A year of strong returns for long/short equity in 2024

Share:

Long/short equity hedge funds posted a standout year in 2024, delivering their most substantial returns since 2020 and outperforming other hedge fund strategies.

Long/Short outperforms other hedge fund strategies

Long/short equity funds posted double-digit average returns in 2024, achieved higher alpha, and had far stronger relative performance against the stock market than in 2023, demonstrating improved stock-picking ability.

For the first time since 2020, long/short equity funds also led all other main hedge fund strategies in performance.

Asia rebounds, but Europe lags

On a regional level, Asia-focused long/short equity funds delivered a particularly welcome rebound following a challenging period of underperformance, especially among Greater China-focused strategies.

Meanwhile, US-focused funds continued to perform strongly, benefiting from the strength of American equity markets.

In contrast, European long/short equity funds lagged behind for the second consecutive year.

Tech leads the way

Unsurprisingly, technology-focused long/short equity funds dominated sector performance in 2024, supported by the continued momentum of large US tech stocks.

These funds posted impressive returns of 25.7%, significantly outpacing other sectors. However, finance-focused funds also saw a marked improvement from 2023.

Strong risk-adjusted returns

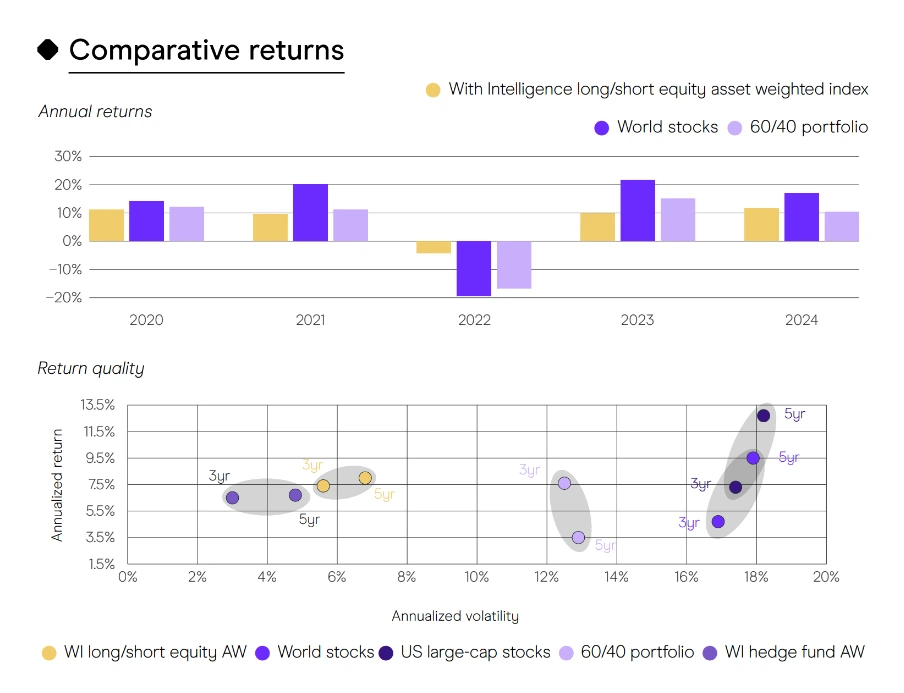

Over the past five years, long/short equity funds have captured less than one-third of the downside of the period’s most significant stock sell-offs, which were driven by geopolitical turmoil, inflationary episodes, and central bank action.

Looking back further than 2024, on both a three-year and five-year look back, long/short equity funds have delivered better risk-adjusted returns than world stocks.

They have also outperformed stocks on an annualized return basis over the past three years, thanks to their downside protection during the 2022 sell-offs.

Hedge fund outlook in 2025

As for the asset class as a whole, hedge funds can look towards 2025 with a degree of optimism.

Compared to 2023, more hedge funds ended 2024 with performance likely to have met, or even exceeded, investor expectations. But we see the opportunity set for different hedge fund strategies - and their attractiveness to allocators - materially changing in the year ahead.

A shift from speculative to macroeconomic events driving market volatility will generate more opportunities for macro, relative value and event-driven funds in particular.

Equity strategies may have to work harder, notably as declining rates remove some of their favorable conditions. But this will also present an opportunity for them to showcase alpha generation in stock selections on both the long and short side.