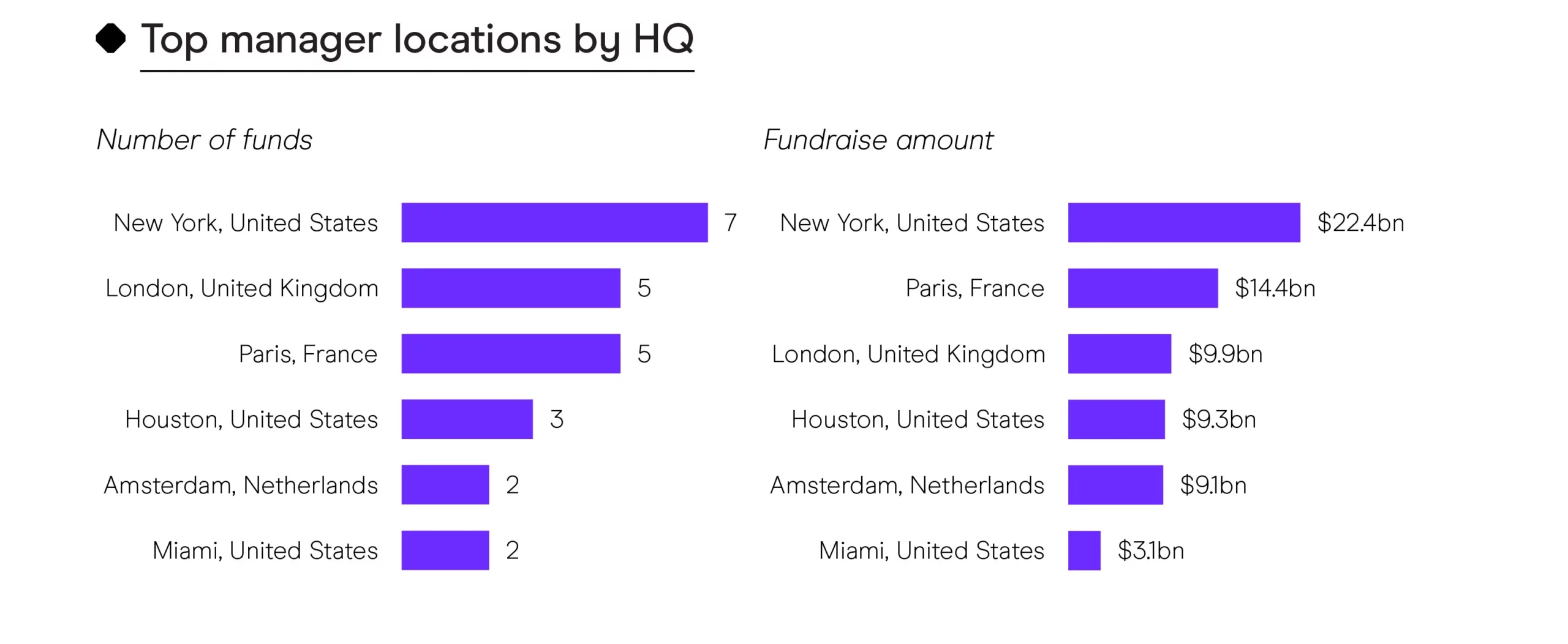

Geography

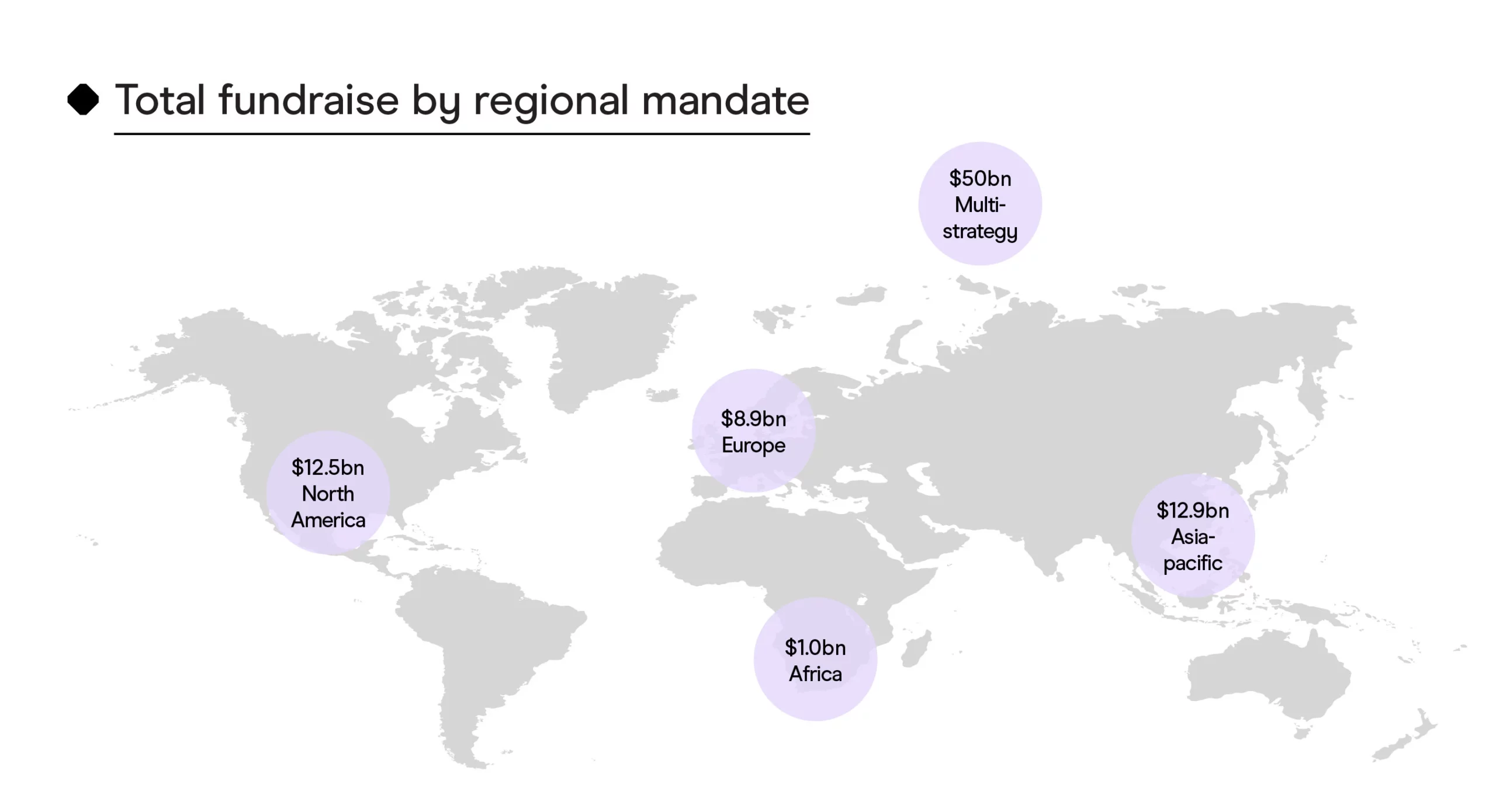

Multi-regional funds have dominated capital raising in 2024, with $50bn in fund closes.

22 New funds launched outside the US in 2024, making up the majority of the year’s 38 total fund launches.

US managers targeted a larger global investment strategy in 2024, showing greater appetite for European infrastructure. A handful of US-based managers were focused exclusively Asia.

European managers remain primarily focused on their home region, although a significant number look globally with flexible mandates.