Pricing performance

From polarizing pass-through practices to co-investment and custom options, smart hedge fund managers are offering innovative deal sweeteners when it comes to fees

A new fees era

That two and twenty is history goes without saying. The once standard practice of charging investors a 2% management fee and a 20% performance fee on hedge fund net profits is being replaced by a raft of innovative fee structures as competition for assets intensifies and firms look for smarter ways to entice investors.

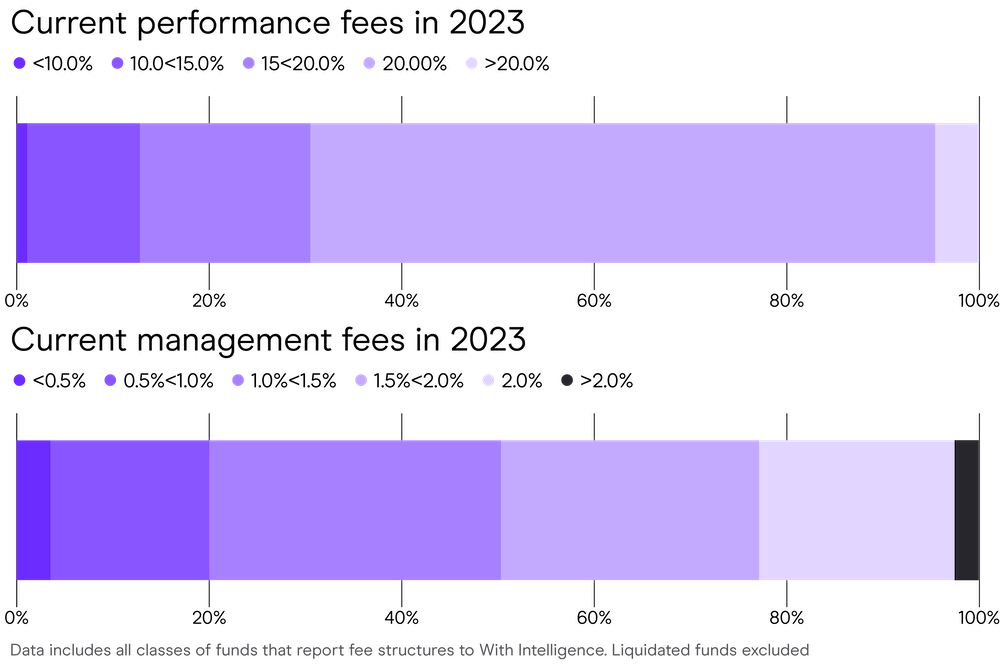

With Intelligence data shows that, while a 69% majority of hedge funds active in 2023 report charging a potential 20% performance fee, only 18% of active funds in our dataset were at high water mark and therefore likely to be charging performance fees in September 2023. Meanwhile more than 50% of management fees reported were at 1.5% or less.

>50% of management fees reported in 2023 were at 1.5% or less

With Intelligence data

The new hedge fees era emerging appears to be one that seeks to balance performance incentives with changes in operating models and a broadening view of investor benefits.

“[Funds’] proactive efforts to align interests with their investors are arguably the most attractive aspect of their offering,” says AIMA’s 2023 report, In Sync. “We now see a suite of fees and fund structures aligned to investor expectations,” Kehoe says.

Ultimately, manager and investor interests align around performance, but co-investment opportunities, longer lock-ups in return for fee discounts and, increasingly, passing on operational costs, are some of the ways in which fund managers and investors are finding that alignment.

Performance at all costs

In a challenging performance environment, a shift towards larger, multi-strategy funds has offered investors flexibility – and created an attractive operating environment for talented asset managers. But the increasing dominance of this more complex fund structure, and the competition for talent it has created, has brought with it changes in fees models. “Fees are being determined by the cost of talent and the cost of managing the business,” says AIMA’s Kehoe. For multi-manager funds, that can mean higher management fees and other pass-through fees.

Pass-through is quite polarizing

Toby Goodworth, head of liquid markets, bfinance

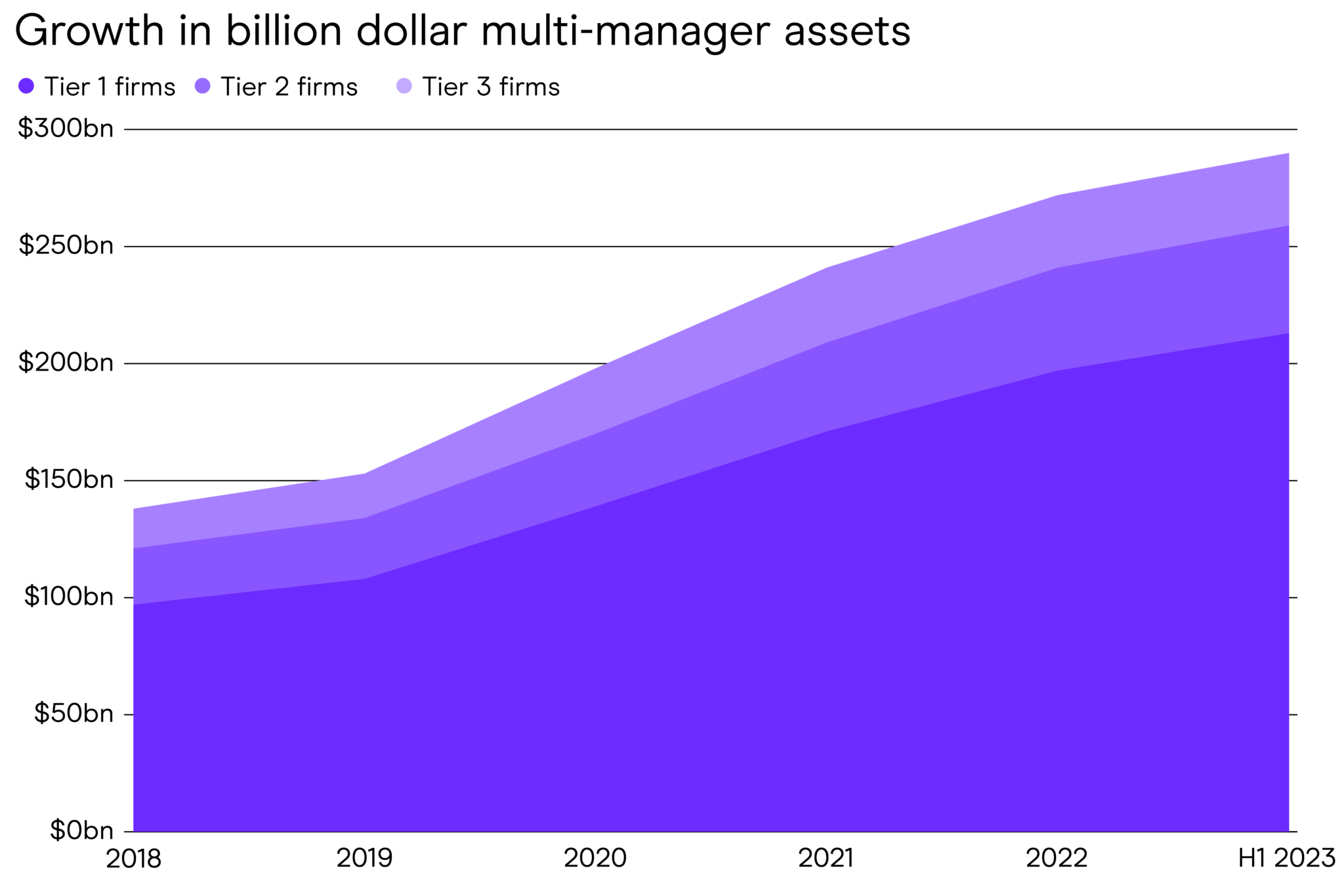

Multi-manager and larger funds remain popular with investors in spite of this, With Intelligence’s recent Multi-manager Hedge Fund Strategy Report shows. The biggest multi-manager funds in our Billion Dollar Club (BDC) ranking of hedge funds with AuM greater than $1bn show growth in assets of 7% in H1 2023.

“Liquidity is a more constraining factor than fees,” says bfinance consultancy’s head of liquid markets, Toby Goodworth. “Pass-through is quite polarizing. At the moment, in the multi-strategy space, we still see a majority of management and performance fee rather than pass-through. Some of the headline pass-through managers are actually closed for investment as well.”

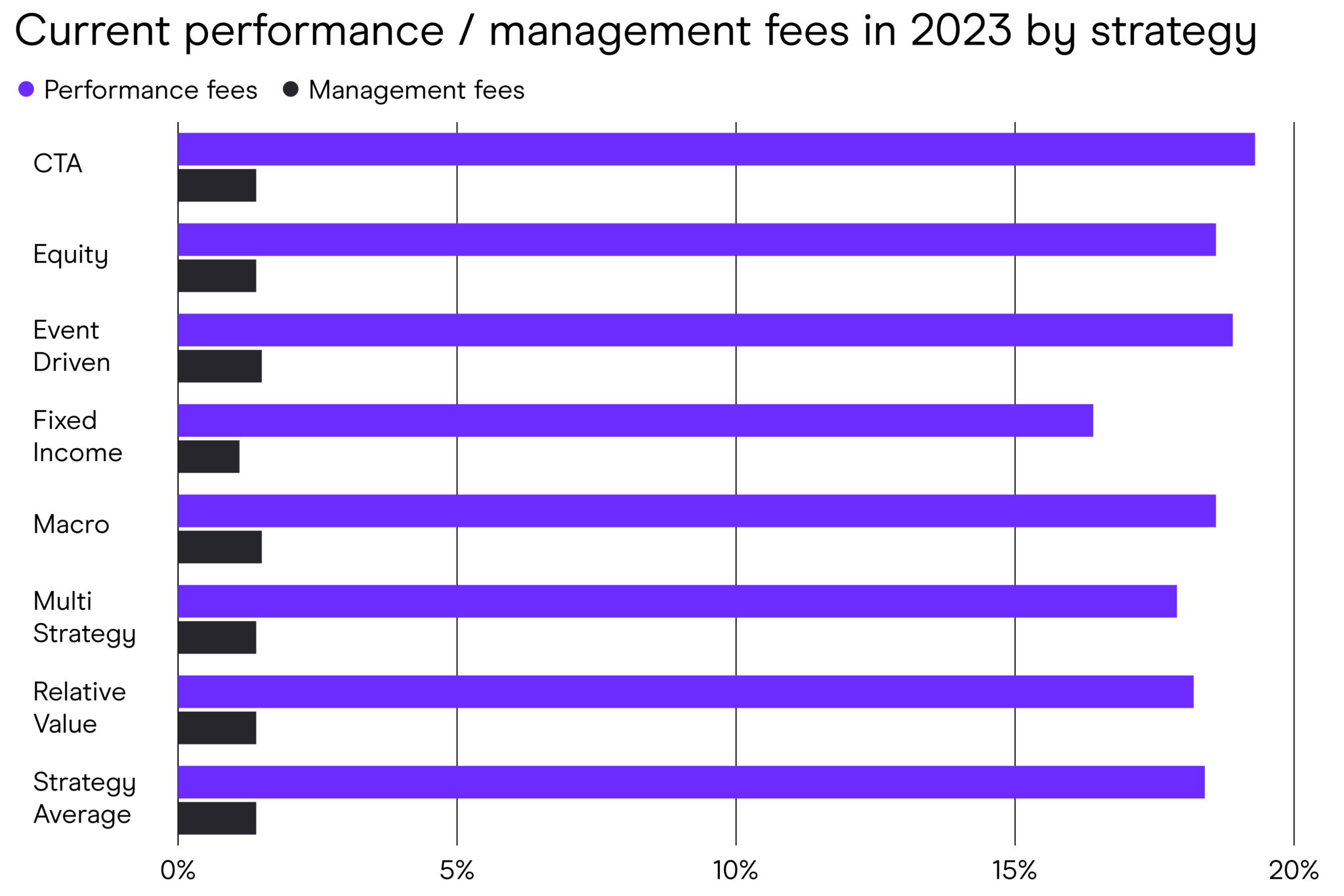

“Multi-strategy aside, it’s market-neutral strategies – CTA and systematic macro – that are most popular at the moment, and we’re not really seeing fees being constraining on that side.” While only one third of hedge funds have seen net inflows this year, up to half of CTA and macro funds have enjoyed inflows. Our fees data shows 2023 CTA management fees were at 1.4% and macro strategy management fees at 1.5%. The all-strategy mean average management fee for active funds in the With Intelligence dataset sits at 1.4% in 2023.

Goodworth believes fees sometimes range lower still: “The median fee in the typical hedge fund space we’re coming up against at the moment is around 1.25% and 15%.”

A fee saving is pure alpha

Toby Goodworth, head of liquid markets, bfinance

While funds may have secured relatively high fees at inception, fee models are nowadays increasingly under review, Goodworth, points out: “Helping investors review fees is incredibly important. Because, if you think about it, if you like the asset manager you’re with, a fee saving is pure alpha.”

Sharing value

A more bespoke arrangement is resulting in more competitive prices

Tom Kehoe, global head of research, AIMA

Greater transparency was cited by 69% of investors surveyed by AIMA in 2023 as a factor that could help align their interests with fund managers’. As well as preferential fee terms (54%) and tiered management fees (37%) investors surveyed suggested customised investment solutions (20%) and co-investment opportunities (20%) would also help to improve alignment of interests with fund managers.

“Certain geographies, such as Australia, and some types of investors – pension funds and some corporate bodies – may be more sensitive to fees than, for example, wealth managers,” says bfinance’s Goodworth.

“If there is a call to arms, it’s to managers who, in this non-zero-rate environment, should really consider if it’s fair to be charging a performance fee on returns that are not earned through the investment strategy,” Goodworth argues.

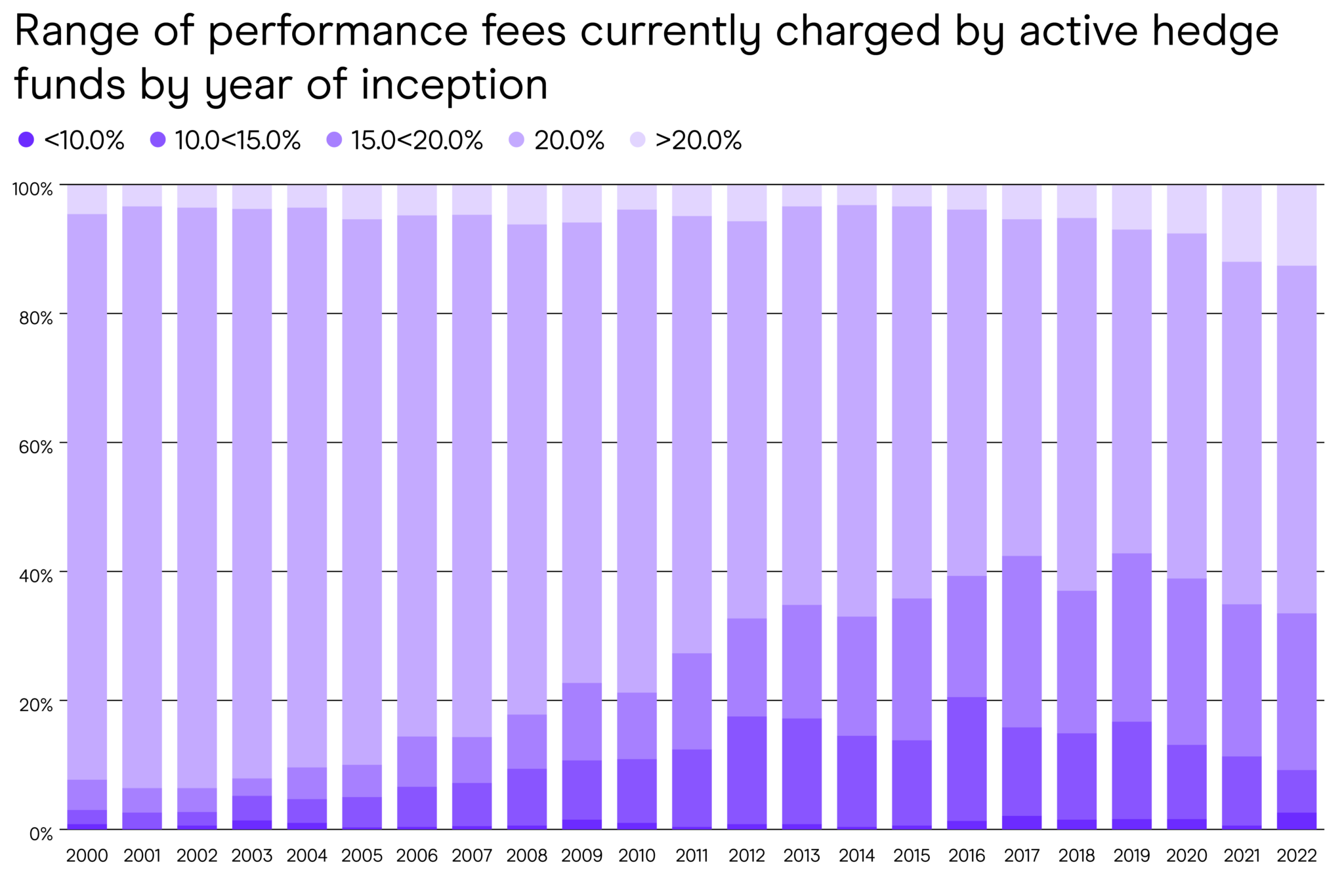

With Intelligence’s snapshot of fees at fund inception date shows performance fees saw little movement between the 18.7% average of 2021, when inflation surged in many economies, and 2022’s 18.6%.

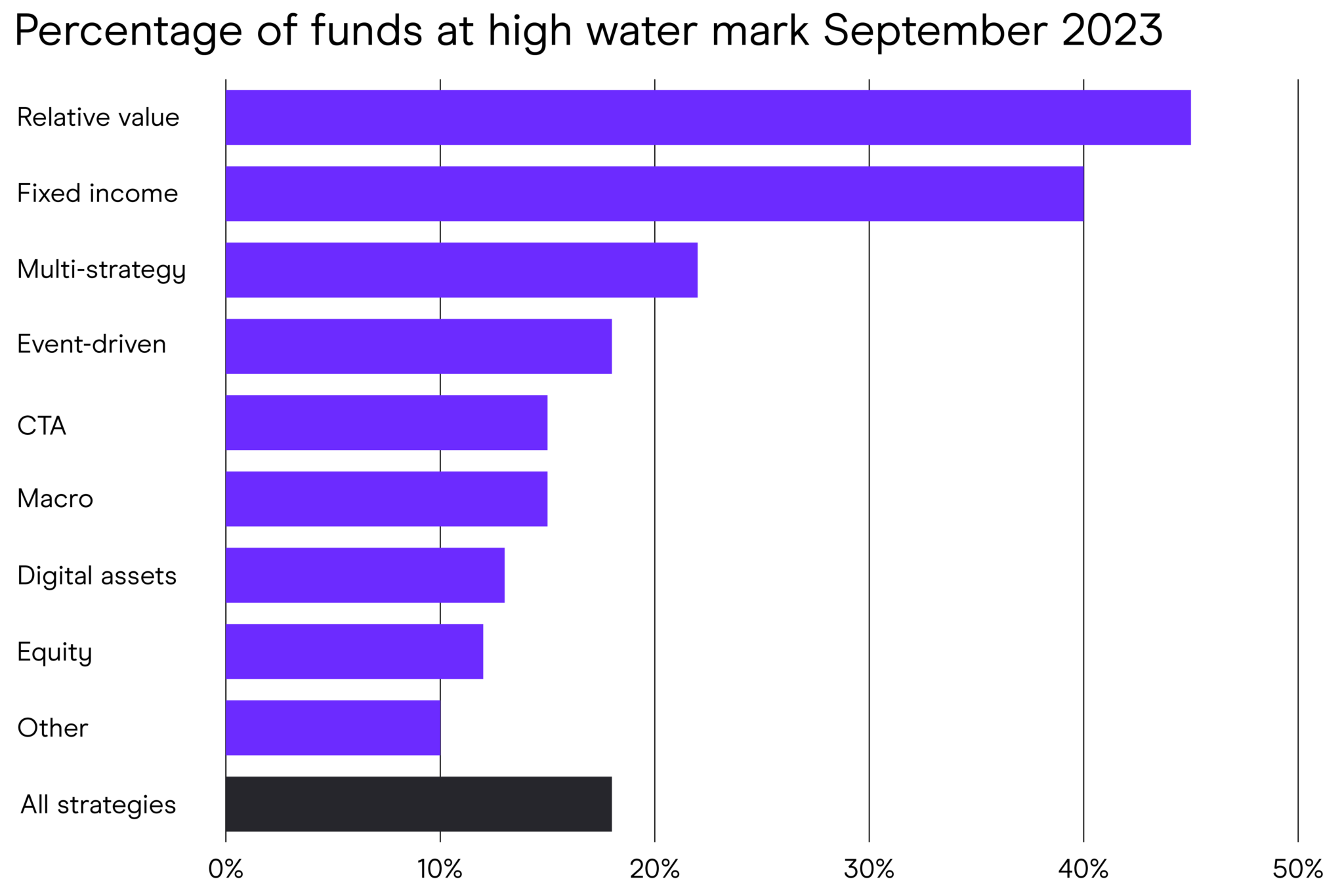

While relative value and fixed income strategy hedge funds show a high number of funds in our database at high water mark in September 2023, at 45% and 40% respectively, the mean average across all strategies stood at just 18%, putting the number of funds likely to be charging performance fees in the minority.

This reflects a challenging performance environment for global hedge funds, which were down 1% on average in October 2023, according to our latest Hedge Fund Performance Report. Multi-strategy, down 0.4% in the same month, remains the second-best performing strategy over the year to October, up 4.3%. Larger, established firms continue to outperform, our Multi-manager Hedge Fund Strategy Report shows, suggesting that multi-manager funds are likely to remain popular with investors, regardless of fee structures.