Our data

Providing rich and valuable information on the investment landscape

Data we provide

We provide both structured and unstructured data. The mix of proprietary and publicly available data means we give you the complete picture.

Proprietary

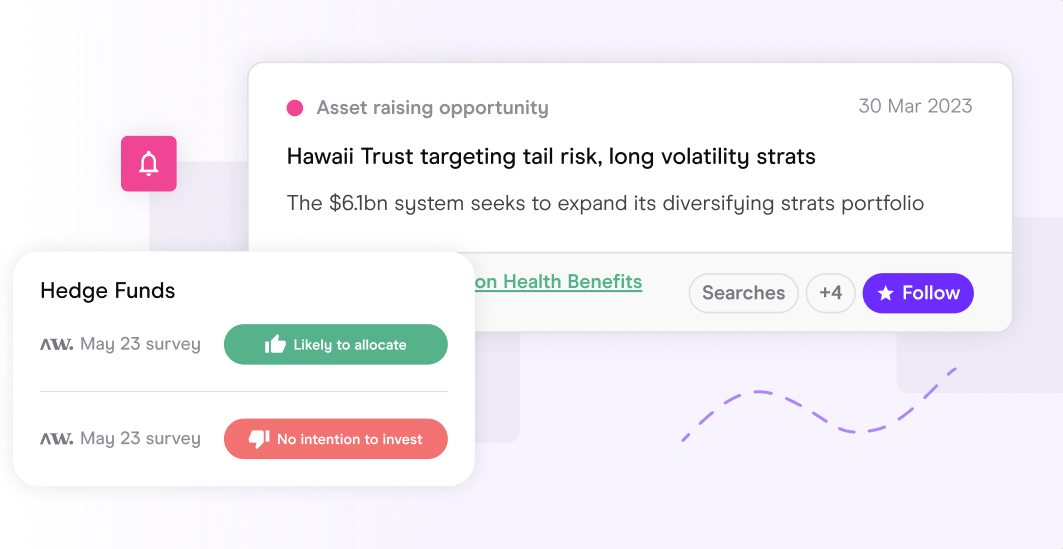

You won’t find this data anywhere else. This includes investor intentions and preferences and information shared with us via our direct industry relationships.

Unstructured

Leveraging our editorial heritage, we present the data differently. The Now Feed connects all our data together.

Inferred

It’s about more than just the type and volume of data we have. We spot the trends and themes within the data and tell you what it shows us.

High barrier to access

Information that is harder to access, including updates shared at investor meetings and data gathered via Freedom of Information requests.

Low barrier to access

Regulatory filings and annual reports. We harvest and validate additional data from companies’ websites and other open sources, leaving you to focus where you need to.

How we collect data

We use people, technology, and our direct industry relationships to collect our data

Direct from source

Managers and investors share information with us in return for exposure to investors and access to exclusive content and events.

Meeting attendance

Our research teams attend over 150 investor meetings a month to collect information which adds additional context to publicly available investor documents.

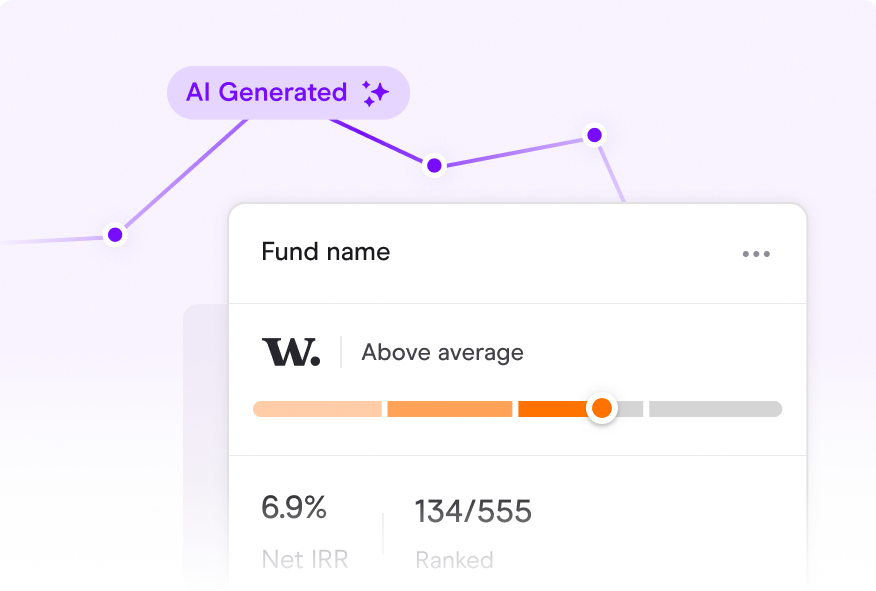

AI & machine learning

We use technology to scan publicly available data and bring information together. Connecting the dots and helping you spot opportunities.

Human verification

We only share the best data with you. Our research team verify information before it is added to the platform.

You can trust our data

Our unique place in the industry means that we can not only source data, but Managers and investors also share information with us because they know that we help them achieve their fundraising and asset allocation goals.

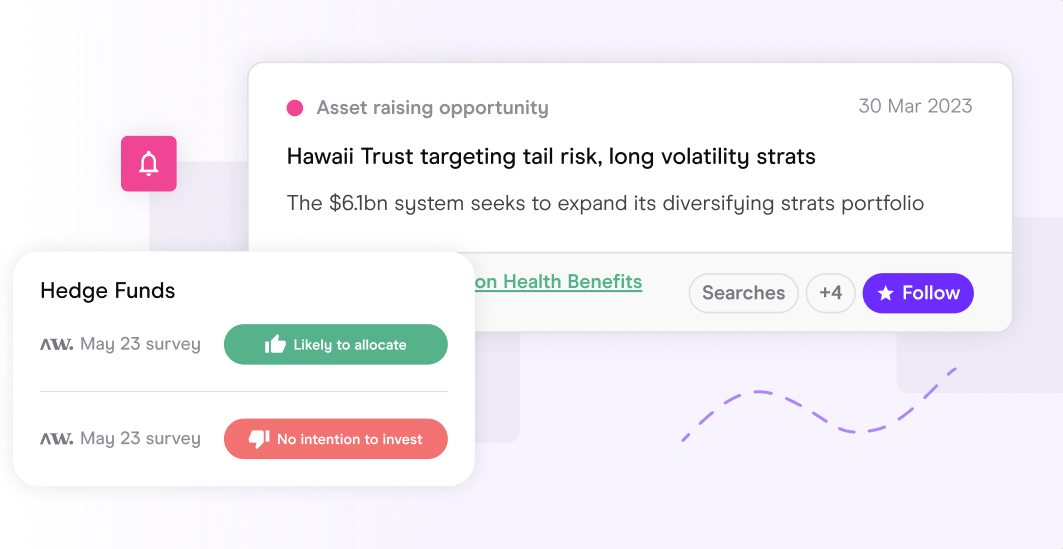

Connected

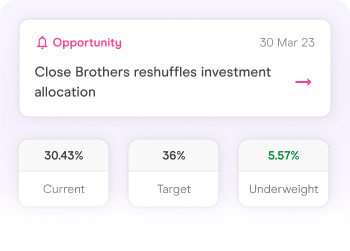

Signals alert you to new opportunities in your Now Feed with profiles and people linked so you have all the information you need to act.

Contextualised

We know what is important and why it is important to you, giving you the first-mover advantage.

Actionable

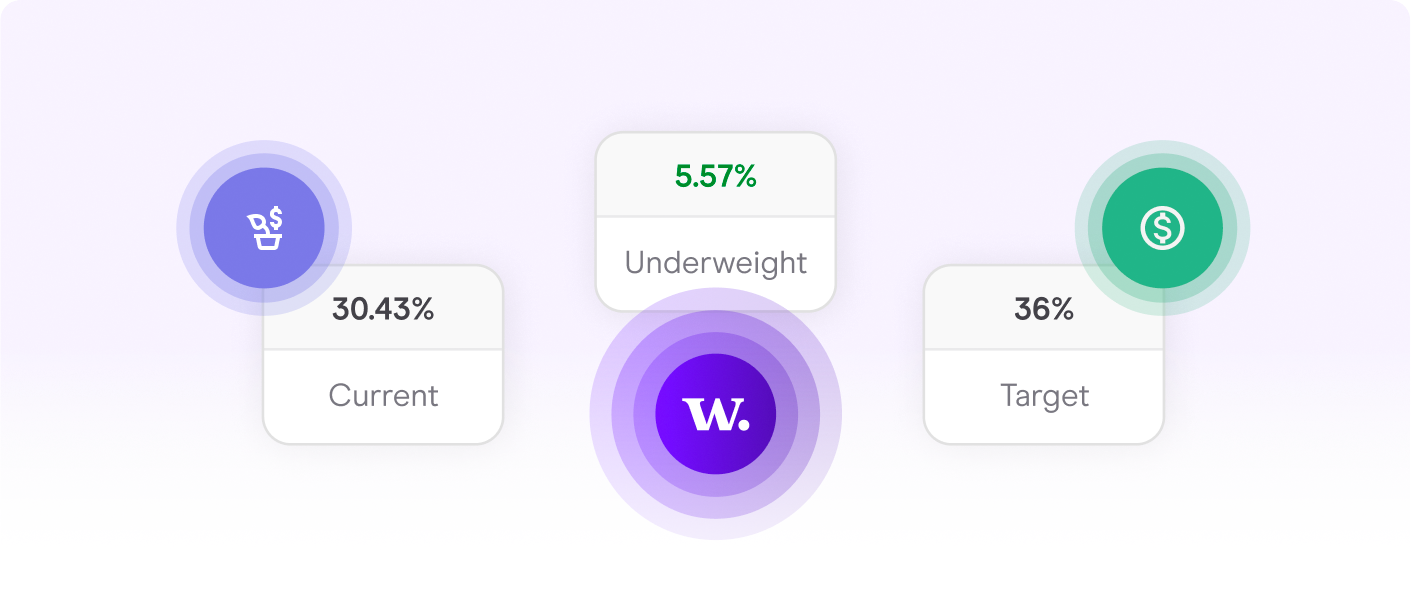

We have data that can inform your actions. We don’t just look back at past allocations; we look forward to who is likely to allocate and where.

Accurate

Our data isn’t static. Our research team continues to update and verify our data. All profiles have date stamps, so you know how fresh the data is.

What you get from our data

Our database has detailed profiles on investors, consultants, funds, managers, searches and people.

Investors

Investor profiles include information on primary strategies, investment regions, and known consultants. Each profile includes a high-level summary, investment intentions and preferences, and key contact information.

Consultants

Consultant profiles include information about intentions and strategy as well as how they conduct manager research. Each profile contains a record of their recommendations, clients, historical and live searches, and key contact information.

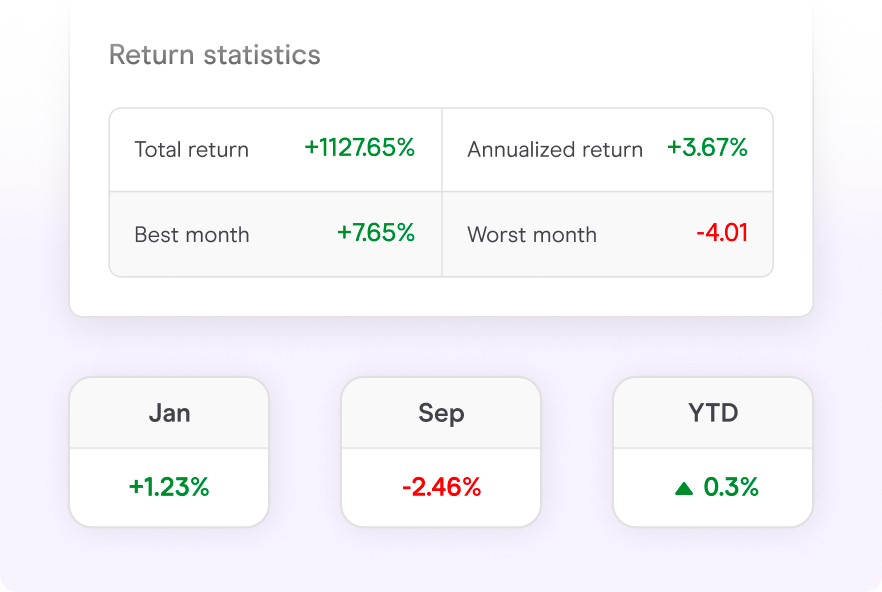

Funds

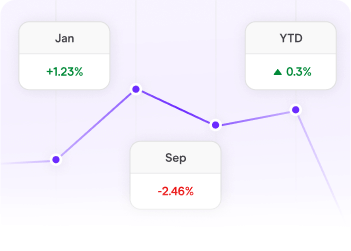

Fund profiles include information about strategies, AuM and returns. You can also see related funds and investor and investment information such as fees and fund terms and criteria. Known service providers are also listed.

Managers

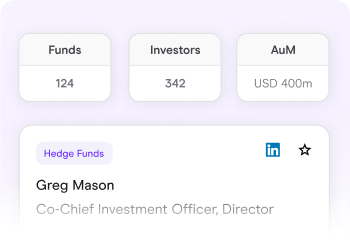

Manager profiles are where you can find information about manager activity, their investors and service providers, as well as key contact details and links to any documents.

People

The people database includes key contact’s profiles related to the institutions within our database. You can search for individuals by name, job title, company, and location amongst other filters.

Searches

Our database of searches includes exclusive potential mandates as well as past mandates. Search by status, asset class, investment region and the investor.

Smarter decisions. Richer connections.

Our data, intelligence and networking events will get you ahead. Connecting you with the people and data you need for efficient fundraising, asset allocation and fund servicing.