Private Equity Outlook 2025: Headwinds easing as private equity continues to innovate

Share:

Executive summary

Liquidity and fundraising are expected to remain key priorities for most General Partners (GPs) this year, though opportunities will persist amidst the challenges. The geopolitical landscape remains characterized by conflict, war, trade disputes, and sanctions. Central bankers and economists warn that lingering inflation is likely to lead to higher for longer interest rates. Meanwhile, global economic uncertainty is underpinned by spiraling government debt levels, which could tie policymakers’ hands in the event of the next economic crisis.

“There is a strong appetite to get markets moving”

Despite these concerns, the macro backdrop has eased somewhat, with signs pointing towards a more conducive environment for dealmaking, particularly in the US under President Trump’s second term. Interest rates are trending downwards in major economies, and a tentative ceasefire in the Middle East could ease some global tensions.

While industry participants will continue to closely monitor geopolitical developments and inflation, there is a strong appetite to get markets moving from both Limited Partners (LPs) looking for increased distributions and GPs looking for realizations across their portfolios.

The secondaries market and Net Asset Value (NAV) lending segment will continue to bolster the toolkit for private equity managers, with the former offering broad market exposure and vintage diversification to LPs. In turn, increasing liquidity could ease some operational pressure on private equity GPs, while allowing allocators more freedom over fresh commitments.

We expect fundraising in 2025 to remain below peak levels, and be challenging for most GPs, with investors still hamstrung from a lack of distributions and overweight Private Equity (PE) sleeves. Allocators will continue to prune portfolios, selectively sticking to favored managers and top performing names, while judiciously monitoring new opportunities.

That said, there is a cohort of investors being opportunistic, with some LPs looking to up allocations to private markets, broaden investment remits, and freshen up their portfolios.

Fundraising: Paradigm shift underway

The private equity fundraising landscape is experiencing a fundamental shift, with many traditional institutional investors constrained in their ability to put new capital to work. The era of guaranteed re-ups is over.

Larger and more savvy GPs have taken swift action to target new types of investors in addition to expanding their business development teams to new geographies. GP-led secondaries, NAV lending, GP stakes, portfolio refinancings, third party distribution, and strategic mergers and acquisitions (M&A) have all been utilized to plug fundraising gaps and tap new pools of capital.

“The era of guaranteed re-ups is over”

However, despite these short-term fundraising and financing difficulties, overall investor sentiment remains largely positive.

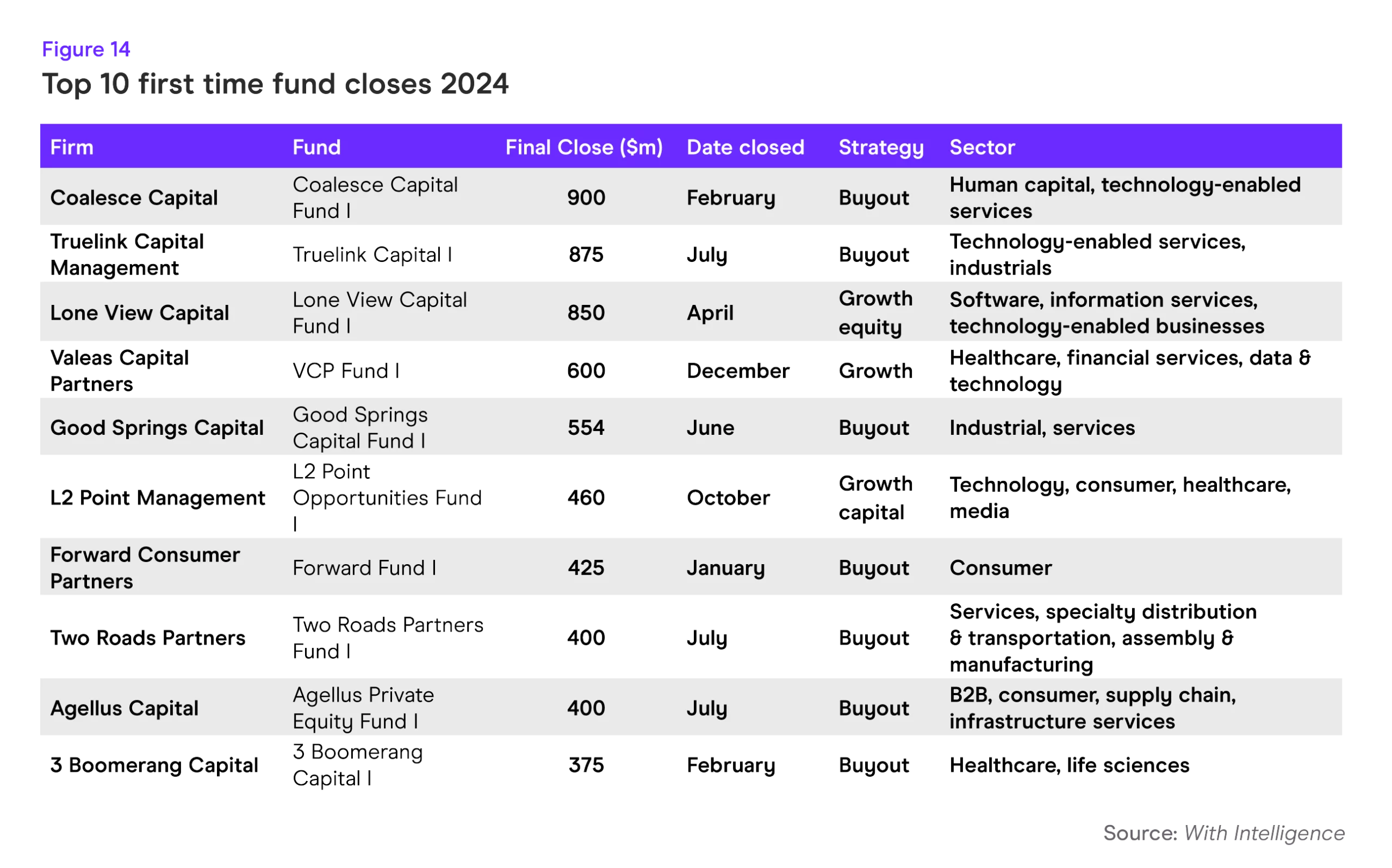

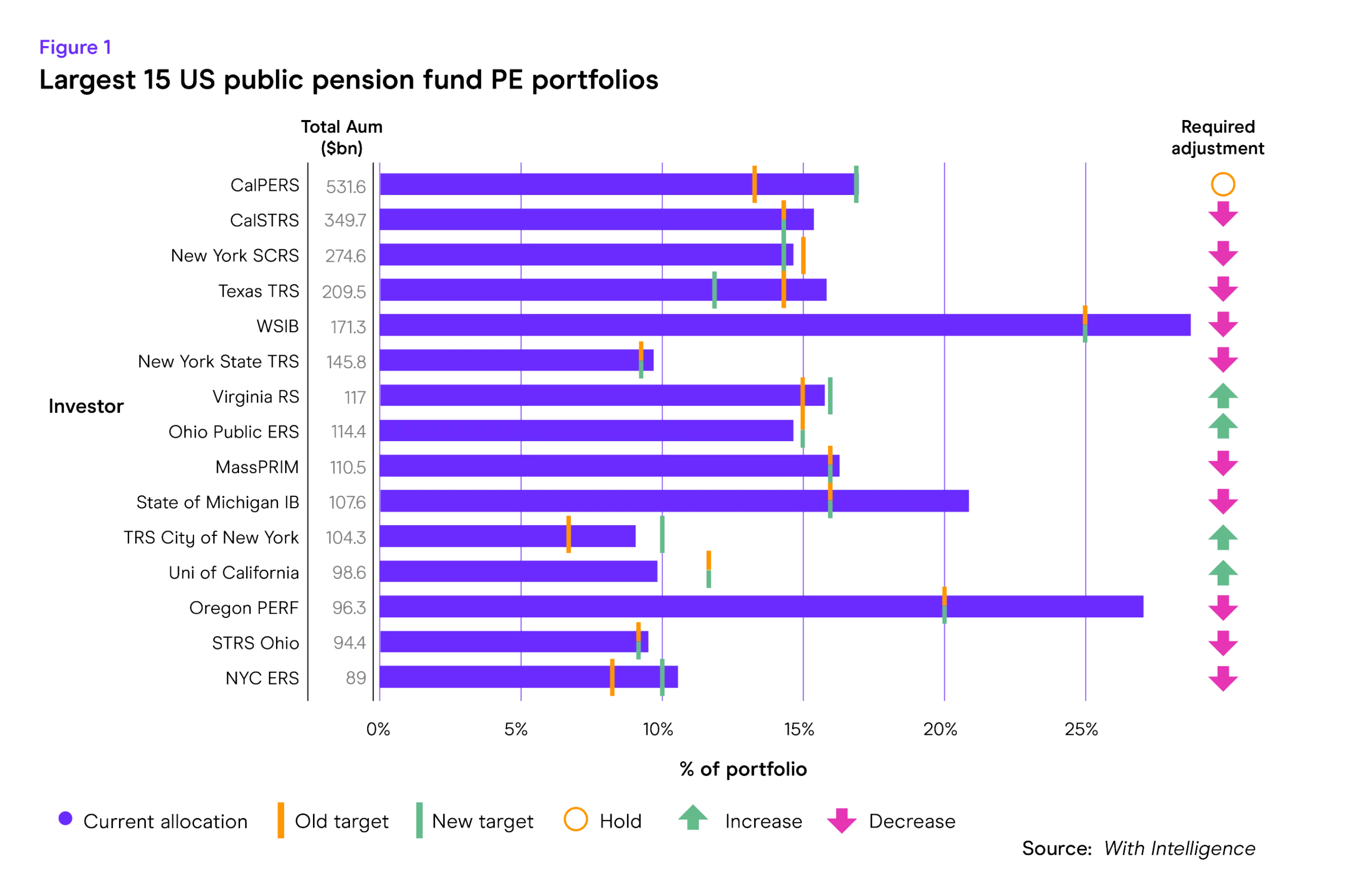

An analysis of the largest 15 US public pension funds highlights the complexities of large LP private equity portfolios (see fig. 1).

These pensions hold a neutral to positive view of the industry overall, based on portfolio adjustments. On average, they increased portfolio allocations to private equity by approximately 1% during their most recent asset allocation reviews, adding a combined $20 billion in capacity.

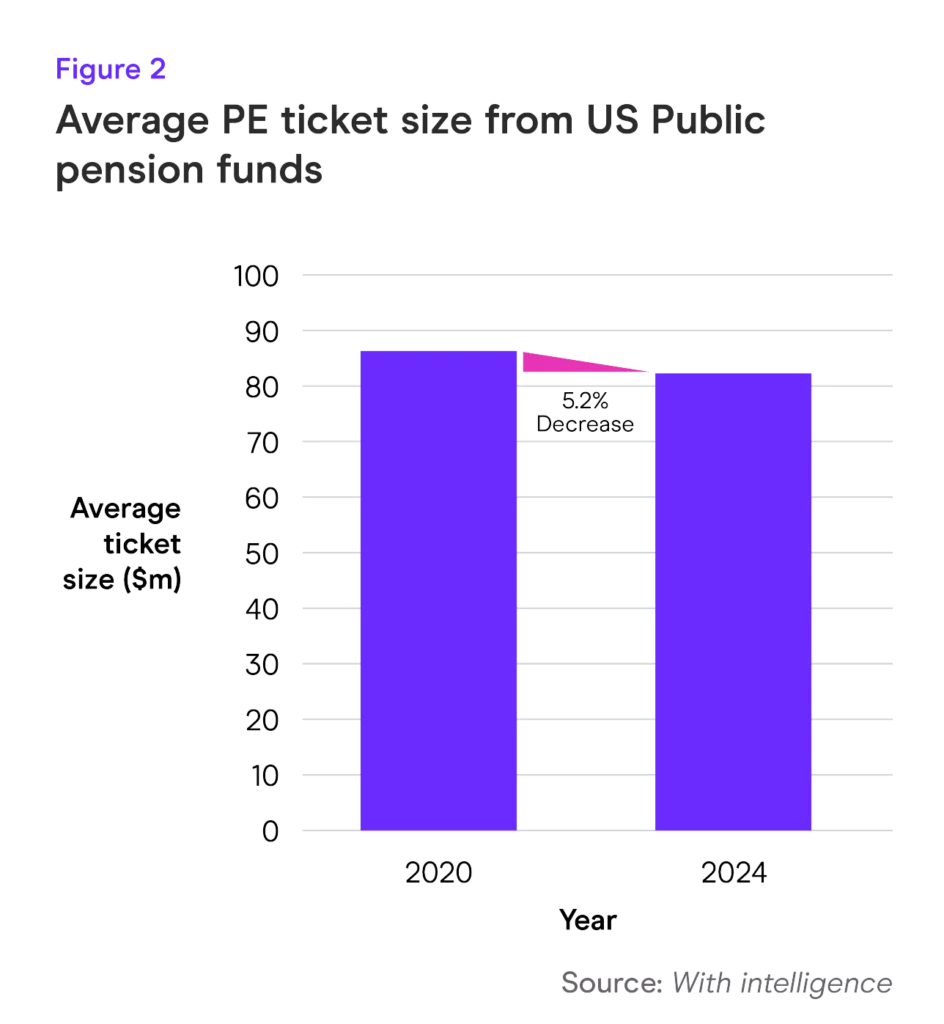

Yet, many continue to find themselves overweight to the sector. 10 of the 15 plans are currently trying to trim private equity positions, collectively these institutions need to reduce exposure by more than $30 billion over time. This goes some way to explain the 5.2% decrease in the average buyout ticket size from US public pensions we tracked between 2020 and 2024 (see fig. 2).

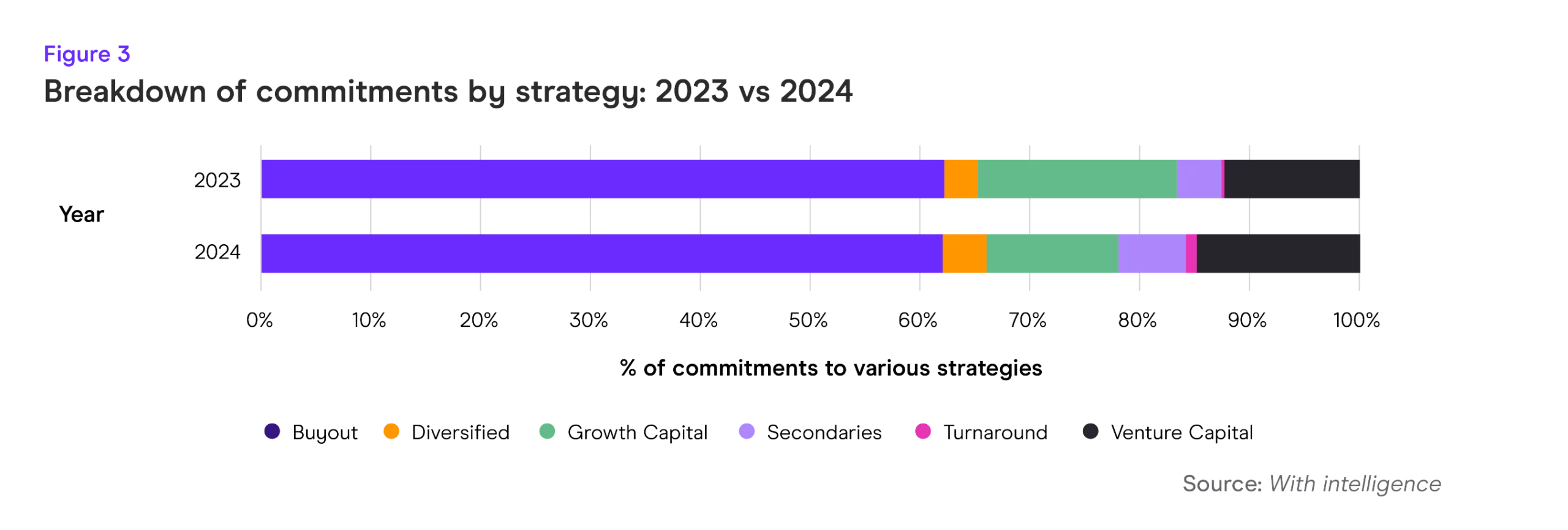

Overall, our mandate data shows there was a consistent flow of capital to buyout strategies between 2023 and 2024 (see fig. 3). Secondaries and venture capital saw a relative increase, while capital flowing to growth strategies was slightly down on the prior year.

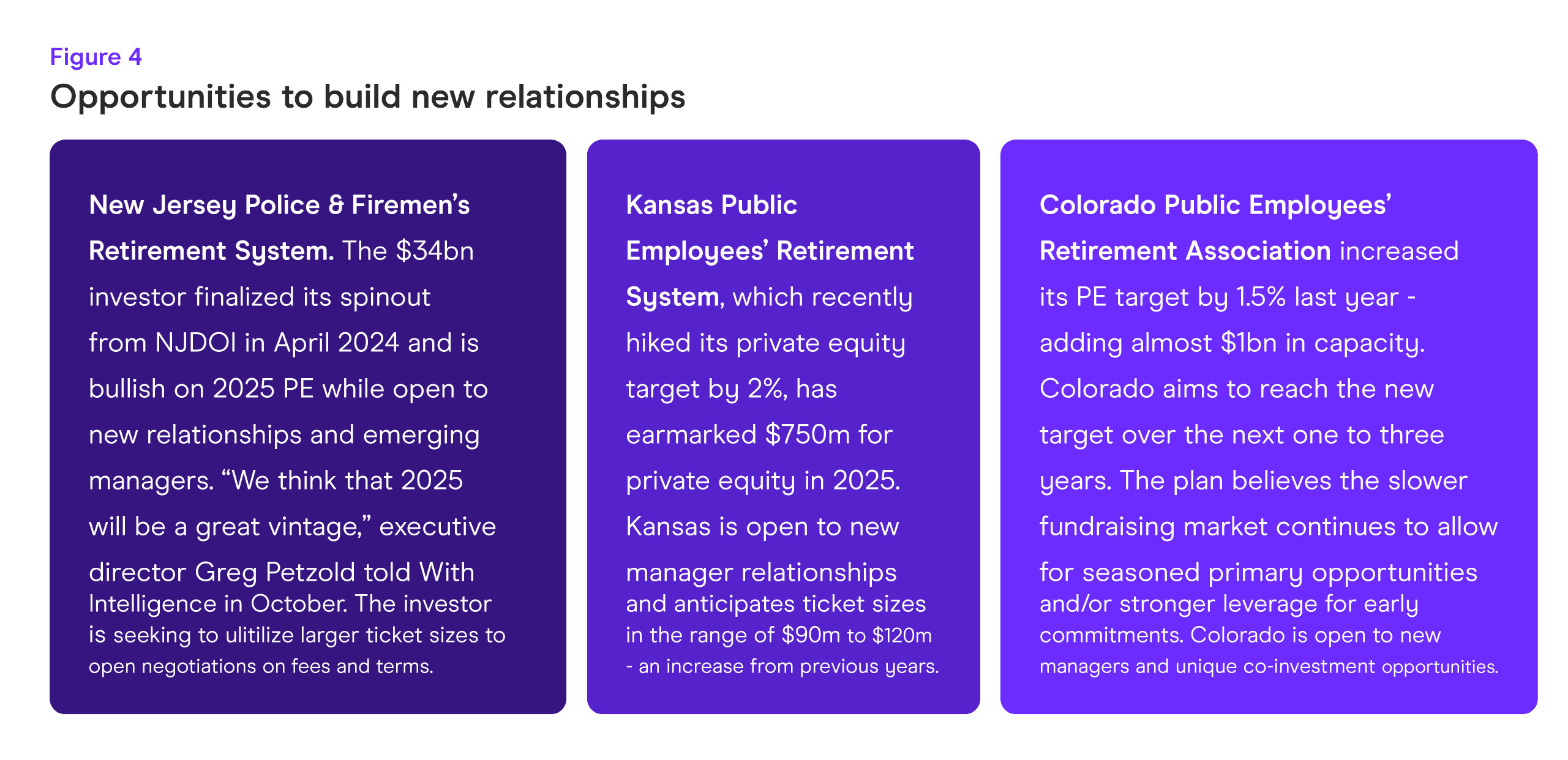

Elsewhere, many LPs are seizing the moment with some seeing the dearth of capital as an opportunity to build new relationships with previously capacity-constrained managers or to develop new strategy/sector sleeves to pounce on favorable market conditions (see fig. 4).

As traditional pools of institutional capital sit near or at capacity, private equity managers will continue to build internal expertise, invest in infrastructure, and utilize third parties to target new types of investors.

For example, larger GPs have been investing heavily in business development and investor relations capabilities with specific expertise in family offices, sovereign wealth funds and insurance channels. There has also been fierce competition to hire talent with specialist experience in bringing products to market for private wealth channels across different geographies. The Gulf region, Latin America, and Asia will continue to be key battlegrounds for GPs seeking to tap new pools of capital.

We expect to see further consolidation in the industry, with larger traditional asset managers continuing to buy up PE managers to seize on alts opportunities and broaden fee revenues. Elsewhere, underperforming managers, and those lacking clear succession plans, are likely to struggle to raise new capital, instead either opting to focus on current portfolios or being forced to wind down.

Evergreen: Pivot from development to distribution

One of the most prominent changes in fundraising has been the development of evergreen private equity products targeting private wealth channels. Most blue- chip private equity firms have now embraced the need to develop ‘democratized’ products targeting wealthy individuals. Eyes are now shifting from the launch of these innovative financial products towards tracking which ones, amidst a crowded field, will see success.

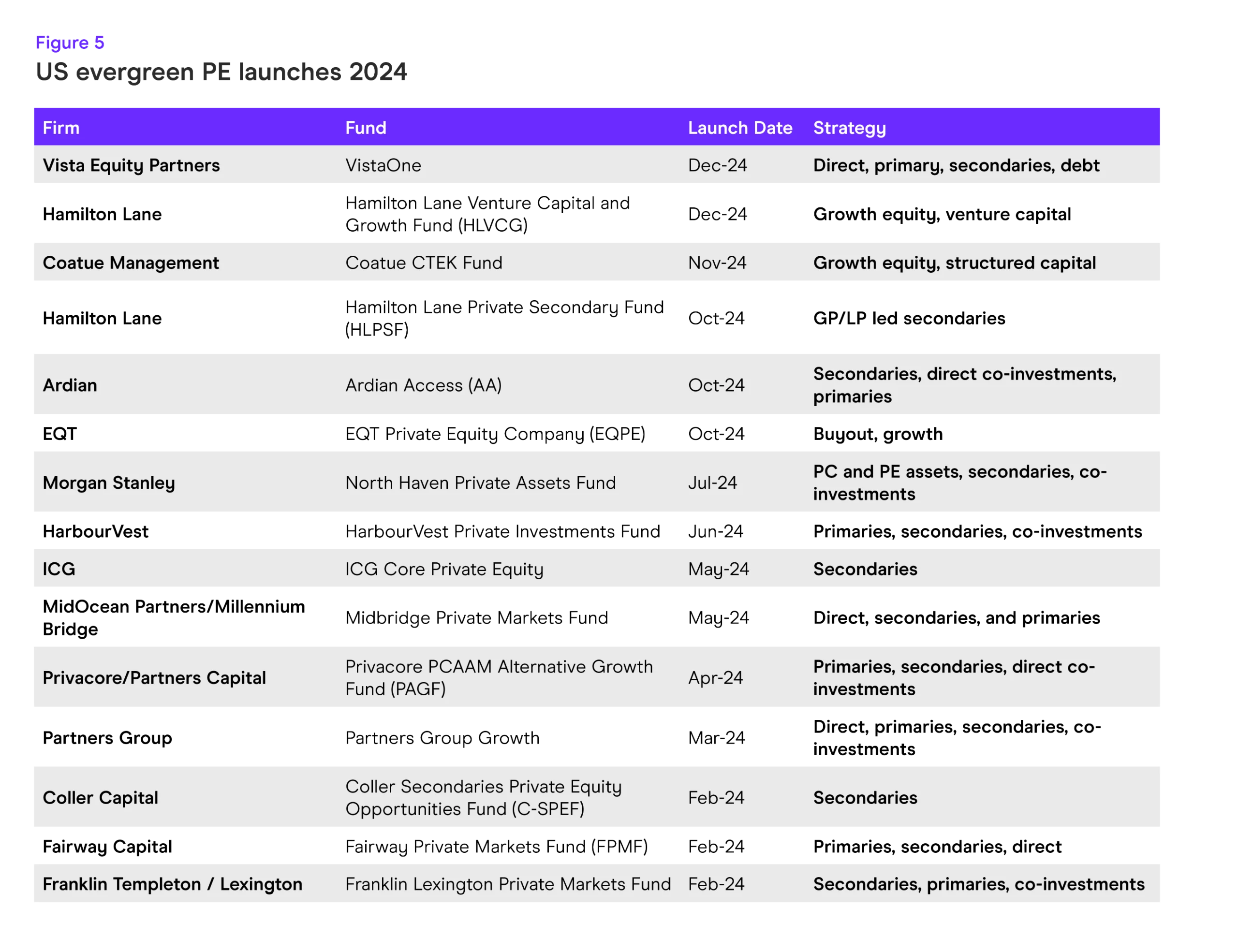

In the US, we tracked a spate of products coming to market in 2024 with strategies spanning the breadth of private markets (see fig. 5). There are now semi- liquid vehicles that offer broad exposure to the private equity industry alongside more sector and sub-asset class specific products. There are also fund of fund (FoF) vehicles set up by third-party distributors and well-connected consultants. Many of these vehicles are also utilizing the secondaries market to acquire seed portfolios.

“Private equity firms are now turning their attention to workplace retirement savings plans”

Market participants will be keenly observing these new vehicles to determine what level of performance is given up in return for increased liquidity, if any. As these vehicles are newer to the market, GPs will continue to allocate resources to educating potential investors, while also focusing on demonstrating the operational sustainability of the funds, particularly if they are slow to raise capital.

In addition to wealthy individuals, private equity firms are now turning their attention to workplace retirement savings plans. In the US, managers are looking to build on a 2020 Department of Labor letter, which gave the green light for defined contribution plans to offer exposure to private equity within a diversified fund, allowing for limited exposure in target-date funds. GPs will continue to work with regulators for clarity over how to implement and expand this with top tier 401k providers, the gatekeepers to a large proportion of retirement wealth.

We expect managers to be cautiously optimistic about making progress in this arena, while remaining mindful of the headline risk and litigious complexities of scaling into the retirement market.

Returns: Can private equity sustain long-term outperformance?

Eyebrows have been raised over the prospect of diminished private equity returns with some market participants questioning whether the industry can continue to outpace other asset classes. Forward looking performance expectations will remain a hot topic with investors throughout 2025.

Though trending downward, interest rates remain elevated and are unlikely to return to the levels seen post-global financial crisis or post-pandemic anytime soon. Long term, this can dampen the amount of leverage private equity managers can use, lower valuations, and reduce overall investment activity.

Within this environment, LPs want assurance that underlying managers are set up to deal with macro headwinds. As the interest rate regime has shifted, GPs are putting more emphasis on portfolio companies’ operational improvements, add-on acquisitions, and strategic changes to offset cash flow difficulties.

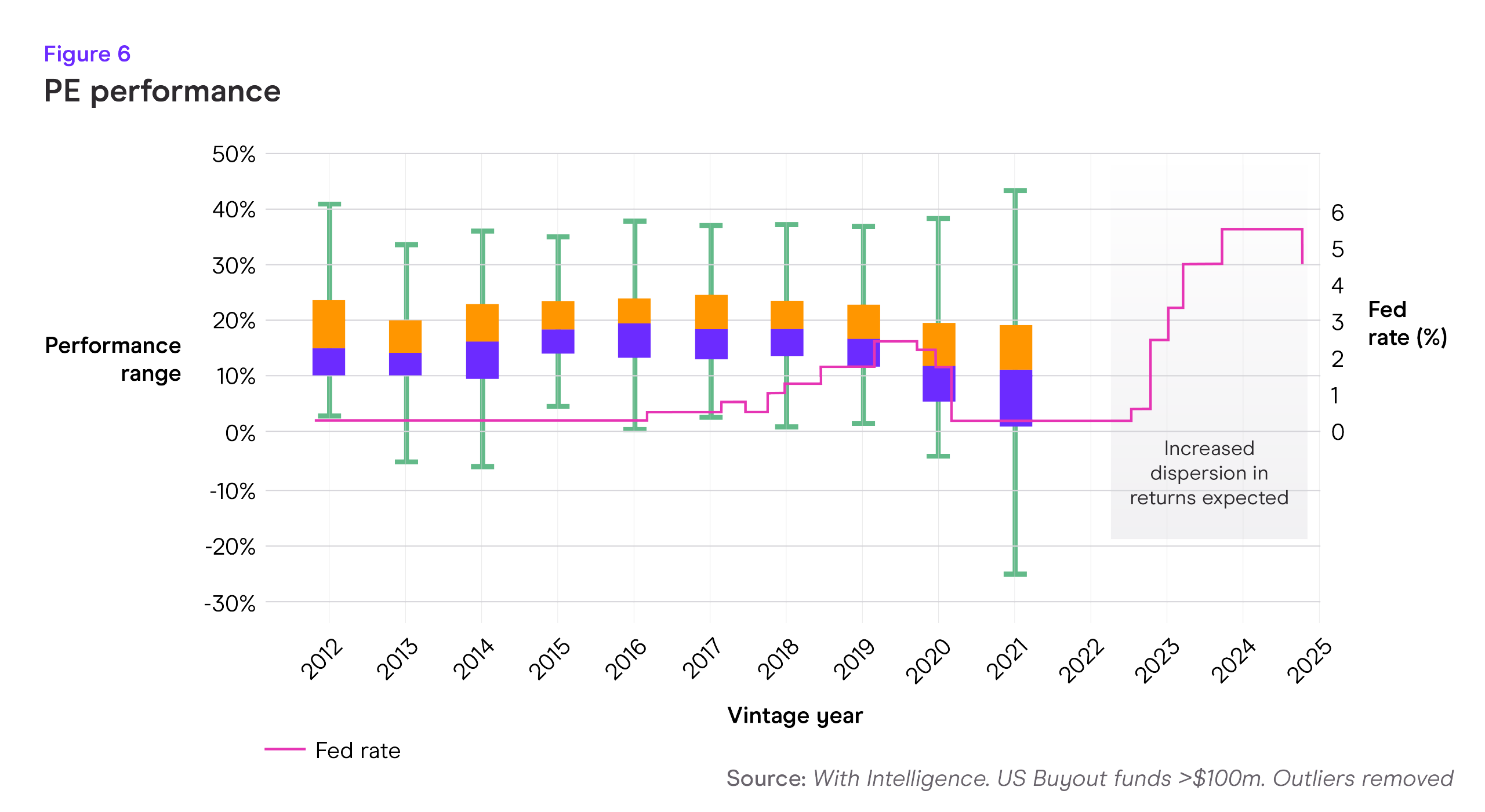

Our data shows that top quartile managers can produce strong returns through both higher interest rates and periods of illiquidity. However, these disruptions can heighten the dispersion of returns making manager selection ever more important. We expect to see a wider dispersion of returns from vintages in the current rate environment relative to those seen in the post-GFC lower rate environment (see fig. 6).

“There are signs that 2025 could be a strong vintage”

There are some signs that 2025 could be a strong vintage, with pricing for assets down from the peak levels seen in 2021, stressed and distressed opportunities on the rise, and a (slow and uneven) global economic recovery on the cards.

Work will continue to be done to find new ways to evaluate how managers are generating returns. The need for managers to demonstrate ‘alpha’ generation alongside outperformance, rather than rising with the tide of growing multiples, will remain an essential tool to

showcase differentiation and attract capital. There will be increasing demand for data and analytics within this field.

Deal activity: Cautious optimism amid valuation resets and macro uncertainty

We expect the deal environment to trend positive through 2025, buoyed by lowering rates, a stronger IPO market, a buildup of dry powder, and an increased appetite from both LPs and GPs to get things moving.

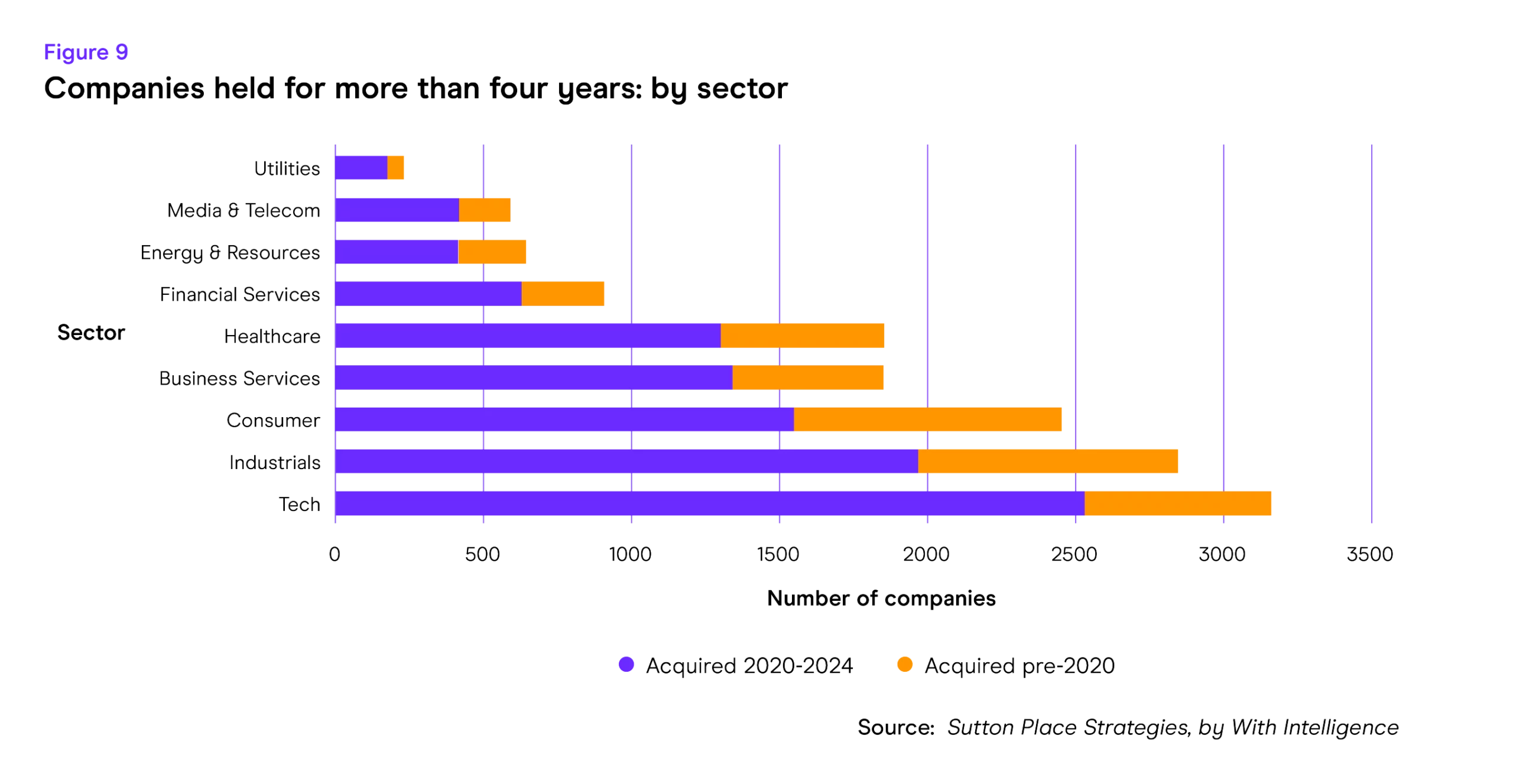

By some estimates, the drop-off in exit activity (exemplified in fig. 7) had caused distributions to investors to fall to levels not seen since 2008. This has made LPs eager to push for cash flow to meet their own liabilities, free up capital for new commitments, and ease concerns on liquidity. Meanwhile, the buildup of assets on the balance sheet of private equity funds (see figs. 8 and 9) is pushing GPs to get deals moving.

“Private equity firms will carry on finding dynamic ways to keep capital flowing”

While GPs’ ability to hold onto assets for longer should not be underestimated, the desire to transact is rising. In addition to traditional exit routes, private equity firms will carry on finding dynamic ways to keep capital flowing with tools like GP-led secondaries, dividend recaps, and the emerging concept of private IPOs playing an important role.

In the short term, it is likely that LPs will continue to place an increased focus on Distributions to Paid in Capital (DPI) as a differentiating marker for current or prospective managers. LPs are looking more closely at DPI as a marker for de-risking their portfolios. Managers that can demonstrate value realization on investments before peers, could be looked upon favorably when returning to market to raise capital for a new fund. That said, long term, Internal Rate of Return (IRR) will remain the ultimate benchmark of a manager’s success.

“Internal Rate of Return (IRR) will remain the ultimate benchmark of a manager’s success”

Secondaries: Unlocking liquidity and opportunity

Strong fundraising within the secondaries sector suggests that 2025 will be another bumper year for deal volume. The secondaries industry continues to be buoyed by the increased need for liquidity, the normalization of the asset class as a tool for portfolio management purposes, and strong historical returns.

Additionally, growing private wealth interest in private markets is fueling the sector as evergreen funds seek to utilize secondaries as an entry point that can mitigate the J-curve, while offering sector and vintage year diversification.

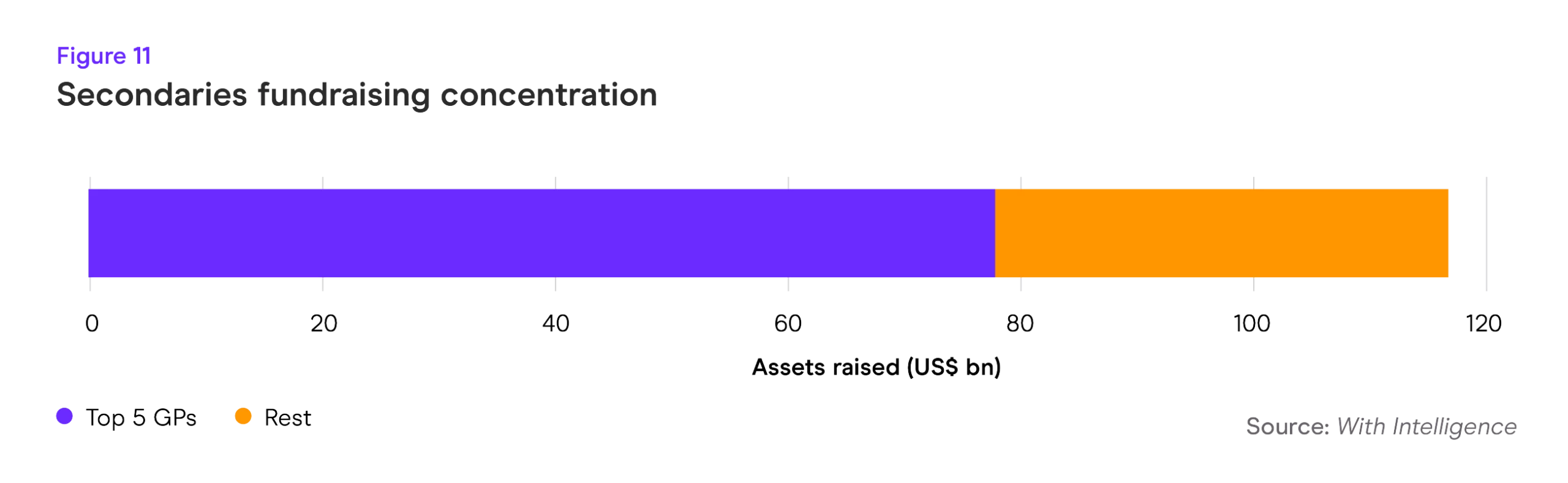

GPs closed on over $115 billion in fresh capital in 2024, with mega fundraises from key players including Blackstone, HarbourVest, and Lexington Partners (see fig. 10). This was followed by the record breaking $30 billion fundraised for Ardian’s latest flagship fund, Ardian Secondaries Fund IX, in January 2025.

Fundraising remained highly concentrated with just five managers pulling in almost three quarters of the $115 billion raised in 2024 (see fig. 11). Despite the dominance of the bigger players, the growth trajectory of the industry is enticing new entrants through both M&A and new launches. Ardian spinout Clipway and SQ Capital, launched by Blackstone’s former head of GP stakes Mustafa Siddiqui, being two prime examples of the latter.

We tracked a further $120 billion being targeted through 56 funds currently in the market and we expect fundraising to remain elevated. Transaction volumes have surpassed $100 billion per year for the past four years and hit $160 billion in 2024, according to Evercore research. At these levels, the industry would be insufficient to sustain itself for more than two years, hinting at the need for more, and larger fundraises.

Since first appearing in the 1990s, LP-led secondaries have become an integral tool used to rebalance portfolios. Investors are also drawn to allocating to secondaries funds as they have outperformed traditional buyouts by an average of 340 basis points between 2004 and 2023, according to our analysis.

GP-led secondaries have grown in importance representing around 50% of overall secondaries volume for the past four years, according to Jefferies research. This is likely to continue as both sponsors and LPs become more familiar with the products and increased data becomes available to allow for performance analysis.

The entrenchment of GP-led secondaries is highlighted by the number of prominent managers launching dedicated sponsor-led vehicles. Around $10 billion is currently being sought for funds focused on GP-led secondaries (see fig. 12).

“LP-led secondaries have become an integral tool used to rebalance portfolios”

GP Stakes: Fueling growth and aligning interests

While still a small segment of the overall industry, GP stakes investing will play a significant role in shaping which managers emerge stronger from this period of illiquidity. Those willing to sell a slice of the GP economics can use proceeds for strategic M&A, build out new strategies, enter new geographies, manage succession planning, or to strengthen their current platform. The trend is also likely to drive further growth in evergreen products as managers look to tap into annualized fee revenue sources more likely to drive higher valuations from prospective buyers.

“There will be increased options for GPs at all stages of their growth journey”

GPs will need to be mindful, however, that their LPs are comfortable with such arrangements. Investors will be keen to make sure senior management at the manager are keeping enough skin in the game and are not being too distracted by new growth opportunities.

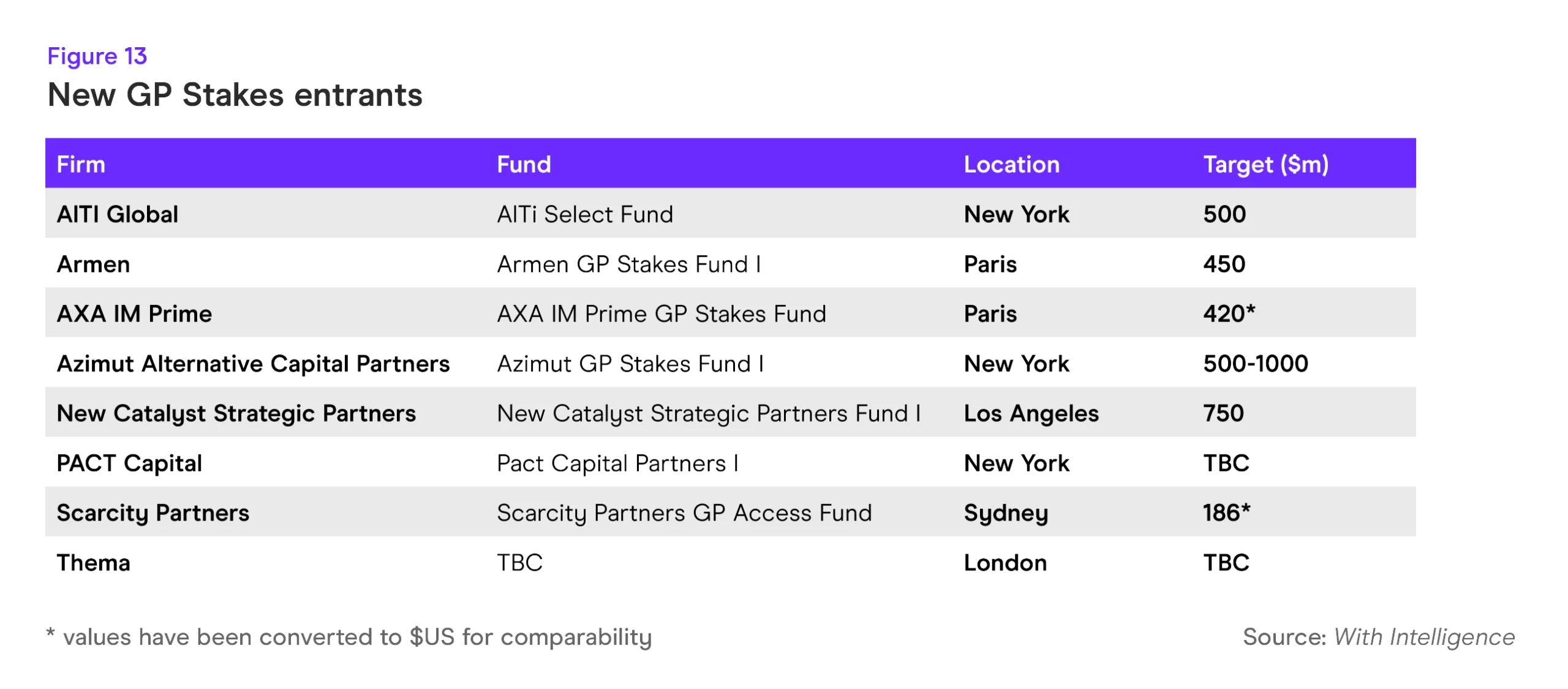

The sector is also gaining popularity with investors who see an opportunity to gain broad exposure to the alternative industry’s growth story. This is exemplified by eight new entrants raising first time funds in 2024 (see fig. 13). Currently, there is over $20 billion being raised for GP-stakes funds albeit with Blue Owl’s latest offering – the $13 billion Dyal Capital Partners VI – taking up a large chunk of that total.

There has also been increased GP stakes activity by investors from outside of the dedicated commingled fund offerings. For example, Affiliated Managers Group, one of the largest and oldest GP stakes firms, has recently picked up its investments in private markets managers. KKR and General Atlantic also bought minority stakes in Catalio Capital Management and Clipway, respectively. Meanwhile, family offices, insurers, and other institutional investors remain active in the space.

With new firms and funds coming to market, there will be increased options for GPs at all stages of their growth journey.

Emerging managers: Navigating opportunity amid fundraising hurdles

The current environment for startup private equity firms remains extremely challenging from both a fundraising and operational perspective, yet there are pockets of opportunities for founders looking to strike out on their own.

With most large investors preferring to put their available capital with trusted managers, Fund I closes are down significantly from peak levels.

However, we see founders with exceptional track records from blue chip incumbents successfully raising a Fund I in this climate. To do so, they must demonstrate the right mix of investment acumen, a differentiated strategy, and unique sector expertise.

10 of the top Fund I closes in 2024 (see fig. 14) demonstrate this, with the most successful fund raises coming from startups whose founders had more than a decade of investment experience at storied institutions such as Warburg Pincus, Platinum Equity, and Golden Gate Capital. Combined, the 10 funds pulled in just under $6 billion in aggregated commitments although notably none of them managed to surpass $1 billion.

Throughout 2024, we tracked 189 firm launches showing that there are investors out there confident in their ability to attract capital.

There has been strong participation from pension funds with emerging manager platforms including plans in California, Illinois, New York, and Texas.

Seeders are also playing an increasingly important role in the emerging manager landscape. With the headwinds facing fledgling firms, some founders have been more receptive to giving away GP equity in exchange for the catalytic capital, operational support, and prestige that comes with working with established platforms.

“Seeders are also playing an increasingly important role in the emerging manager landscape”

TPG, GCM, and Wafra are all LPs in high-profile launches coming to market in 2024. GSAM’s Petershill Partners is also in the market with a new $1 billion seeding vehicle. Elsewhere, family offices, HNWIs, and FoFs remain strong supporters of startup managers.

Highly experienced investors with a clear vision could see an opportune moment for a fresh start and we expect plenty of high quality spin-outs and launches in the coming years.