Setting up in the Middle East: Lessons learned from those already in the region

Why move into the Middle East?

The Middle East is attracting the attention of significant players to help build its position as a global financial centre.

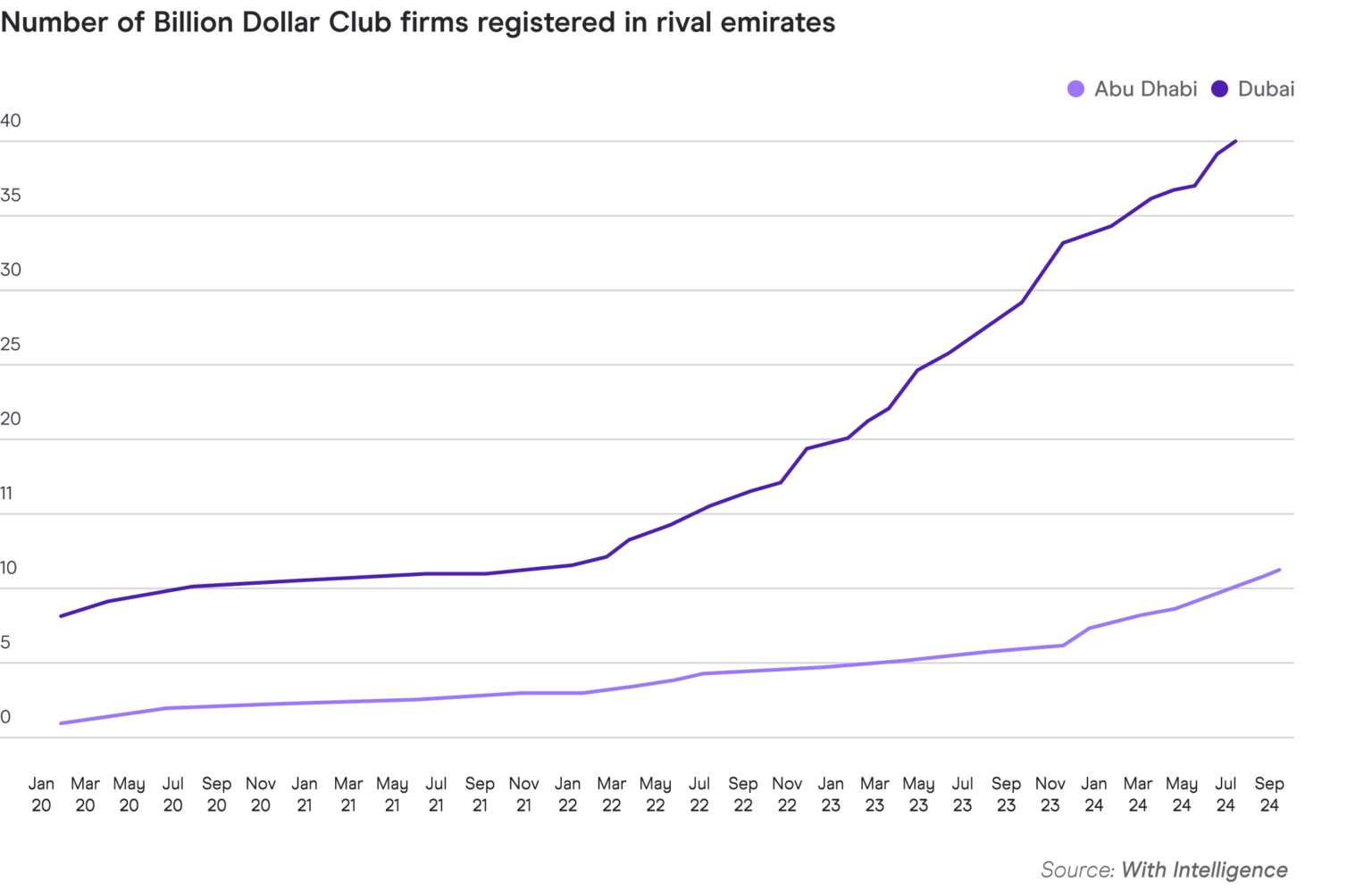

The Middle East is seeing growing momentum with a significant number of hedge fund managers either already in the region or considering having some presence. Data from With Intelligence places 28 of the top 100 Billion Dollar Club hedge funds having registered a presence in the UAE already. More broadly, at least 140 hedge funds have an office in Dubai and 35 have one in Abu Dhabi. It isn’t just well-established funds (e.g. Millenium, ExodusPoint, Point72), but recently launched funds (JJJ Capital Management, JNE Partners) that have, or plan to have a UAE presence.

The Dubai International Financial Centre (DIFC) is looking to support further activity in this space as they are set to open a new funds centre in Q1 2025 to foster the growth of hedge funds, fund platforms and boutique investment firms.

The Abu Dhabi Global Market (ADGM) is also actively demonstrating its commitment to this space with 11 billion dollar+ hedge funds having offices in the region. Notably, Breven Howard runs circa $10bn from the Emirates International Free Zone.

Although it is recognized that much of the wealth is situated in Abu Dhabi rather than Dubai, the hub for fund management is more so in Dubai. Abu Dhabi however, is keen to encourage more to consider locating themselves in the city, citing the calmer lifestyle, less traffic and its appeal to the older generation with families. Whichever centre managers prefer, the idea that they can ‘fly in and fly out’ to do business doesn’t cut the mustard with local investors. Access to decision makers, strong relationships and trust built through a demonstration of commitment to the region is key when attracting domestic assets. Just because the assets are there, they must not make the mistake of thinking that fundraising will be easy.

Abu Dhabi and Dubai have many similarities, but managers will need to assess their own business reasons for choosing one over another.

The regulatory environments are very similar, as are the people and the rule books. The DIFC is regulated by the Dubai Financial Services Authority (DFSA), whose rule book is based on international standards and principles of common law, tailored to the region's unique needs. The ADGM operates under its own set of civil and commercial laws, based on English common law, and maintains a regulatory environment through its Financial Services Regulatory Authority (FSRA). As the DIFC was established around a decade prior to the ADGM, there is more experience in the region. However, thanks to relatively straightforward and largely digitized systems, neither centre offers a quicker or cheaper entry. There are examples of employees who may be based in one location (i.e. Abu Dhabi) for family, but commute weekly to Dubai for work.

For managers, moving to the region is a long-term expansion play, as opposed to a short-term shift away from other centres. There are some funds who may have relocated from Hong Kong for example, but that shift away may have been driven by specific factors such as geo-political uncertainty. The additional benefit of a Middle East location is how central the time zone is. The challenge of a Sunday to Thursday week remains, and with a strong cultural tie to this working week, it may be challenging to expect alignment with the western week in the short to medium term.

Dubai is now recognized as an alternative hub for Asia.

Saudi Arabia is entering the fray with incentives, but there are a few hurdles to be overcome.

There is a significant amount of assets in Saudi, largely sitting in cash, gold and equities. The market is starting to evolve and become more sophisticated. However, the asset opportunity is providing a catalyst to make a move to Riyadh as it sets itself up as a new financial centre.

Setting up an office in Saudi is not without its challenges. Hiring can be straightforward, as are things like creating a personal bank account and renewing driving licences. However, opening a corporate account is more challenging where documents need to be notarized for example. Talent is scarcer in Saudi, but the pull of attractive compensation packages - which goes further in Riyadh than Dubai - could pull managers in.

There aren’t any hedge funds in Saudi yet, but business is being done in private equity and around the Venture Capital (VC) space. There may be more interest in hedge funds as performance starts to tick up. For now, private credit is seeing more traction.

Service providers are also starting to see the opportunity and need to be in the region

To open fund management operations in the UAE, service providers have recognized the need to provide tailored support and advice for each jurisdiction. Where larger managers may have relied on their global service providers, clients in the region have the expectation that there are boots on the ground beyond the local representatives or even portfolio managers. Proximity, access, a deep knowledge of the region’s nuances are increasingly table stakes for service providers.

This is another example of where the Middle East working week must be catered for fully, including having capabilities at full scale on a Sunday as they would on any other day of the week.

Although larger multi-strategy managers have taken the first steps, start-ups will follow

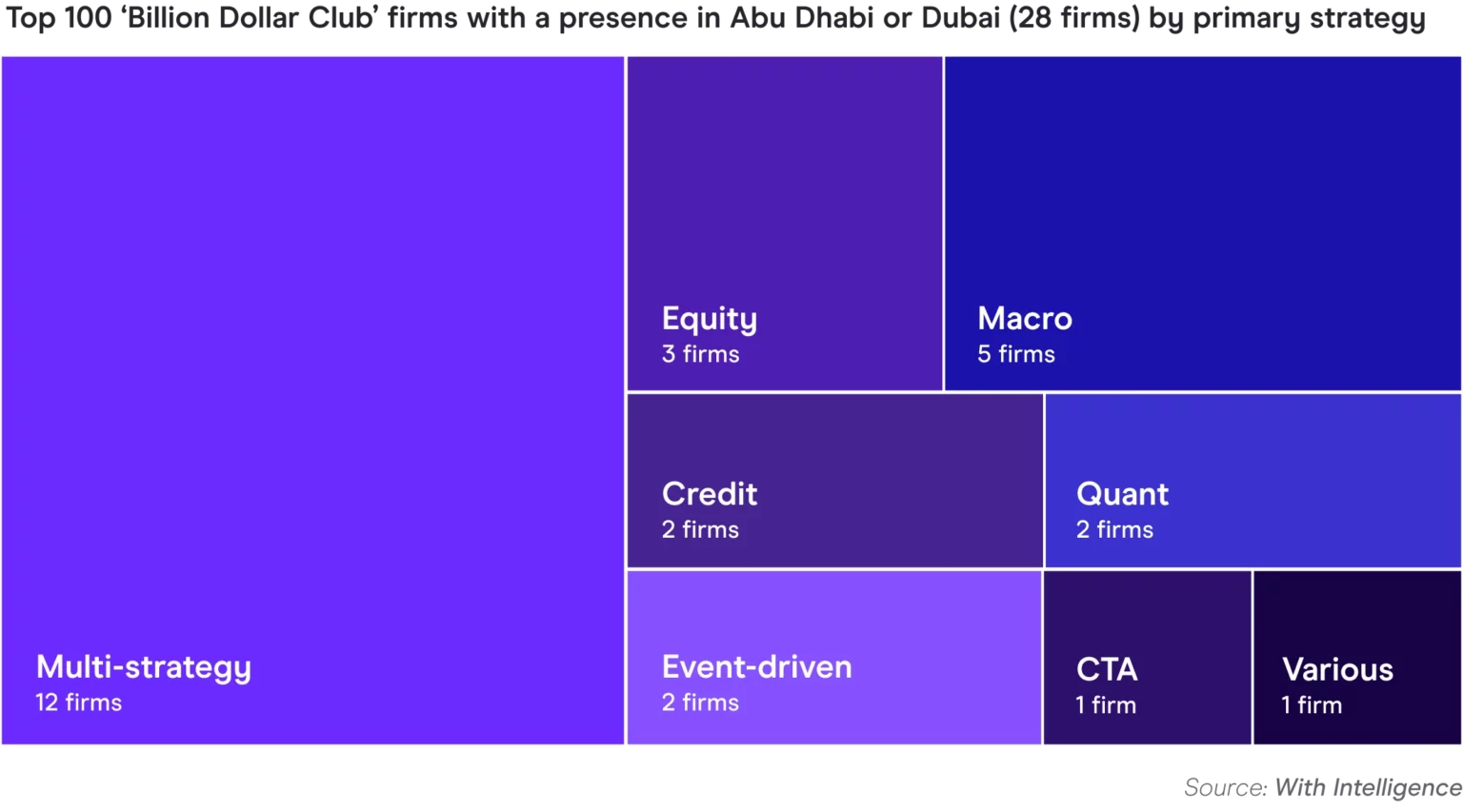

With Intelligence data shows that most hedge funds already in the region are the large multi-strategy funds, as scale helps mitigate the high entry costs.

However, with the introduction of a new fund platform in the DIFC, this will lower the entry barriers and pave the way for smaller firms to enter the market. We also expect to see the typical spinoffs from the larger firms, as Portfolio Managers (PMs) follow their entrepreneurial spirit to leave their larger firms and strike out on their own, while staying in the region.

Some significant local investors like Mubadala and PIF do have a focus on ‘in region’ investments. For PIF, this is in line with Saudi Arabia’s Vision 2030 plan. They are making investments to support a more start-up friendly ecosystem.

A masterclass in the Middle East’s financial centres and regulatory regimes

Local PM talent gets you further than a representative office

It is still possible to set up sales/distribution marketing hubs or representative offices as shop windows. Many firms have done this to dip their toe into the region. However, hedge funds, particularly the larger multi-strategy firms, have set up local portfolio management entities. Some firms have taken both approaches. There is also the option of local fund structure, e.g. feeder funds to get access to the local market. However, as the International Financial Centre's (IFCs) are looking to attract more significant and ongoing presence from global players, they are providing a lot of help and assistance with finding office space and recommending service providers. For reasons discussed above, building trusted relationships is critical to accessing capital, so a light touch approach to presence often doesn’t bear fruit.

Managers are landing in the UAE in different ways via licence categories (e.g. Category 4 - distribution, 3c - management). Some firms that started with a category 4 licence are starting to move their portfolio managers out to the region and hence are looking to upgrade these licences. However, the capital requirements will be different, as will the broader expectations and requirements.

Set up timeframes are reducing...

There have been some record years for newly licenced firms lately. There is a new process that the recent wave of hedge fund managers have benefited from. Where 83% of licence applicants were in the wealth management sector last year, the application process has reduced from circa 90-120 days to under 25. The aim is to get individuals face-to-face in a room with the regulators within the first 2 weeks so that when the formal application arrives, there is already comfort around the individual’s suitability, motivation, pedigree and commitment.

…and the approval process is relatively smooth

Working with the ADGM and DIFC is unlike dealing with a European regulator. It is a people-oriented business and very engaging. Conversations are far more frequent and access to people at the regulator is much more open. Quality is what determines the speed of an application. It is also much more transparent than the Financial Conduct Authority (FCA) process for example. It is largely digitized and streamlined and as you hit any roadblocks, you tend to be able to speak to real people.

The ADGM and DIFC are financial free zones. They have their own commercial and civil laws and their own regulatory bodies.

Dubai has made its name in business (rather than oil) and has experience in facilitating growth and innovation.

Dubai now has a tried and tested regime and is working to lay the foundations for the next phase of growth. The DIFC is 20 years old this year. There are several new offices being built; DIFC 2.0 will double the footprint of the centre. The DIFC have also stepped up their game, recognizing that beyond finding office space, getting kids into schools and finding accommodation are key milestones that need to be tackled to promote talent inflow.

Saudi and Qatar are learning from the UAE but have their own nuances

Saudi Arabia and Qatar are starting to build their infrastructure, but are both still somewhat behind the UAE. With Saudi’s Vision 2030, there are further hurdles to overcome for managers to build a credible presence. For example, managers can’t outsource as many roles as is possible in the DIFC or ADGM.

Alternative fund structures (e.g. feeder, umbrella funds, ICCs and PCCs) can help to gain access to investors outside the UAE, but it very much depends on what sort of investors you plan on marketing to.

Fund platforms will be a game changer for emerging managers

There is an expectation that the fund universe will reasonably double in the next year. This is in part thanks to the introduction of platforms in the DIFC and beyond. These will provide emerging managers the ability to get up and running easily. These managers will eventually grow and feed into the ecosystem of established, large funds, which will in turn create further spin-offs.

Each region has its nuances, which evolve rapidly

Funds need to be aware of what is and isn’t possible as the rules are different across the region. There are lots of moving parts. Having advisors/service providers that live and breathe each region can be critical to avoiding unexpected challenges further down the line. You need to have nuanced guidance for the region and each jurisdiction and investor base you are targeting (e.g. SWF, pensions, etc).

Being officially regulated is often a much easier way to operate as the costs justify the peace of mind

'Tolerated market practice' means different things everywhere. There are 10,000 funds marketed by 138 firms in the DIFC. They no longer tolerate ‘suitcase banking’. For the cost of a handful of business class flights, you can have a presence in the DIFC bona fide licence. You also then get the benefits of networking and support.

The Middle East sovereign asset pool is well fished

Despite sovereign wealth funds having significant asset bases, the number of funds is small. Not only is competition fierce to manage these assets, but increasing proportions of sovereign funds are being managed in-house. ADIA for example manages 50% of its assets in-house.

For managers to be successful in managing the outsourced sovereign assets, they need to understand the detailed background, context and objectives of each fund, and demonstrate their unique differentiators to attract the investors’ attention. They will need to demonstrate how they can deliver alpha in a particular asset class. It is worth comparing these sovereigns with the Canadian model where a lot is in-sourced, but there is always a proportion where specialist managers are needed.

Many sovereigns now benchmark themselves against the likes of Government of Singapore Investment Corporation (GIC), which has a highly professional and sophisticated model.

Private wealth as an investor group is showing most promise

Where some managers already have a mature sovereign asset base to manage, private wealth is the next attractive frontier.

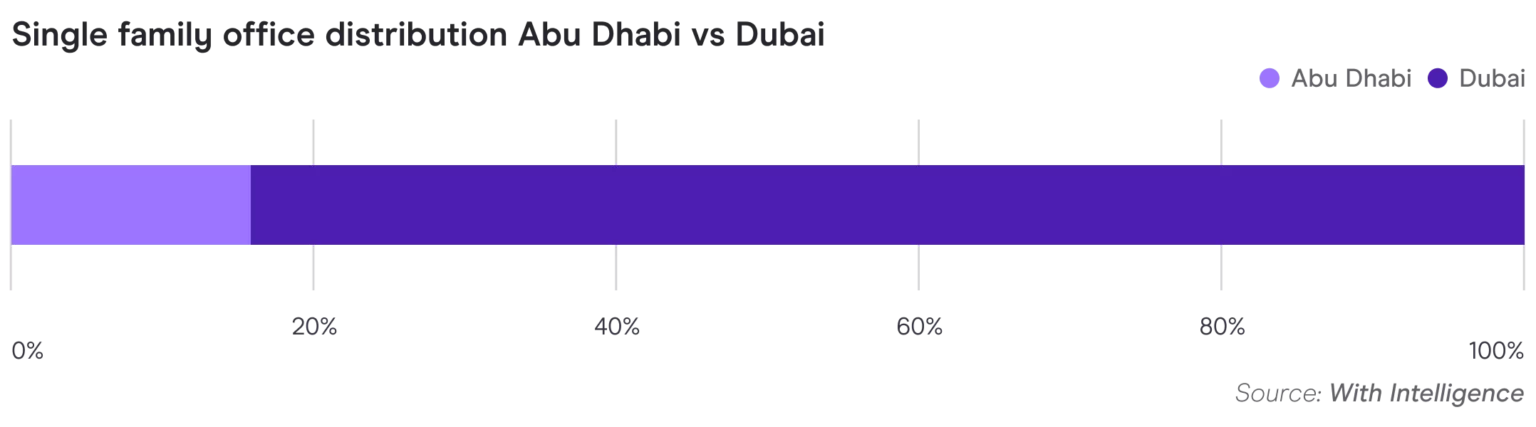

The DIFC is a larger private wealth centre compared to the ADGM – i.e. there are more family offices based in Dubai as shown above in the analysis of data in the Single Family Office module on the With Intelligence platform.

There are some pod structures in the DIFC, seeded by a Single Family Office. This may happen more as there are further spin-outs looking to set up a fund in the region. It’s otherwise challenging for a smaller/emerging manager to start in the region without a seed investor.

Assessment and selection for regional needs

Managers must find service providers with regional expertise and global experience

After the initial phase of movement involving large multi-strategy hedge funds into the region, the next phase will see emerging managers making the move. We’re also seeing service providers catching up and reacting to this trend. The building of the service provider ecosystem is still in its infancy and the relocation of talent on this front is yet to come. Again, beyond the funds themselves, the local representative or ‘fly-in, fly-out’ model is not accepted. Relocation to the region to enable meaningful relationships is critical. These relationships are formed based on the brand of the individual and how they demonstrate their pedigree, commitment and appreciation of the local needs and distinctions. This is best done through co-location with investors.

A good service provider in London doesn't necessarily make a good service provider in the region. You’ll need to run further due diligence/selection processes for the needs in the region. We may see more joint ventures and global/local partnerships set up to enable the marriage of regional expertise, backed by global experience.

Operational due diligence support needs to be up to par and in tune with regional demands

Considering the importance of the relationship-based culture in the Middle East, you can't just point clients towards a portal to access a service. Allocators may still have a way to go in developing their operations, but they still demand external providers to be sophisticated and operate along local timeframes and needs. For example, getting an automated response on a Sunday is not acceptable. Service levels need to be upheld across the full Sunday to Thursday week. If these expectations are not met from service providers, it has a knock-on effect on the managers’ reputation.

Local investor intelligence can be a game changer

As a locally based service provider, you have an overarching view of what’s happening across several clients and so can provide ‘hard to access’ intelligence around which funds are looking to allocate, fees levels and other insights valuable to funds and allocators.

Of course, much of this can also be gained from data and intelligence providers (e.g. With Intelligence data platform) covering the region. See an example of investor Intentions & Preference (I&P) data below:

Investment intentions

October 2024

- Private equity:

- Planning to commit to micro (0-€100m) and mid (€500-€2bn) private equity funds in the upcoming 12 months.

- Sectors of interest include healthcare, technology, energy, business, financial and consumer services as well as industrials and communication.

- Also interested in in co-investments, buyout opportunities across Europe, secondaries and minority stakes as well as direct investments.

- Planning to commit to micro (0-€100m) and mid (€500-€2bn) private equity funds in the upcoming 12 months.

Preferences and manager selection criteria

- Private equity:

- Minimum ticket size is $76m-$100m.

- Maximum ticket size is $251m+.

- Infrastructure:

- Opts for digital platforms over traditional fund structures.

- ESG factors and advanced cybersecurity in data storage are becoming increasingly important considerations in investment decisions.

- Lack of quick closure and no chosen CEO are concerns with new digital platforms.

When it comes to compliance, quality matters

It’s challenging to find a compliance advisor that is on top of all areas within the Middle East. Any advisor needs to be accurate and up to date with each part of the region. It’s not advisable to save money to get the cheapest provider here. It could cost you significantly (financially and reputationally) when you realize, for example, that you have the wrong fund structure. Many providers have multiple legal advisors who are specialists in different areas. There is potential for consolidation here so this will be an interesting space to watch.

The region isn’t yet mature enough to demand local crypto expertise from service providers…

There are fewer service providers in the crypto space, so it is more about who has the technical skills to support these funds and investors.

…but technology innovation will enable some providers to leapfrog US/European counterparts

The ability to learn from global peers and experience will add to the momentum and innovation in the region.

Service provider talent is about to accelerate

The talent in the service provider community will also start to accelerate in 2025, as they follow the surge in PM talent moving over. As a result, local talent pools will become more experienced.

May 2024

- Private equity:

- Re-directing its investment strategy towards high-growth regions and future-oriented sectors with a focus on renewable energy.

- Intends to target Artificial Intelligence (AI) and future energy in Asia and Latin America.

- Infrastructure:

- Interested in digital infrastructure, life sciences and pioneering technologies.

- Prefers data centres, telecommunication towers, and fiber optic networks and keeps and eye on broader trends and dynamics within the space, such as new technologies or market pricing.

- Open to global opportunities.

A discussion on capital raising in the region

Some key drivers are meaning allocators are looking to invest more broadly

Many allocators are reviewing their asset allocation policies in light of the new rate environment and the lack of confidence in the traditional capital markets. New capital allocation options are being explored.

There is a desire in the Middle East to invest locally. So, having a genuine local presence with credible investment options will be attractive to allocators.

Private markets are increasing being considered, and in particular private credit. However, it isn’t clear how investors can access these opportunities while maintaining the return confidence in their overall portfolio.

As the inflation to spending power ratio is unfavorable, true diversification lead by economic drivers and the illiquidity premium is attractive.

For managers, the drivers to diversify are equally strong

Wealth managers are under pricing and profitability pressure, as well as the burden of more complex and increasing regulation. They need to find ways to differentiate and make their proposition stand out to secure capital flows.

Insurers are facing market volatility and sustainability challenges. Many are trying to understand how private credit may hold opportunities for income, but they are still lacking the governance to push forward.

There is no such thing as a typical family office

Although there is a shift to private markets to facilitate higher returns, there is no typical family office so a ‘one size fits all’ approach won’t work. Each will bring with them their own family background and desire around what they want to focus on. Some require daily cash flow and liquidity for the operating businesses, whereas others may be seeking 10/15 year locks-ups. Some may have sharia requirements; some will want to invest locally.

AUMs can be in the billions. Some have CIOs, investment teams and sophisticated corporate governance. These investors set themselves up as institutions. Treat them as such.

Local hurdle rates and preferences will shape what an attractive investment proposition looks like

If local yields are already 5-7%, then investors may prefer to invest locally. Specific needs and preferences (i.e. diversification, stability in uncertain markets, supporting net zero objectives) need to be reflected in investment offerings to look attractive to investors. It may be that an investment in technology innovation is desired to bring that expertise and financial return into the region for the economic benefit of the country.

There are no quick, easy, long-term wins

Despite institutional money being quite sticky, the lifecycle to win a mandate can take 12-18 months.

There is also a question around sustainability of investor assets. In this region in particular, oil price shocks need to be modelled in as it may result in some institutions holding back or even redeeming invested assets. Some fluctuations in flows will be unique to the region.

Deterioration or shocks in the oil price can also have knock-on effects. Secondary and tertiary industries that rely on oil will also be affected. Managers need to monitor and manage their investor composition so they’re not over exposed to one segment (e.g. oil-based investors).

Gaining introductions in the region is very different to elsewhere in the world. It takes time. A transactional approach doesn’t work. It is a nascent market, and relationship building is a long but critical process to build the necessary trust. You must be connecting in person, via VC, email and other methods regularly. Managers must also be mindful of time periods that will impact decision making speed (e.g. Ramadan).

Face-to-face interaction is the primary way to meet potential investors. Events (e.g. conferences) have proven to provide the best opportunities. As you see the same decision-makers at subsequent events, you build up relationships. Flying out to the region once a year for meetings is unlikely to yield any success. Also, once you start to build relationships, you can gain traction through word of mouth.

Choose a placement agent carefully

The use of placement agents is common, but you do have to do your research. It is recommended that you meet with 3 or 4 to understand their track record. Also, having a placement agent doesn't mean you will be successful. You must ensure that their proposition resonates with your target investors and your offerings. Again, a deep understanding of the region is critically important.

Picking the right team for the desert dream

The local talent pool is growing but still not fully up to speed with regional needs

Finding talent in and for the Middle East is still challenging. There are people moving from London, but shortages remain. It is becoming easier as the front runners have paved the way, and the region becomes more sophisticated and set up for expatriates.

There are incentives and a desire to hire locally. However, there is a disconnect because the drive and intensity of individuals isn't on par with other financial centres. In previous years (2018–2022) there were several PMs and analysts coming into the region. We’re now seeing that talent is moving (being poached) within the region between managers so there is more of a local talent market.

There is a still a way to go in developing the operational talent pool and the ecosystem around operations. Executive assistants, personal assistants and office managers are in short supply and heavily demanded, which means a huge war for talent. This has resulted in salaries increasing for these roles by up to 50% in past 12 months.

The flow of talent will continue, but not at the same rate

As Europe is getting more expensive this may be generating a sense of anxiety and pessimism for the future. With this context, if the opportunity arises for European-based managers to make a lifestyle choice and relocate to a warmer, sunnier location, rolling out the welcome mat with optimism, it’s understandable that expatriation to the Middle East looks attractive.

Historically there was a sense of skepticism and lack of familiarity around living in the Middle East. However, an increasing number of people now know someone who has relocated to the region, which gives a sense of familiarity and reassurance. Recruiters are certainly receiving more inbound enquiries and doing more work out in the Middle East.

The Middle East is fast becoming an alternative and/or additional location for managers. As regulators and governments make it easier to set up in the region, the influx and interest will continue.

Where some have concerns around geo-political instability in surrounding countries, one could take the view that, not unlike Switzerland during the second world war, the UAE can still do great business despite the chaos all around. The view is that there is no real impact on the Gulf Cooperation Council (GCC) at the level of the capital market. As the political landscape eventually settles and the region matures further, the opportunity will only become more attractive.

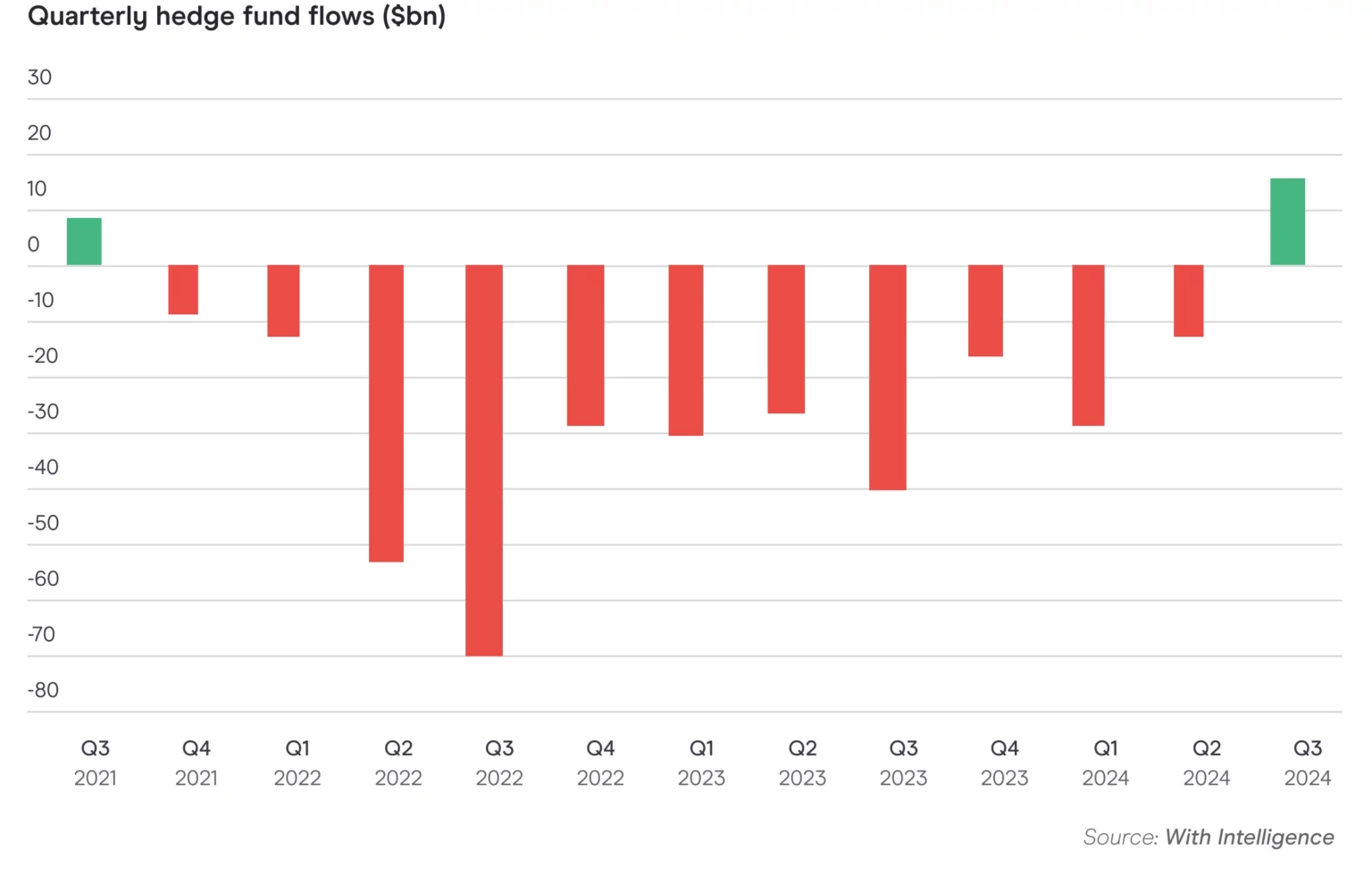

The talent inflow to the region won’t necessarily continue at the recent pace. As larger funds have built their presence, we may be reaching an inflection point as critical mass is achieved. Additionally, as flows into hedge funds globally start to pick up, as we saw last quarter (see chart below), the focus on new regional assets may soften.

Motivation to relocate must be considered carefully

There are examples of individuals coming to Dubai on holiday, enjoying the experience and looking for jobs in the region. Living there is clearly very different to holidaying there and expectations are frequently misaligned with the reality. Support for expatriates to integrate may also be required. The DIFC portal can make many aspects very straightforward, and processes are increasingly digitally enabled. However, in some parts of the region, the requirement for verification and notarization of degree certification and other documentations can be very time consuming and frustrating.

The culture is very different to London for example. There is more of an office-based culture rather than working remotely. Patience and respect are critical, even when environments and processes may be frustrating.

If you are expecting a family to relocate, factors such as accommodation type and commute are important considerations, as are school options and lifestyle differences. Tax-free compensation is not a sufficient motivator to enable some to successfully relocate. Despite higher take home salaries, the cost of living is very high. One example is landlords commonly asking for a year’s worth of rent in advance. Employers must consider that employees may need assistance here to avoid embarrassment and make the move less prohibitive. Also, facilitating bank account openings will help smooth many official and necessary processes when settling in.

Some thresholds for local talent may apply

There are some quotas for what proportion of hires must be local. For example, 25% of hires in Abu Dhabi must be local. Dubai may be more relaxed but there are new rules coming. There may be exceptions for within the DIFC.

Although talent diversity is important, you must recognize that the Middle East is a conservative region and certain countries (e.g. Saudi Arabia) can be very conservative compared to western values.

Other remuneration and relocation package elements can be important factors to attract talent

401k savings plans are being introduced and must be provided to everyone that's hired. A percentage of the employee’s salary must go into these accounts. However, unlike a pension account, these funds are released on departure from the firm.

Whether an employer offers domestic or global health insurance, how frequent flights back home are provided and how much time off to leave the region (e.g. over the summer) can all play into how attractive a relocation package looks.