Evergreen private credit funds surpassed $500bn in AuM in 2024

Share:

The rapid rise of evergreen private credit fund structures continued in 2024, with total AuM held in these vehicles surpassing the $500bn mark during the year.

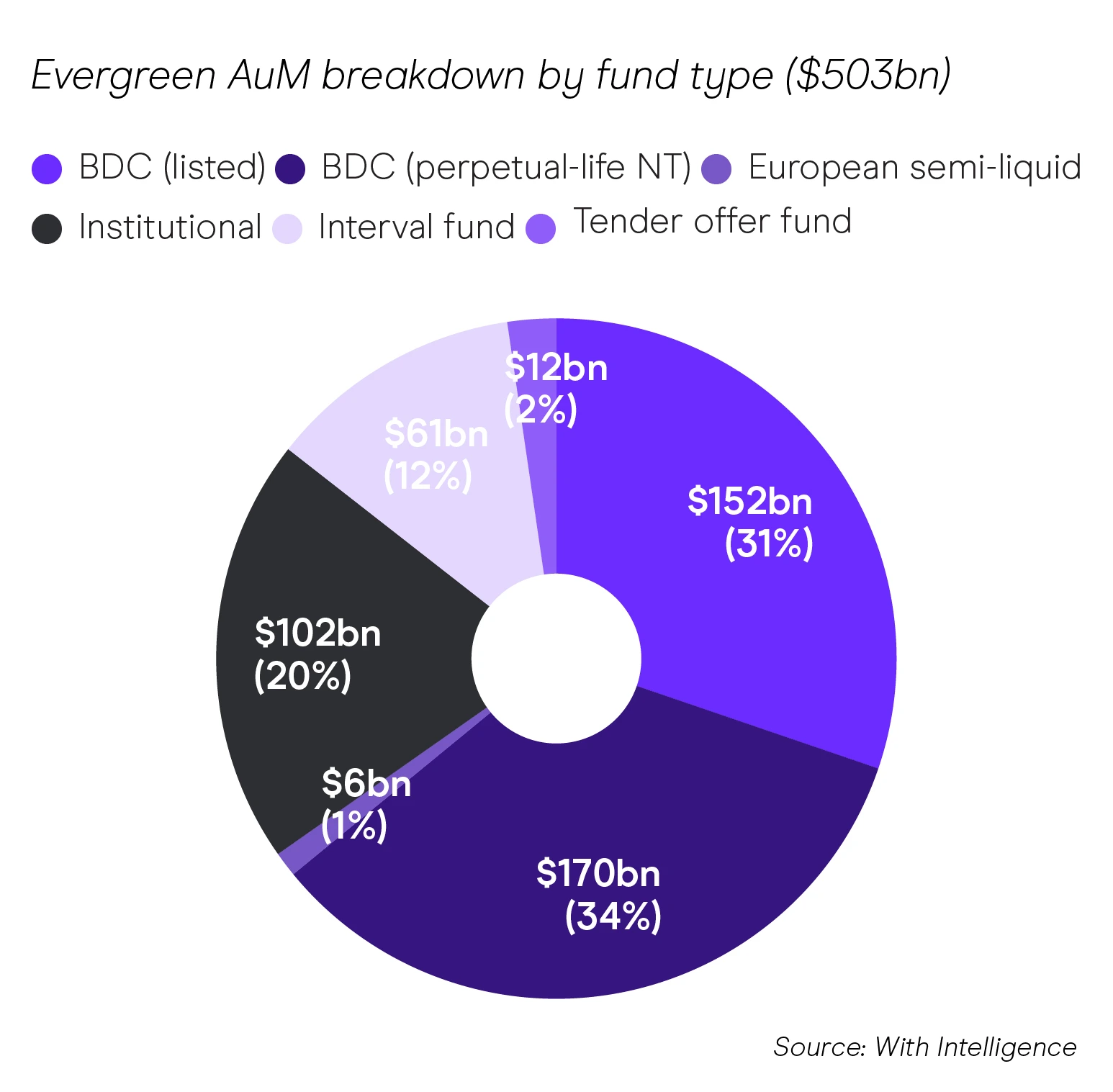

According to With Intelligence data, evergreen funds – including dedicated institutional vehicles, perpetual-life business development companies, interval funds, tender offer funds, and emerging European semi-liquid structures – currently have a total of $503bn in assets, up 27% on H1’s figure of $395bn.

The most striking development is the continued rise of the perpetual-life non-traded BDC, the primary tool used by US managers to access the private wealth segment: assets in these vehicles rose to $170bn in H2, marking a 33% increase in just six months.

Blackstone’s flagship non-traded BDC, BCRED, surpassed $64bn as of 30 September 2024, making it by far the largest private debt fund in the world. By year-end, the fund had grown further and now has over $70bn in assets.

Meanwhile, private evergreen vehicles surpassed $100bn in AuM in H2 – up from $66bn in H1 – helped by the final close of Blackstone’s $22bn Senior Direct Lending Fund.

GP concentration

As with other segments of private credit, evergreen funds show a significant degree of concentration among the largest managers: while 136 managers operate in this space, the five largest GPs manage $254bn – over half of the outstanding evergreen AuM. The top 20 managers collectively handle more than 80% of all assets.

Strategy breakdown

Direct lending is the most popular strategy in institutional evergreen funds, both by AuM and fund count: overall, 28 institutional funds manage $54bn in direct lending AuM. Seven of the 10 largest institutional evergreen funds by AuM are direct lending funds.

Opportunistic credit ranks second by AuM, with Sixth Street’s flexible “best ideas” fund, TAO, maintaining its position as the largest active evergreen vehicle. Ares’ flexible alternative credit fund, Pathfinder Core, is now the third-largest evergreen fund with $5.8bn in assets.

Top 10 managers by evergreen AuM

| Manager | Evergreen funds | Evergreen AuM |

|---|---|---|

| Blackstone | 5 | $101bn |

| Blue Owl | 7 | $47.6bn |

| Ares Management | 5 | $47.1bn |

| Sixth Street | 2 | $32.5bn |

| Cliffwater | 2 | $26.8bn |

| KKR* | 8 | $22.5bn |

| Apollo Global Management | 6 | $19.1bn |

| HPS Investment Partners | 1 | $13.8bn |

| Golub Capital | 3 | $13.6bn |

| PIMCO | 6 | $12.2bn |

*Includes $15.5bn held in FS/KKR BDCs

10 largest institutional evergreen funds

| Manager | Fund | Strategy | AuM |

|---|---|---|---|

| Sixth Street | Sixth Street TAO | Opportunistic | $29.0bn |

| Blackstone | Blackstone Senior Direct Lending Fund | Direct lending | $22.0bn |

| Ares Management | Ares Pathfinder Core Fund | Opportunistic | $5.8bn |

| MGG Investment Group | MGG SF Evergreen Fund (Levered + Unlevered) | Direct lending | $4.1bn |

| PIMCO | PIMCO Distressed Senior Credit Opportunities Fund II | Distressed debt | $4.1bn |

| KKR | KKR US Direct Lending Evergreen Fund | Direct lending | $3.9bn |

| Oak Hill Advisors | OHA Senior Private Lending Fund | Direct lending | $2.4bn |

| AllianceBernstein | AB Private Credit Investors Middle Market Direct Lending Fund | Direct lending | $2.3bn |

| TPG Angelo Gordon | AG Direct Lending Evergreen Fund | Direct lending | $2.2bn |

| Golub Capital | Golub Capital International Ltd | Direct lending | $2.1bn |